Answered step by step

Verified Expert Solution

Question

1 Approved Answer

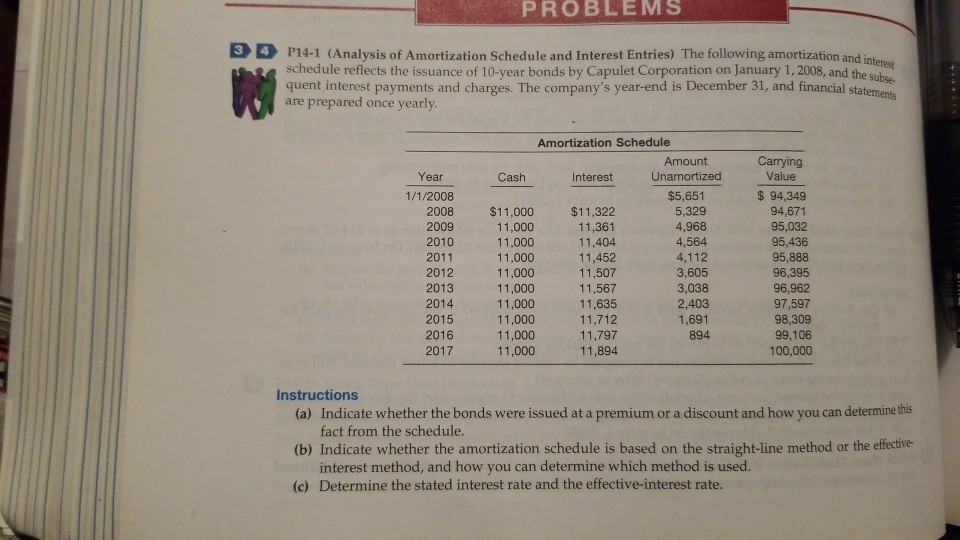

PROBLEMS 3 4 P14-1 (Analysis of Amortization Schedule and Interest Entries) The following amortization ard schedule reflects the issuance of 10-year bonds by Capulet Corporation

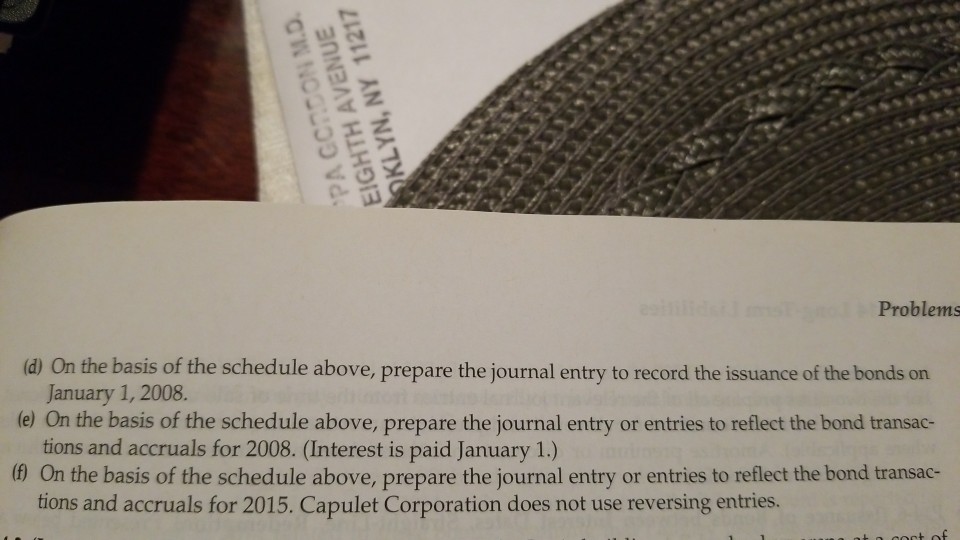

PROBLEMS 3 4 P14-1 (Analysis of Amortization Schedule and Interest Entries) The following amortization ard schedule reflects the issuance of 10-year bonds by Capulet Corporation on January 1,2008, and the subse. quent interest payments and charges. The company's year-end is December 31, and financial stat are prepared once yearly ements Amortization Schedule Carrying Value Amount Year Cash Interest Unamortized 1/1/2008 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 $11,000 11,000 11,000 11,000 11,000 11,000 11,000 11,000 11,000 11,000 $11,322 11,361 11,404 11,452 11,507 11,567 11,635 11,712 11,797 11,894 $5,651 5,329 4,968 4,564 4,112 3,605 3,038 2,403 1,691 894 94,349 94,671 95,032 95,436 95,888 96,395 97,597 98,309 99,106 100,000 Instructions Indicate whether the bonds were issued at a premium or a discount and how you can determine this fact from the schedule. (a) (b) Indicate whether the amortization schedule is based on the straight-line method or the effective (c) interest method, and how you can determine which method is used. Determine the stated interest rate and the effective-interest rate. PROBLEMS 3 4 P14-1 (Analysis of Amortization Schedule and Interest Entries) The following amortization ard schedule reflects the issuance of 10-year bonds by Capulet Corporation on January 1,2008, and the subse. quent interest payments and charges. The company's year-end is December 31, and financial stat are prepared once yearly ements Amortization Schedule Carrying Value Amount Year Cash Interest Unamortized 1/1/2008 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 $11,000 11,000 11,000 11,000 11,000 11,000 11,000 11,000 11,000 11,000 $11,322 11,361 11,404 11,452 11,507 11,567 11,635 11,712 11,797 11,894 $5,651 5,329 4,968 4,564 4,112 3,605 3,038 2,403 1,691 894 94,349 94,671 95,032 95,436 95,888 96,395 97,597 98,309 99,106 100,000 Instructions Indicate whether the bonds were issued at a premium or a discount and how you can determine this fact from the schedule. (a) (b) Indicate whether the amortization schedule is based on the straight-line method or the effective (c) interest method, and how you can determine which method is used. Determine the stated interest rate and the effective-interest rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started