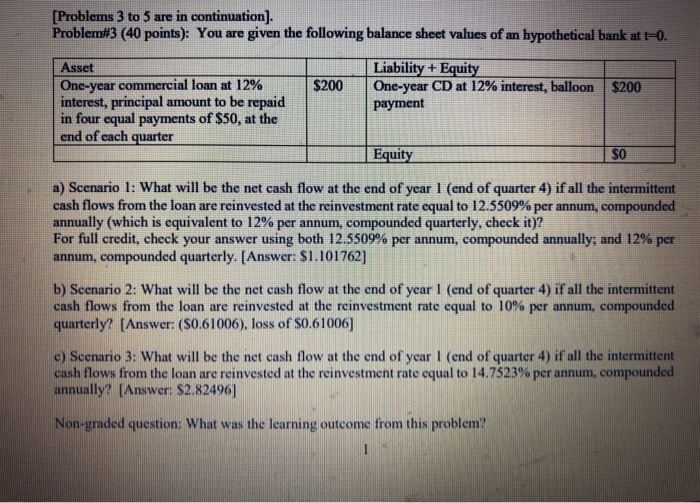

[Problems 3 to 5 are in continuation]. Problem#3 (40 points): You are given the following balance sheet values of an hypothetical bank at to. Asset Liability + Equity One-year commercial loan at 12% $200 One-year CD at 12% interest, balloon $200 interest, principal amount to be repaid payment in four equal payments of $50, at the end of each quarter Equity $0 a) Scenario 1: What will be the net cash flow at the end of year 1 (end of quarter 4) if all the intermittent cash flows from the loan are reinvested at the reinvestment rate equal to 12.5509% per annum, compounded annually (which is equivalent to 12% per annum, compounded quarterly, check it)? For full credit, check your answer using both 12.5509% per annum, compounded annually, and 12% per annum, compounded quarterly. [Answer: $1.101762] b) Scenario 2: What will be the net cash flow at the end of year 1 (end of quarter 4) if all the intermittent cash flows from the loan are reinvested at the reinvestment rate equal to 10% per annum, compounded quarterly? [Answer: ($0.61006), loss of $0.61006) c) Scenario 3: What will be the net cash flow at the end of year I (end of quarter 4) if all the intermittent cash flows from the loan are reinvested at the reinvestment rate equal to 14.7523% per annum, compounded annually? [Answer: S2.82496] Non-graded question: What was the learning outcome from this problem? [Problems 3 to 5 are in continuation]. Problem#3 (40 points): You are given the following balance sheet values of an hypothetical bank at to. Asset Liability + Equity One-year commercial loan at 12% $200 One-year CD at 12% interest, balloon $200 interest, principal amount to be repaid payment in four equal payments of $50, at the end of each quarter Equity $0 a) Scenario 1: What will be the net cash flow at the end of year 1 (end of quarter 4) if all the intermittent cash flows from the loan are reinvested at the reinvestment rate equal to 12.5509% per annum, compounded annually (which is equivalent to 12% per annum, compounded quarterly, check it)? For full credit, check your answer using both 12.5509% per annum, compounded annually, and 12% per annum, compounded quarterly. [Answer: $1.101762] b) Scenario 2: What will be the net cash flow at the end of year 1 (end of quarter 4) if all the intermittent cash flows from the loan are reinvested at the reinvestment rate equal to 10% per annum, compounded quarterly? [Answer: ($0.61006), loss of $0.61006) c) Scenario 3: What will be the net cash flow at the end of year I (end of quarter 4) if all the intermittent cash flows from the loan are reinvested at the reinvestment rate equal to 14.7523% per annum, compounded annually? [Answer: S2.82496] Non-graded question: What was the learning outcome from this