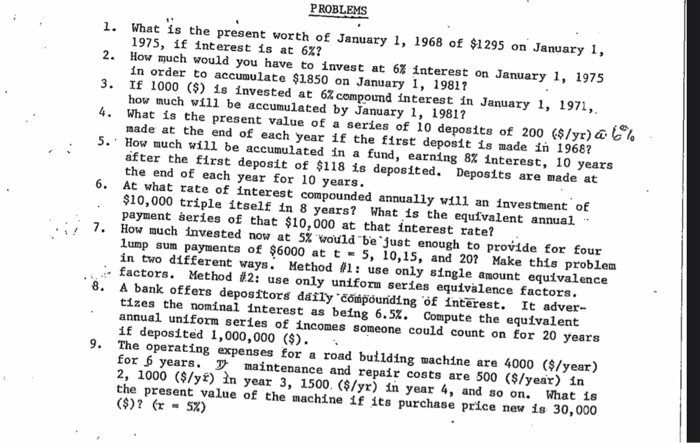

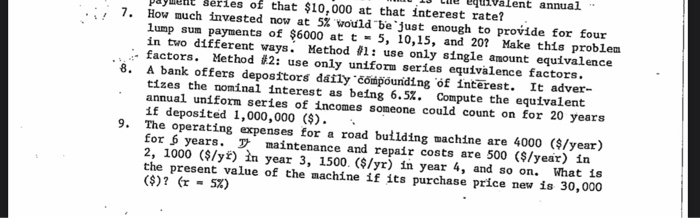

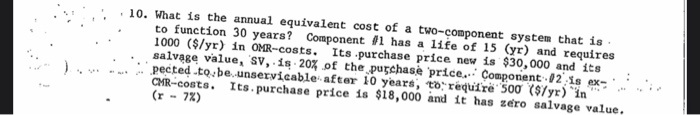

PROBLEMS 3. . What is the present worth of January 1, 1968 of $1295 on January 1, 1975, if interest is at 6Z? 2. How much would you have to invest at 67 interest on January 1, 1975 In order to accumulate $1850 on January 1, 19817 If 1000 ($) 1.s invested at 62 compound interest in January 1, 1971, how much will be accumulated by January 1, 1981? 4. What is the present value of a series of 10 deposits of 200 ($/yr) 6% made at the end of each year if the first deposit is made in 1968? 5. How much will be accumulated in a fund, earning 8% interest, 10 years after the first deposit of $118 is deposited. Deposits are made at the end of each year for 10 years. 6. At what rate of interest compounded annually will an investment of $10,000 triple itself in 8 years? What is the equivalent annual payment series of that $10,000 at that interest rate? How much invested now at 5% would be just enough to provide for four lump sum payments of $6000 at t = 5, 10,15, and 20+ Make this problem in two different ways. Method #1: use only single amount equivalence factors. Method #2: use only uniform series equivalence factors. 8. A bank offers depositors daily compounding of interest. It adver- tizes the nominal interest as being 6.5%. Compute the equivalent annual uniform series of incomes someone could count on for 20 years 1f deposited 1,000,000 ($). The operating expenses for a road building machine are 4000 ($/year) years. T maintenance and repair costs are 500 ($/year) in 2, 1000 ($/yt) in year 3, 1500. ($/yr) in year 4, and so on. What 16 the present value of the machine if its purchase price new is 30,000 ($)? (r - 5%) 7. :: pwywett series of that $10,000 at that interest rate? 7. How much invested now at 5% would be just enough to provide for four lump sum payments of $6000 at t = 5, 10,15, and 201 Make this problem in two different ways. Method 81: use only single amount equivalence factors. Method #2: use only uniform series equivalence factors. A bank offers depositors daily compounding of interest. It adver- tizes the nominal interest as being 6.5%. Compute the equivalent annual uniform series of incomes someone could count on for 20 years 1f deposited 1,000,000 ($). i The operating expenses for a road building machine are 4000 ($/year) for 5 years, maintenance and repair costs are 500 ($/year) in 2, 1000 ($/yt) in year 3, 1500. ($/yr) in year 4, and so on. What is the present value of the machine if its purchase price new is 30,000 ($)? (r = 5%) . 10. What is the annual equivalent cost of a two-component system that is to function 30 years? Component 11 has a life of 15 (yr) and requires 1000 ($/yr) in OMR-costs. Its purchase price new is $30,000 and its salvage value, 'SV, is 20% of the purchase price. Component 12 is ex- pected to be unservicable after 10 years, to require 500 (s7yr) in CHR-costs. Its purchase price is $18,000 and it has zero salvage value. (r - 7%)