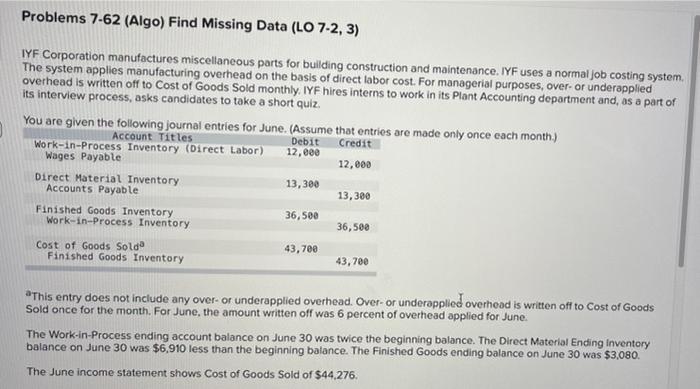

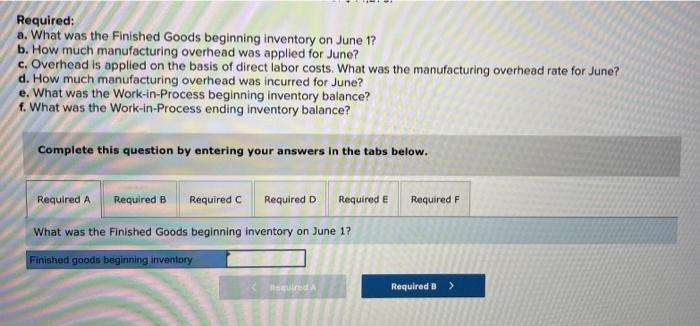

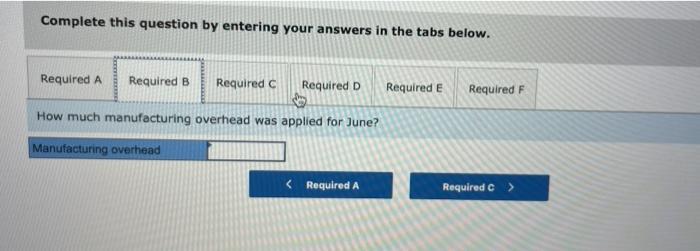

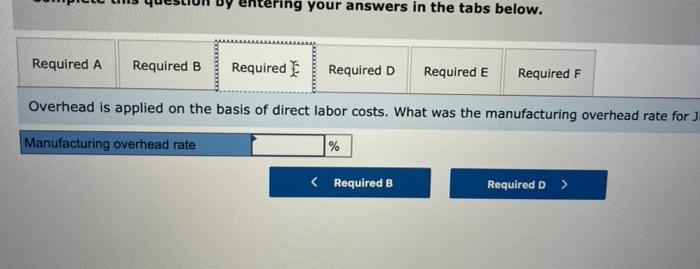

Problems 7-62 (Algo) Find Missing Data (LO 7-2, 3) IYF Corporation manufactures miscellaneous parts for building construction and maintenance. IYF uses a normal job costing system, The system applies manufacturing overhead on the basis of direct labor cost. For managerial purposes, over- or underapplied overhead is written off to Cost of Goods Sold monthly, IYF hires interns to work in its Plant Accounting department and, as a part of its interview process, asks candidates to take a short quiz. You are given the following journal entries for June. (Assume that entries are made only once each month.) Account Titles Debit Credit Work-in-Process Inventory (Direct Labor) 12,000 Wages Payable 12,000 Direct Material Inventory 13,300 Accounts Payable 13, 380 Finished Goods Inventory 36,500 Work-in-Process Inventory 36,500 Cost of Goods Soldo 43,700 Finished Goods Inventory 43,700 This entry does not include any over- or underapplied overhead. Over- or underapplied overhead is written off to Cost of Goods Sold once for the month. For June, the amount written off was 6 percent of overhead applied for June The Work-in-Process ending account balance on June 30 was twice the beginning balance. The Direct Material Ending inventory balance on June 30 was $6,910 less than the beginning balance. The Finished Goods ending balance on June 30 was $3,080. The June income statement shows Cost of Goods Sold of $44.276. Required: a. What was the finished Goods beginning inventory on June 1? b. How much manufacturing overhead was applied for June? c. Overhead is applied on the basis of direct labor costs. What was the manufacturing overhead rate for June? d. How much manufacturing overhead was incurred for June? e. What was the Work-in-process beginning inventory balance? f. What was the Work-in-Process ending inventory balance? Complete this question by entering your answers in the tabs below. Required F Required A Required B Required Required D Required E What was the finished Goods beginning inventory on June 1? Finished goods beginning inventory Required 3 > Complete this question by entering your answers in the tabs below. Required A Required B Required Required D Required E Required F How much manufacturing overhead was applied for June? Manufacturing overhead tering your answers in the tabs below. Required A Required B Required Required D Required E Required F Overhead is applied on the basis of direct labor costs. What was the manufacturing overhead rate for J Manufacturing overhead rate % Complete this question by entering your answers in the tabs below. Required A Required B Required C Regired D Required E Required F How much manufacturing overhead was incurred for June? Manufacturing overhead Complete this question by entering your answers in the tabs below. Required A Required B Required Required D RiIquired E Required F What was the Work-in-Process beginning inventory balance? Work-in-process beginning inventory c. Overhead is applied on the basis of direct labor costs. What was the manufacturing overhead rate for June? d. How much manufacturing overhead was incurred for June? e. What was the Work-in-Process beginning inventory balance? f. What was the Work-in-Process ending inventory balance? Complete this question by entering your answers in the tabs below. Required A Required B Required Required D Required E Rebuired F What was the Work-in-process ending inventory balance? Work-in-process ending inventory