Problems: 8.1, 8.2 part b only on pages 313-314

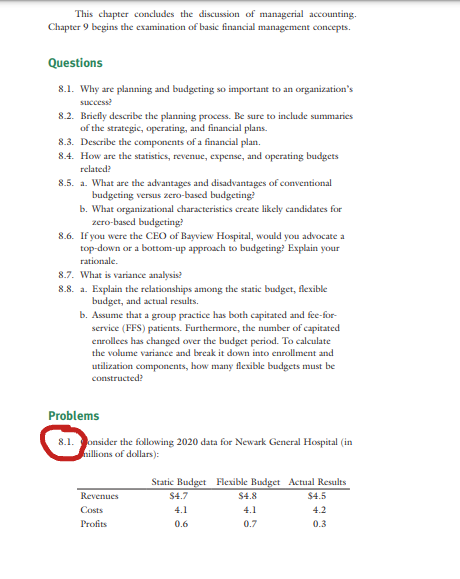

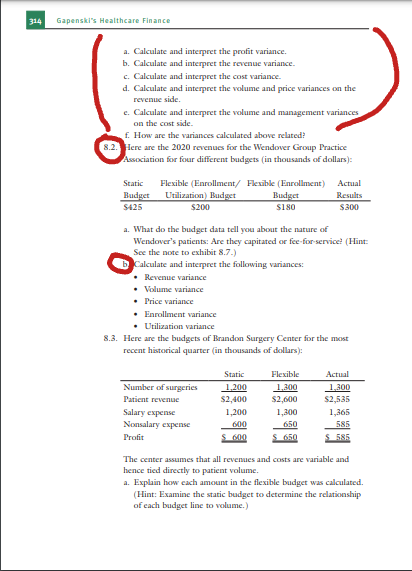

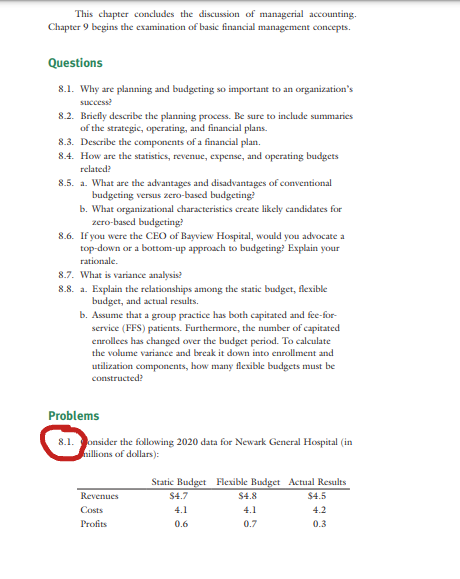

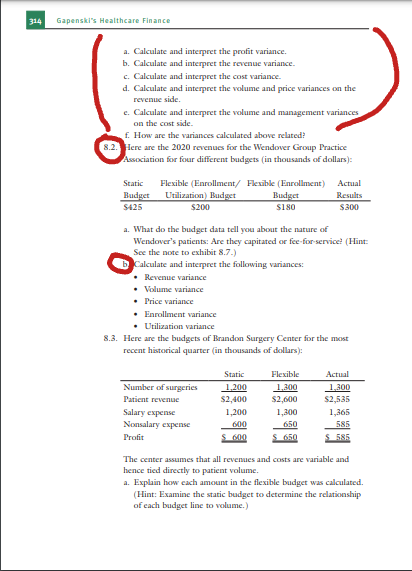

This chapter concludes the discussion of managerial accounting. Chapter 9 begins the examination of basic financial management concepts. Questions 8.1. Why are planning and budgeting so important to an organization's success? 8.2. Briefly describe the planning process. Be sure to include summaries of the strategic, operating, and financial plans. 8.3. Describe the components of a financial plan. 8.4. How are the statistics, revenue, expense, and operating budgets related? 8.5. a. What are the advantages and disadvantages of conventional budgeting versus zero-based budgeting? b. What organizational characteristics create likely candidates for zero-based budgeting? 8.6. If you were the CEO of Bayview Hospital, would you advocate a top-down or a bottom-up approach to budgeting? Explain your rationale. 8.7. What is variance analysis? 8.8. a. Explain the relationships among the static budget, flexible budget, and actual results. b. Assume that a group practice has both capitated and fee-forservice (FFS) patients. Furthermore, the number of capitated enrollees has changed over the budget period. To calculate the volume variance and break it down into enrollment and utilization components, how many flexible budgets must be constructed? Problems 8.1. onsider the following 2020 data for Newark General Hospital (in hillions of dollars): a. Calculate and interpeet the profit variance. b. Calculate and interpeet the revenue variance. c. Calculate and interpret the cost variance. d. Calculate and interpeet the volume and price variances on the revenue side. e. Calculate and interpeet the volume and management variances on the cost side. f. How are the variances calculated above relared? 8.2. Here are the 2020 revenues for the Wendover Group Practice Association for four different budgets (in thousands of dollars): a. What do the budget data tell you about the nature of Wendover's patients: Are they capitated or fee-for-service? (Hint: See the note to exhibit 8.7.) b. Calculate and interpeet the following variances: - Revenue variance - Volume variance - Price variance - Enrollment variance - Utilization variance 8.3. Here are the budgets of Brandon Surgery Center for the most recent historical quarter (in thousands of dollars): The center assumes that all revenues and costs are variable and bence tied directly to patient volume. a. Explain bow each amount in the flexible budget was calculated. (Hint: Examine the static budget to determine the relationship of each budget line to volume.) This chapter concludes the discussion of managerial accounting. Chapter 9 begins the examination of basic financial management concepts. Questions 8.1. Why are planning and budgeting so important to an organization's success? 8.2. Briefly describe the planning process. Be sure to include summaries of the strategic, operating, and financial plans. 8.3. Describe the components of a financial plan. 8.4. How are the statistics, revenue, expense, and operating budgets related? 8.5. a. What are the advantages and disadvantages of conventional budgeting versus zero-based budgeting? b. What organizational characteristics create likely candidates for zero-based budgeting? 8.6. If you were the CEO of Bayview Hospital, would you advocate a top-down or a bottom-up approach to budgeting? Explain your rationale. 8.7. What is variance analysis? 8.8. a. Explain the relationships among the static budget, flexible budget, and actual results. b. Assume that a group practice has both capitated and fee-forservice (FFS) patients. Furthermore, the number of capitated enrollees has changed over the budget period. To calculate the volume variance and break it down into enrollment and utilization components, how many flexible budgets must be constructed? Problems 8.1. onsider the following 2020 data for Newark General Hospital (in hillions of dollars): a. Calculate and interpeet the profit variance. b. Calculate and interpeet the revenue variance. c. Calculate and interpret the cost variance. d. Calculate and interpeet the volume and price variances on the revenue side. e. Calculate and interpeet the volume and management variances on the cost side. f. How are the variances calculated above relared? 8.2. Here are the 2020 revenues for the Wendover Group Practice Association for four different budgets (in thousands of dollars): a. What do the budget data tell you about the nature of Wendover's patients: Are they capitated or fee-for-service? (Hint: See the note to exhibit 8.7.) b. Calculate and interpeet the following variances: - Revenue variance - Volume variance - Price variance - Enrollment variance - Utilization variance 8.3. Here are the budgets of Brandon Surgery Center for the most recent historical quarter (in thousands of dollars): The center assumes that all revenues and costs are variable and bence tied directly to patient volume. a. Explain bow each amount in the flexible budget was calculated. (Hint: Examine the static budget to determine the relationship of each budget line to volume.)