Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problems 8-12 7. Ping Corp. has outstanding accounts receivable totaling $2.5 million as of December 31 and sales on credit during the year of $12

Problems 8-12

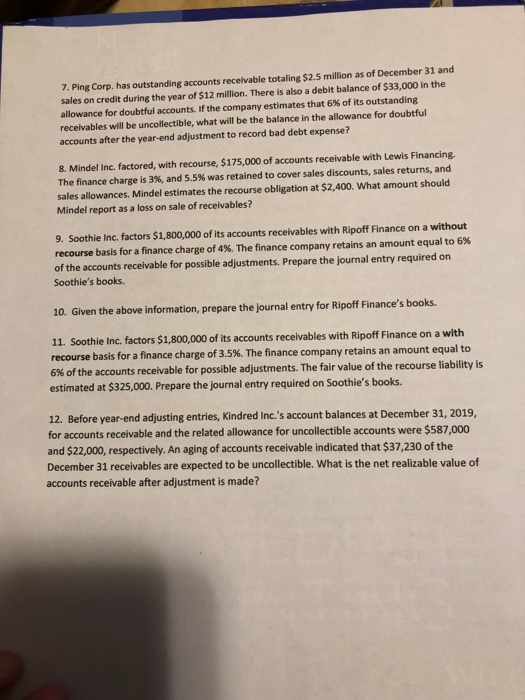

7. Ping Corp. has outstanding accounts receivable totaling $2.5 million as of December 31 and sales on credit during the year of $12 million. There is also a debit balance of $33,000 in the allowance for doubtful accounts. If the company estimates that 6% of its outstanding receivables will be uncollectible, what will be the balance in the allowance for doubtful accounts after the year-end adjustment to record bad debt expense? 8. Mindel Inc. factored, with recourse, $175,000 of accounts receivable with Lewis Financing. The finance charge is 3%, and 5.5% was retained to cover sales discounts, sales returns, and sales allowances. Mindel estimates the recourse obligation at $2,400. What amount should Mindel report as a loss on sale of receivables? 9. Soothie Inc. factors $1,800,000 of its accounts receivables with Ripoff Finance on a without recourse basis for a finance charge of 4%. The finance company retains an amount equal to 6% Soothie's books. 10. Given the above information, prepare the journal entry for Ripoff Finance's books. of the accounts receivable for possible adjustments. Prepare the journal entry required on 11. Soothie Inc. factors $1,800,000 of its accounts receivables with Ripoff Finance on a with recourse basis for a finance charge of 3.5%. The finance company retains an amount equal to 6% of the accounts receivable for possible adjustments. The fair value of the recourse liability is estimated at $325,000. Prepare the journal entry required on Soothie's books. 12. Before year-end adjusting entries, Kindred Inc.'s account balances at December 31, 2019, for accounts receivable and the related allowance for uncollectible accounts were $587,000 and $22,000, respectively. An aging of accounts receivable indicated that $37,230 of the December 31 receivables are expected to be uncollectible. What is the net realizable value of accounts receivable after adjustment is made

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started