Question: Problems A property owner is evaluating the following alternatives for leasing space in his office building for the next five years: Net lease with steps.

Problems

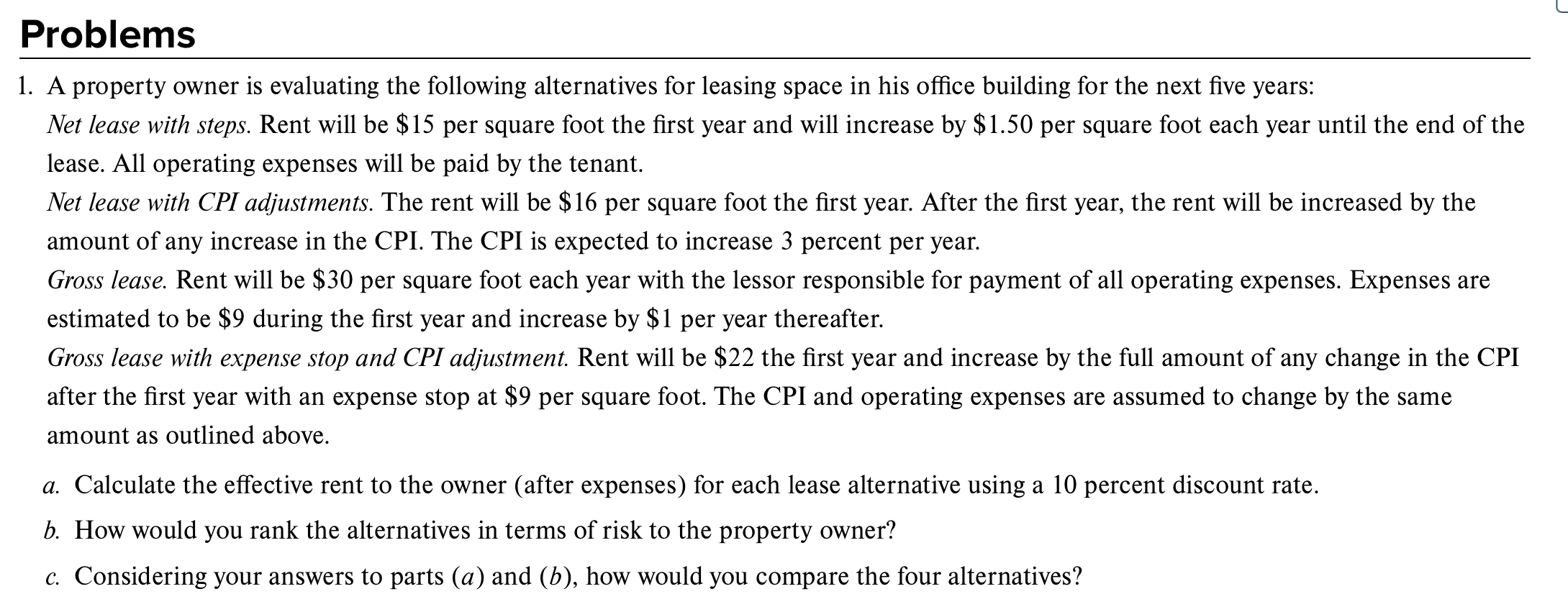

A property owner is evaluating the following alternatives for leasing space in his office building for the next five years:

Net lease with steps. Rent will be $ per square foot the first year and will increase by $ per square foot each year until the end of the

lease. All operating expenses will be paid by the tenant.

Net lease with CPI adjustments. The rent will be $ per square foot the first year. After the first year, the rent will be increased by the

amount of any increase in the CPI. The CPI is expected to increase percent per year.

Gross lease. Rent will be $ per square foot each year with the lessor responsible for payment of all operating expenses. Expenses are

estimated to be $ during the first year and increase by $ per year thereafter.

Gross lease with expense stop and CPI adjustment. Rent will be $ the first year and increase by the full amount of any change in the CPI

after the first year with an expense stop at $ per square foot. The CPI and operating expenses are assumed to change by the same

amount as outlined above.

a Calculate the effective rent to the owner after expenses for each lease alternative using a percent discount rate.

How would you rank the alternatives in terms of risk to the property owner?

Considering your answers to parts and how would you compare the four alternatives?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock