Answered step by step

Verified Expert Solution

Question

1 Approved Answer

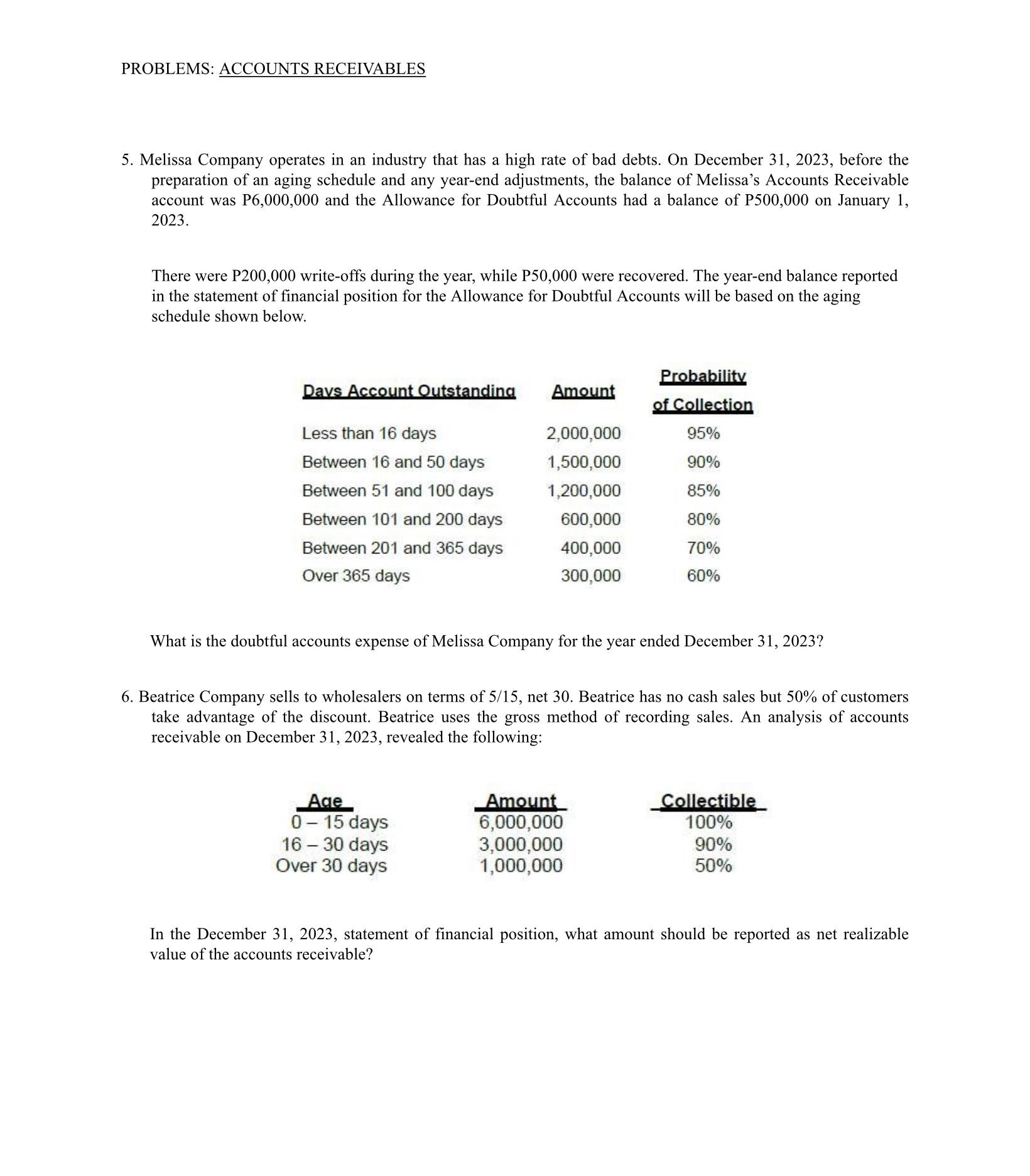

PROBLEMS: ACCOUNTS RECEIVABLES 5. Melissa Company operates in an industry that has a high rate of bad debts. On December 31, 2023, before the

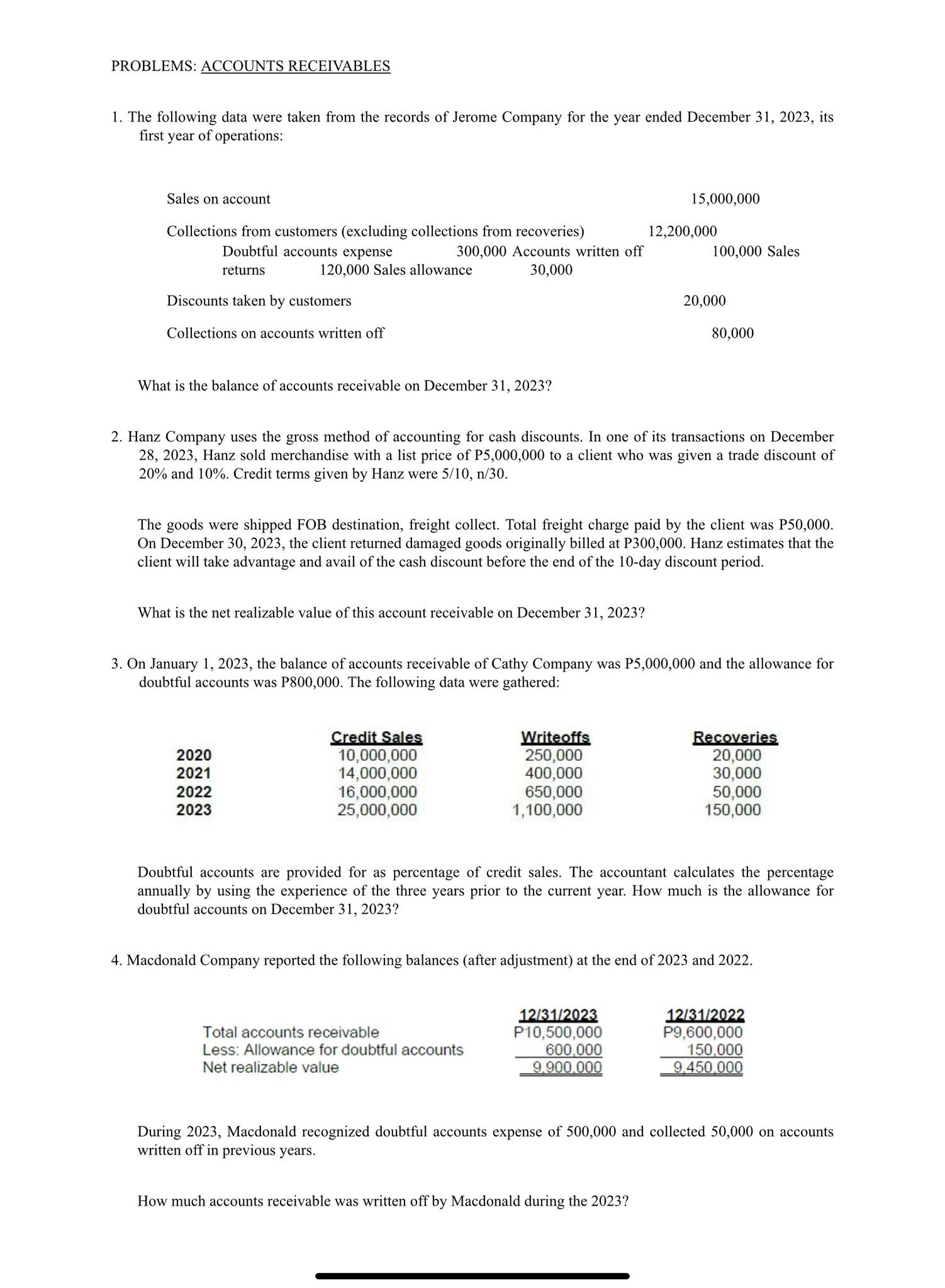

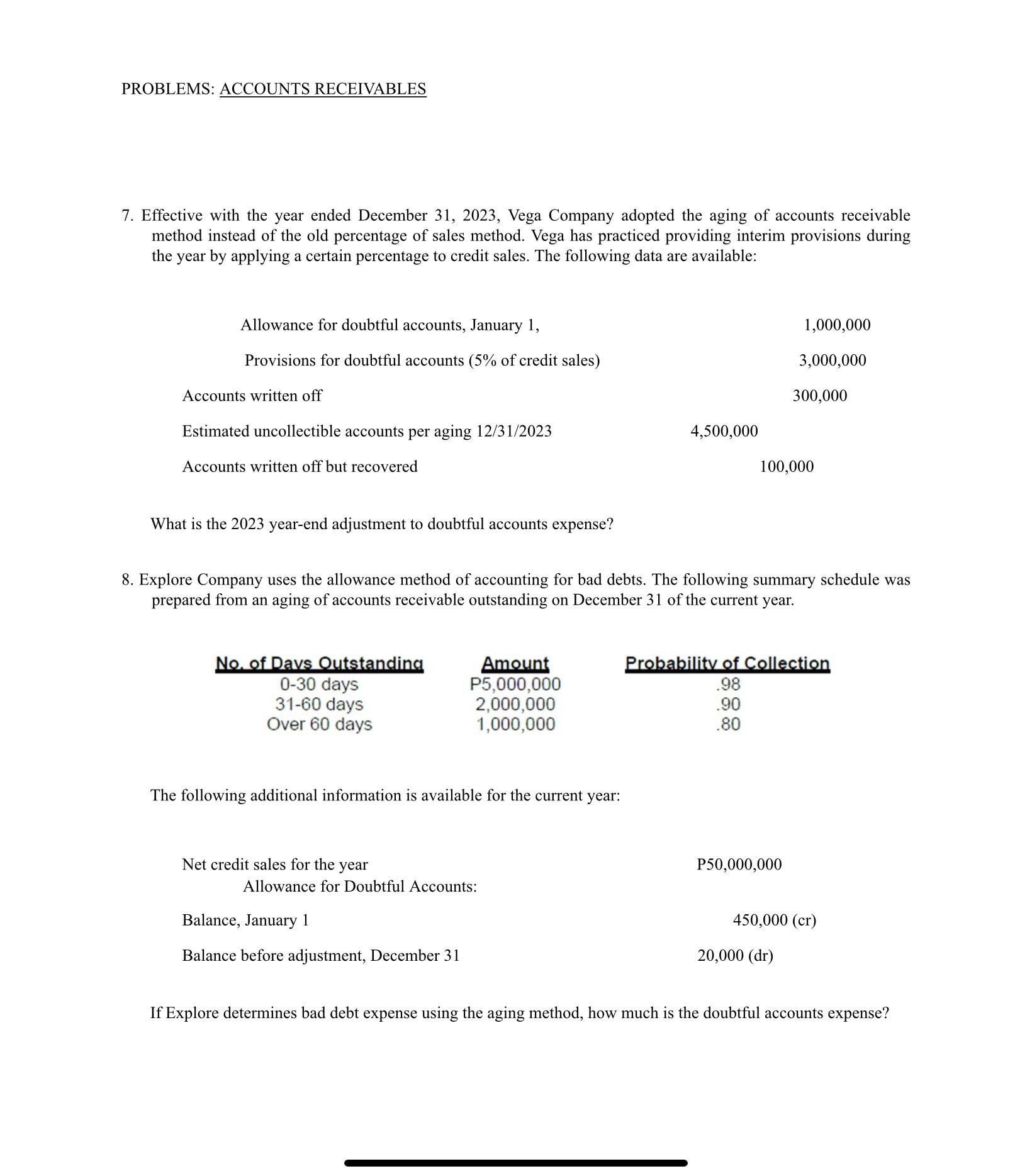

PROBLEMS: ACCOUNTS RECEIVABLES 5. Melissa Company operates in an industry that has a high rate of bad debts. On December 31, 2023, before the preparation of an aging schedule and any year-end adjustments, the balance of Melissa's Accounts Receivable account was P6,000,000 and the Allowance for Doubtful Accounts had a balance of P500,000 on January 1, 2023. There were P200,000 write-offs during the year, while P50,000 were recovered. The year-end balance reported in the statement of financial position for the Allowance for Doubtful Accounts will be based on the aging schedule shown below. Days Account Outstanding Less than 16 days Between 16 and 50 days Between 51 and 100 days Between 101 and 200 days Between 201 and 365 days Over 365 days Amount 2,000,000 1,500,000 1,200,000 600,000 400,000 300,000 Age 0 - 15 days 16-30 days Over 30 days What is the doubtful accounts expense of Melissa Company for the year ended December 31, 2023? Probability of Collection 95% 90% 85% 80% 70% 60% 6. Beatrice Company sells to wholesalers on terms of 5/15, net 30. Beatrice has no cash sales but 50% of customers take advantage of the discount. Beatrice uses the gross method of recording sales. An analysis of accounts receivable on December 31, 2023, revealed the following: Amount 6,000,000 3,000,000 1,000,000 Collectible 100% 90% 50% In the December 31, 2023, statement of financial position, what amount should be reported as net realizable value of the accounts receivable? PROBLEMS: ACCOUNTS RECEIVABLES 1. The following data were taken from the records of Jerome Company for the year ended December 31, 2023, its first year of operations: Sales on account Collections from customers (excluding collections from recoveries) Doubtful accounts expense returns Discounts taken by customers Collections on accounts written off 120,000 Sales allowance 300,000 Accounts written off 30,000 What is the balance of accounts receivable on December 31, 2023? What is the net realizable value of this account receivable on December 31, 2023? 2020 2021 2022 2023 Credit Sales 10,000,000 14,000,000 16,000,000 25,000,000 2. Hanz Company uses the gross method of accounting for cash discounts. In one of its transactions on December 28, 2023, Hanz sold merchandise with a list price of P5,000,000 to a client who was given a trade discount of 20% and 10%. Credit terms given by Hanz were 5/10, n/30. The goods were shipped FOB destination, freight collect. Total freight charge paid by the client was P50,000. On December 30, 2023, the client returned damaged goods originally billed at P300,000. Hanz estimates that the client will take advantage and avail of the cash discount before the end of the 10-day discount period. Writeoffs 250,000 400,000 650,000 1,100,000 15,000,000 3. On January 1, 2023, the balance of accounts receivable of Cathy Company was P5,000,000 and the allowance for doubtful accounts was P800,000. The following data were gathered: Total accounts receivable Less: Allowance for doubtful accounts Net realizable value 12,200,000 100,000 Sales 12/31/2023 P10,500,000 20,000 600,000 9.900,000 80,000 How much accounts receivable was written off by Macdonald during the 2023? Doubtful accounts are provided for as percentage of credit sales. The accountant calculates the percentage annually by using the experience of the three years prior to the current year. How much is the allowance for doubtful accounts on December 31, 2023? 4. Macdonald Company reported the following balances (after adjustment) at the end of 2023 and 2022. Recoveries 20,000 30,000 50,000 150,000 12/31/2022 P9,600,000 150,000 9.450.000 During 2023, Macdonald recognized doubtful accounts expense of 500,000 and collected 50,000 on accounts written off in previous years. PROBLEMS: ACCOUNTS RECEIVABLES 7. Effective with the year ended December 31, 2023, Vega Company adopted the aging of accounts receivable method instead of the old percentage of sales method. Vega has practiced providing interim provisions during the year by applying a certain percentage to credit sales. The following data are available: Allowance for doubtful accounts, January 1, Provisions for doubtful accounts (5% of credit sales) Accounts written off Estimated uncollectible accounts per aging 12/31/2023 Accounts written off but recovered What is the 2023 year-end adjustment to doubtful accounts expense? No. of Days Outstanding 0-30 days 31-60 days Over 60 days The following additional information is available for the current year: Net credit sales for the year 8. Explore Company uses the allowance method of accounting for bad debts. The following summary schedule was prepared from an aging of accounts receivable outstanding on December 31 of the current year. Amount P5,000,000 2,000,000 1,000,000 Allowance for Doubtful Accounts: Balance, January 1 Balance before adjustment, December 31 4,500,000 1,000,000 3,000,000 300,000 100,000 P50,000,000 Probability of Collection .98 .90 .80 450,000 (cr) 20,000 (dr) If Explore determines bad debt expense using the aging method, how much is the doubtful accounts expense?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

5 To calculate the doubtful accounts expense for Melissa Company we need to determine the appropriate allowance for doubtful accounts balance based on ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started