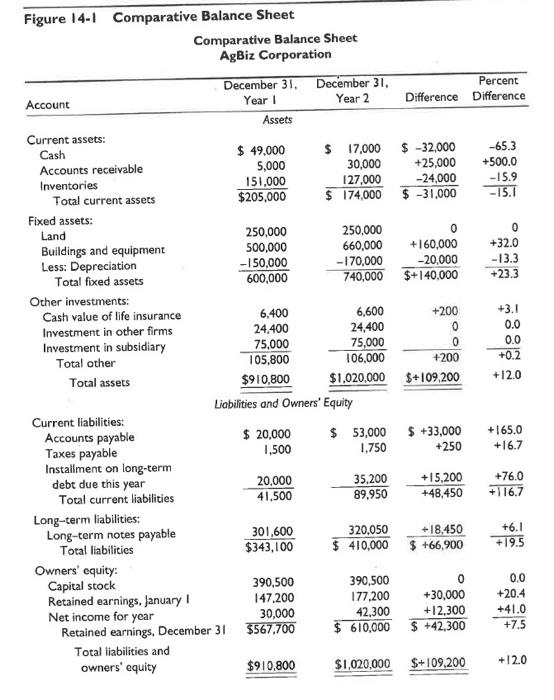

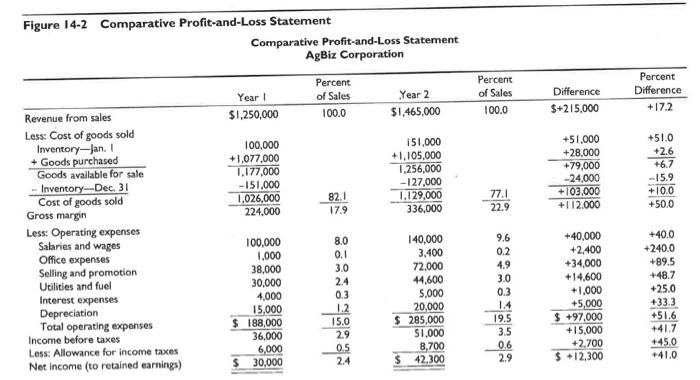

Problems on Ratio Analysis: 1. Calculate the following ratios (using information from the attached tables) for years 1 and 2 and interpret the change. Profitability Ratios: a. Return on Equity b. Return on Assets c. Gross Margin Ratio Liquidity Ratios: a. Current Ratio b. Quick Ratio Solvency Ratios: a. Debt to Equity Ratio b. Debt to Asset Ratio Efficiency Ratios: a. Inventory turnover Ratio b. Days of Inventory at Hand c. Days of Sales Outstanding 24,400 Figure 14-1 Comparative Balance Sheet Comparative Balance Sheet AgBiz Corporation December 31. December 31, Percent Account Year Year 2 Difference Difference Assets Current assets: Cash $ 49,000 $ 17,000 $ -32,000 -65.3 Accounts receivable 5,000 30,000 +25,000 +500.0 Inventories 151.000 127,000 -24,000 -15.9 Total current assets $205,000 $ 174,000 $ -31,000 - 15.1 Fixed assets: Land 250,000 250,000 0 Buildings and equipment 500,000 660,000 +160,000 +32.0 Less: Depreciation - 150,000 - 170,000 -20,000 -13.3 Total fixed assets 600,000 740,000 $+140,000 +23.3 Other investments: Cash value of life insurance 6,400 6,600 +200 +3.1 Investment in other firms 24.400 0 0.0 Investment in subsidiary 75,000 75,000 0 0.0 Total other 105,800 106,000 +200 +0.2 Total assets $910,800 $1,020,000 $+109,200 +12.0 Liabilities and Owners' Equity Current liabilities: Accounts payable $ 20,000 $ 53,000 $ +33,000 +165.0 Taxes payable 1,500 1.750 +250 +16.7 Installment on long-term debt due this year 20,000 35,200 +15,200 +76.0 Total current liabilities 41,500 89.950 +48,450 +116.7 Long-term liabilities: Long-term notes payable 301,600 320,050 +18,450 +6.1 Total liabilities $343,100 $ 410,000 $ +66,900 +19.5 Owners' equity: Capital stock 390,500 390,500 0 0.0 Retained earnings, January ! 147.200 177,200 +30,000 +20.4 Net income for year 30,000 42,300 +12,300 +41.0 Retained earnings, December 31 $567,700 $ 610,000 $ +42,300 +7.5 Total liabilities and owners' equity $910.800 $1,020,000 $+109.200 +12.0 Figure 14-2 Comparative Profit-and-Loss Statement Comparative Profit-and-Loss Statement AgBiz Corporation Percent of Sales 100.0 Year! $1,250,000 Year 2 $1,465,000 Percent of Sales 100.0 Percent Difference +17.2 Difference $+215,000 100,000 +1,077,000 1.177,000 -151,000 1,026,000 224.000 151,000 +1,105,000 1,256,000 - 127,000 1,129,000 336,000 +51.000 +28.000 +79,000 -24,000 +103.000 +1 12.000 +51.0 +2.6 +6.7 -15.9 +10.0 +50.0 82.1 17.9 77.1 22.9 Revenue from sales Less: Cost of goods sold Inventory-Jan. 1 + Goods purchased Goods available for sale - Inventory--Dec 31 Cost of goods sold Gross margin Less: Operating expenses Salaries and wages Office expenses Selling and promotion Utilities and fuel Interest expenses Depreciation Total operating expenses Income before taxes Less: Allowance for income taxes Net Income (to retained earnings) 100,000 1,000 38,000 30,000 4,000 15,000 $ 188,000 36,000 6,000 $ 30,000 8.0 0.1 3.0 2.4 0.3 1.2 15.0 29 0.5 2.4 140,000 3,400 72.000 44,600 5,000 20,000 $ 285,000 51.000 8,700 42.300 9.6 0.2 4.9 3.0 0.3 1.4 19.5 3.5 06 2.9 +40,000 +2.400 +34,000 +14,600 + 1,000 +5,000 $ +97.000 +15,000 +2,700 $ +12,300 +40.0 +240.0 +89.5 +48.7 +25.0 +33.3 +51.6 +41.7 +45.0 +41.0