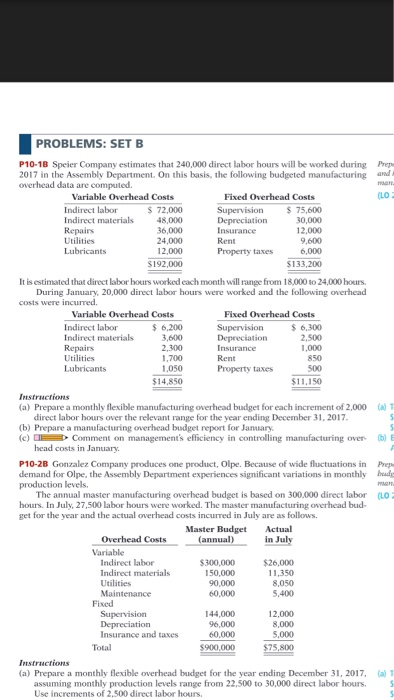

PROBLEMS: SET B Prep and (LO P10-1B Speier Company estimates that 240,000 direct labor hours will be worked during 2017 in the Assembly Department. On this basis, the following budgeted manufacturing Overhead data are computed. Variable Overhead Costs Fixed Overhead Costs Indirect labor S 72.000 Supervision $75.600 Indirect materials 48,000 Depreciation 30,000 Repairs 36,000 Insurance 12.000 Utilities 24.000 Rent 9.600 Lubricants 12.000 Property taxes 6,000 $192.000 $133,200 It is estimated that direct labor hours worked each month will range from 18,000 to 24,000 hours During January, 20,000 direct labor hours were worked and the following overhead Costs were incurred. Variable Overhead Costs Fixed Overhead Costs Indirect labor $ 6,200 Supervision $ 6,300 Indirect materials 3.600 Depreciation 2.500 Repairs 2.100 Insurance 1.000 Utilities 1.700 Rent Lubricants 1,050 Property taxes 500 $14,850 $11,150 Torstructions (a) Prepare a monthly flexible manufacturing overhead budget for each increment of 2,000 (a) 1 direct labor hours over the relevant range for the year ending December 31, 2017 (b) Prepare a manufacturing overhead budget report for January (c) Comment on management's efficiency in controlling manufacturing over ) head costs in January P10-2B Gonzalez Company produces one product, Olpe. Because of wide fluctuations in Prep demand for Olpe, the Assembly Department experiences significant variations in monthly bude production levels. The annual master manufacturing overhead budget is based on 300.000 direct labor (LO hours. In July, 27,500 labor hours were worked. The master manufacturing overhead bud get for the year and the actual overhead costs incurred in July are as follows. Master Budget Actual Overhead Costs (annual) In July Variable Indirect labor $300,000 $20,000 Indirect materials 150.000 11.350 Utilities 90.000 8,050 Maintenance 60,000 5,400 Fixed Supervision 144.000 12.000 Depreciation 96,000 8,000 Insurance and taxes 60.000 5,000 Total $900,000 $75,800 Instructions (a) Prepare a monthly flexible overhead budget for the year ending December 31, 2017. (a) T assuming monthly production levels range from 22.500 to 30,000 direct labor hours. Use increments of 2,500 direct labor hours. PROBLEMS: SET B Prep and (LO P10-1B Speier Company estimates that 240,000 direct labor hours will be worked during 2017 in the Assembly Department. On this basis, the following budgeted manufacturing Overhead data are computed. Variable Overhead Costs Fixed Overhead Costs Indirect labor S 72.000 Supervision $75.600 Indirect materials 48,000 Depreciation 30,000 Repairs 36,000 Insurance 12.000 Utilities 24.000 Rent 9.600 Lubricants 12.000 Property taxes 6,000 $192.000 $133,200 It is estimated that direct labor hours worked each month will range from 18,000 to 24,000 hours During January, 20,000 direct labor hours were worked and the following overhead Costs were incurred. Variable Overhead Costs Fixed Overhead Costs Indirect labor $ 6,200 Supervision $ 6,300 Indirect materials 3.600 Depreciation 2.500 Repairs 2.100 Insurance 1.000 Utilities 1.700 Rent Lubricants 1,050 Property taxes 500 $14,850 $11,150 Torstructions (a) Prepare a monthly flexible manufacturing overhead budget for each increment of 2,000 (a) 1 direct labor hours over the relevant range for the year ending December 31, 2017 (b) Prepare a manufacturing overhead budget report for January (c) Comment on management's efficiency in controlling manufacturing over ) head costs in January P10-2B Gonzalez Company produces one product, Olpe. Because of wide fluctuations in Prep demand for Olpe, the Assembly Department experiences significant variations in monthly bude production levels. The annual master manufacturing overhead budget is based on 300.000 direct labor (LO hours. In July, 27,500 labor hours were worked. The master manufacturing overhead bud get for the year and the actual overhead costs incurred in July are as follows. Master Budget Actual Overhead Costs (annual) In July Variable Indirect labor $300,000 $20,000 Indirect materials 150.000 11.350 Utilities 90.000 8,050 Maintenance 60,000 5,400 Fixed Supervision 144.000 12.000 Depreciation 96,000 8,000 Insurance and taxes 60.000 5,000 Total $900,000 $75,800 Instructions (a) Prepare a monthly flexible overhead budget for the year ending December 31, 2017. (a) T assuming monthly production levels range from 22.500 to 30,000 direct labor hours. Use increments of 2,500 direct labor hours