Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problems to solve - 1,2,3,4,5,6,7 Information for problem General Ledger 1. Calculate the budgeted cost of goods manufactured for the year. 0 0 Average Table

Problems to solve - 1,2,3,4,5,6,7

Information for problem

General Ledger

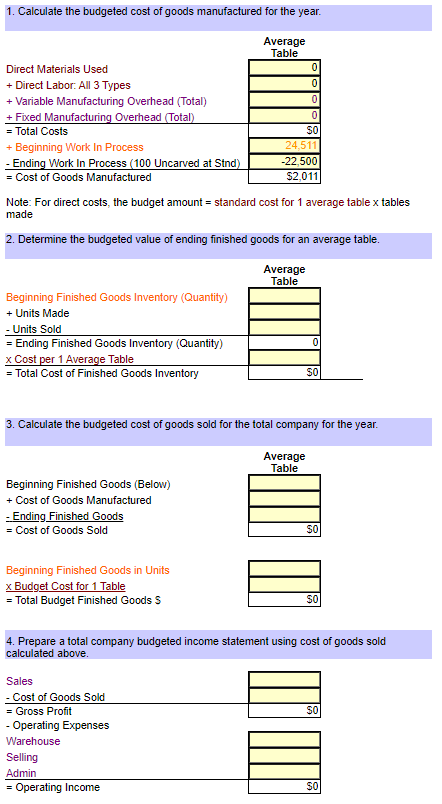

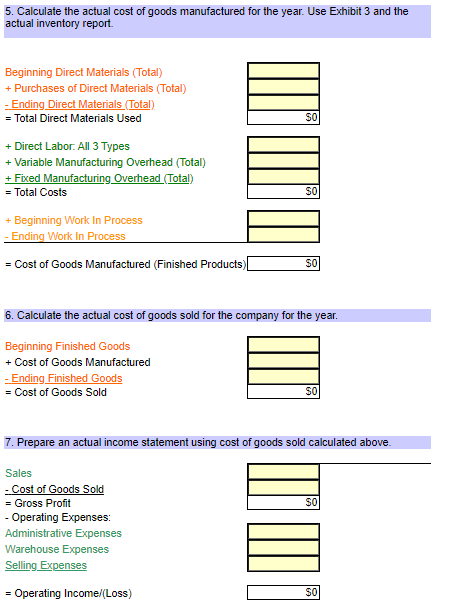

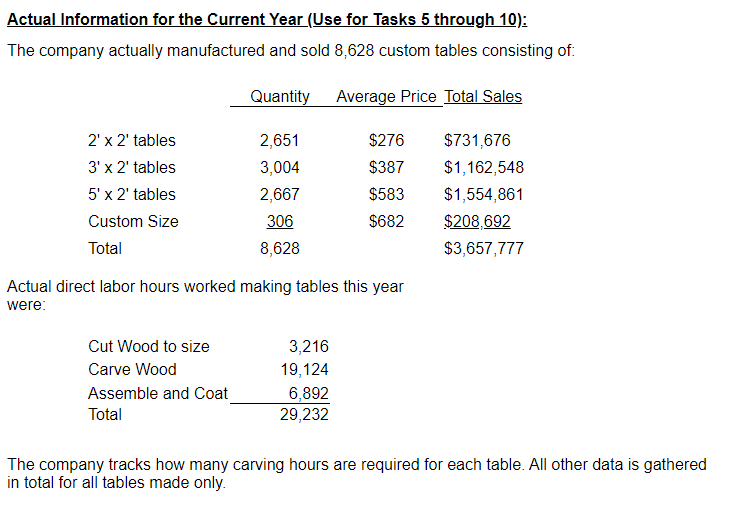

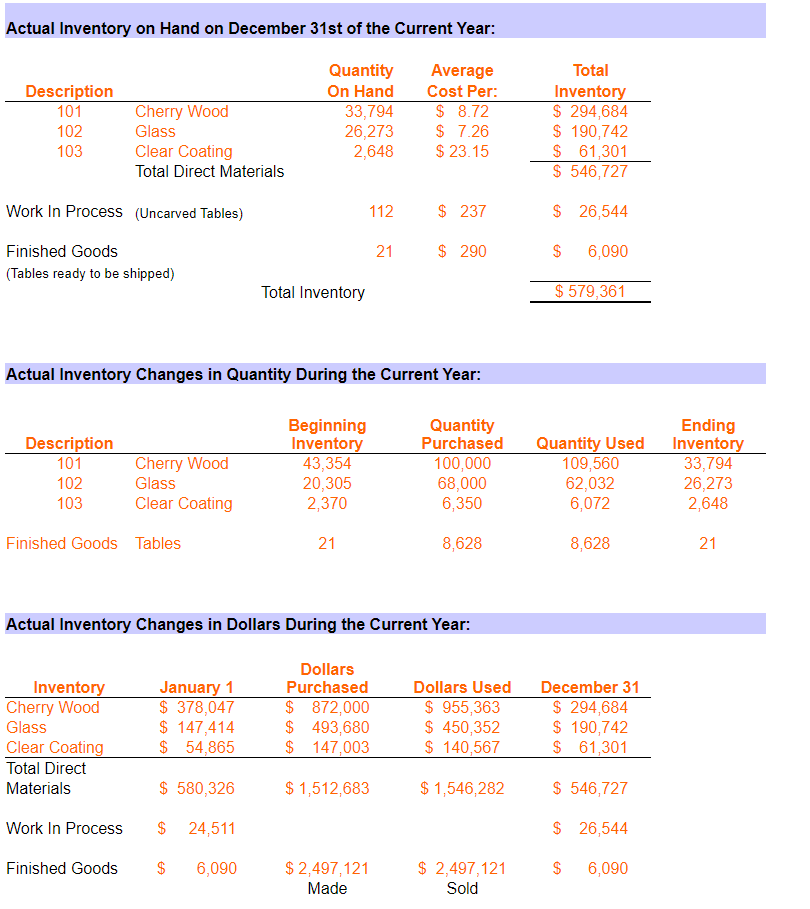

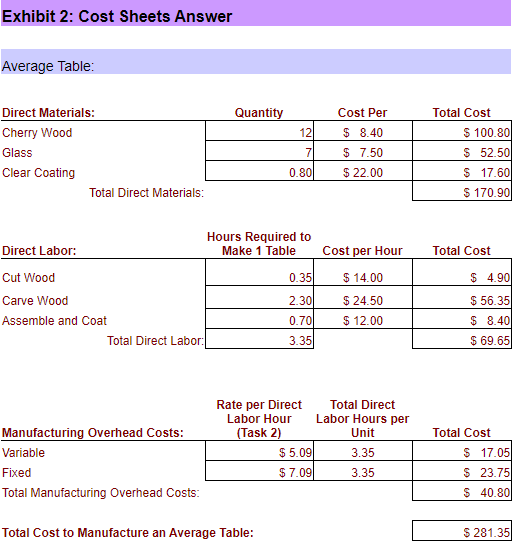

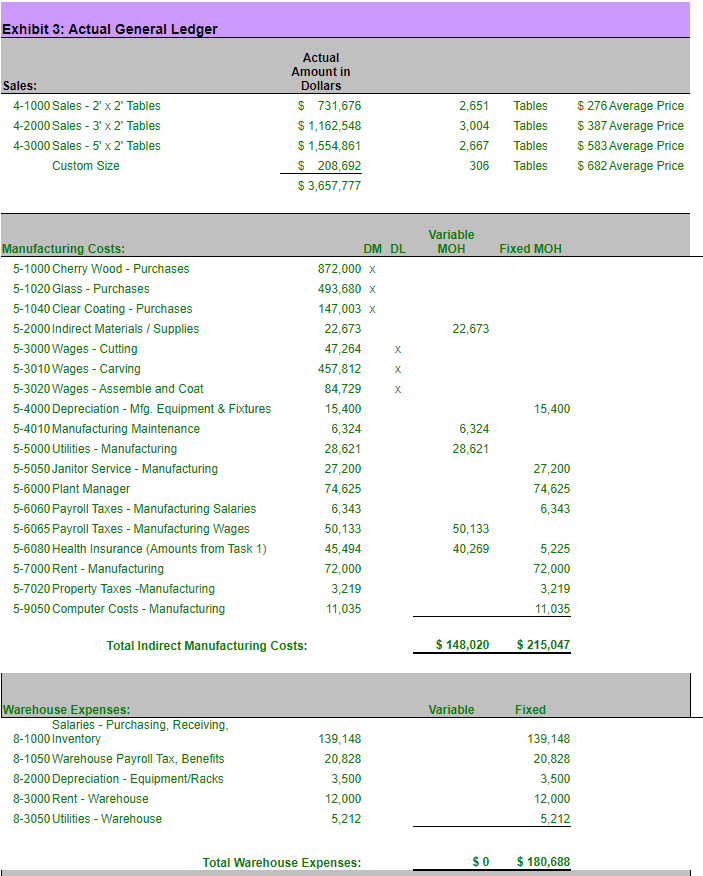

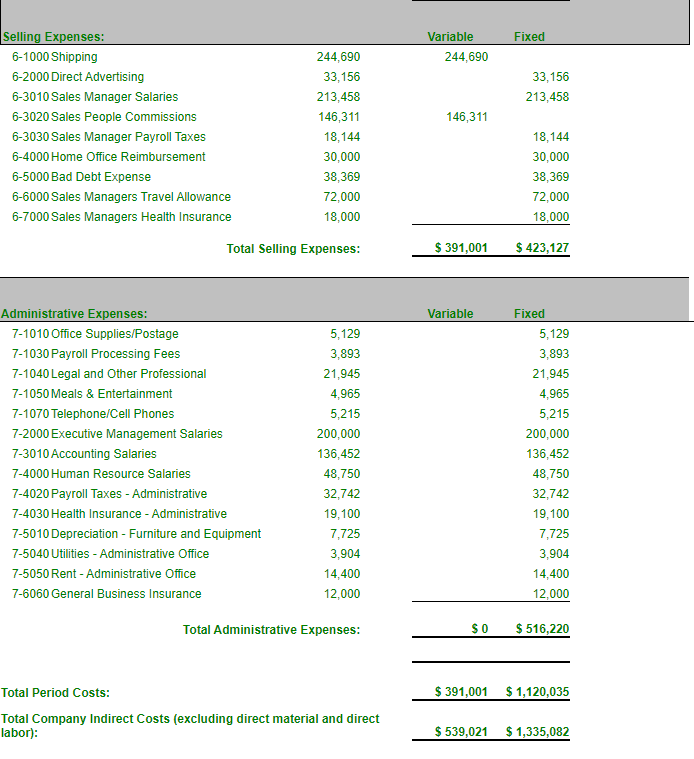

1. Calculate the budgeted cost of goods manufactured for the year. 0 0 Average Table Direct Materials Used 0 + Direct Labor: All 3 Types + Variable Manufacturing Overhead (Total) 0 + Fixed Manufacturing Overhead (Total) = Total Costs $0 + Beginning Work In Process 24,511 - Ending Work In Process (100 Uncarved at Stnd) -22,500 = Cost of Goods Manufactured $2,011 Note: For direct costs, the budget amount = standard cost for 1 average table x tables made 2. Determine the budgeted value of ending finished goods for an average table. Average Table Beginning Finished Goods Inventory (Quantity) + Units Made -Units Sold = Ending Finished Goods Inventory (Quantity) x Cost per 1 Average Table = Total Cost of Finished Goods Inventory 0 SO 3. Calculate the budgeted cost of goods sold for the total company for the year. Average Table Beginning Finished Goods (Below) + Cost of Goods Manufactured - Ending Finished Goods = Cost of Goods Sold SO Beginning Finished Goods in Units x Budget Cost for 1 Table = Total Budget Finished Goods S SON 4. Prepare a total company budgeted income statement using cost of goods sold calculated above. SON Sales - Cost of Goods Sold = Gross Profit - Operating Expenses Warehouse Selling Admin = Operating Income SO 5. Calculate the actual cost of goods manufactured for the year. Use Exhibit 3 and the actual inventory report Beginning Direct Materials (Total) + Purchases of Direct Materials (Total) - Ending Direct Materials (Total) = Total Direct Materials Used SO + Direct Labor. All 3 Types + Variable Manufacturing Overhead (Total) + Fixed Manufacturing Overhead (Total) = Total Costs + Beginning Work In Process - Ending Work In Process SO = Cost of Goods Manufactured (Finished Products) SO 6. Calculate the actual cost of goods sold for the company for the year. Beginning Finished Goods + Cost of Goods Manufactured - Ending Finished Goods = Cost of Goods Sold SO 7. Prepare an actual income statement using cost of goods sold calculated above. SO Sales - Cost of Goods Sold = Gross Profit - Operating Expenses: Administrative Expenses Warehouse Expenses Selling Expenses = Operating Income/(Loss) Actual Information for the Current Year (Use for Tasks 5 through 10): The company actually manufactured and sold 8,628 custom tables consisting of Quantity Average Price Total Sales 2' x 2' tables 3' x 2' tables 5' x 2' tables Custom Size Total 2,651 3,004 2,667 306 8,628 $276 $387 $583 $682 $731,676 $1,162,548 $1,554,861 $208,692 $3,657,777 Actual direct labor hours worked making tables this year were: Cut Wood to size Carve Wood Assemble and Coat Total 3,216 19,124 6,892 29,232 The company tracks how many carving hours are required for each table. All other data is gathered in total for all tables made only. Actual Inventory on Hand on December 31st of the Current Year: Description 101 102 103 Cherry Wood Glass Clear Coating Total Direct Materials Quantity On Hand 33,794 26,273 2,648 Average Cost Per: $ 8.72 $ 7.26 $ 23.15 Total Inventory $ 294,684 $ 190,742 $ 61,301 $ 546,727 Work In Process (Uncarved Tables) 112 $ 237 $ 26,544 21 $ 290 $ 6,090 Finished Goods (Tables ready to be shipped) Total Inventory $ 579,361 Actual Inventory Changes in Quantity During the Current Year: Description 101 102 103 Cherry Wood Glass Clear Coating Beginning Inventory 43,354 20,305 2,370 Quantity Purchased 100,000 68,000 6,350 Quantity Used 109,560 62,032 6,072 Ending Inventory 33,794 26,273 2,648 Finished Goods Tables 21 8,628 8,628 21 Actual Inventory Changes in Dollars During the Current Year: Inventory Cherry Wood Glass Clear Coating Total Direct Materials January 1 $ 378,047 $ 147,414 $ 54,865 Dollars Purchased $ 872,000 $ 493,680 $ 147,003 Dollars Used $ 955,363 $ 450,352 $ 140,567 December 31 $ 294,684 $ 190,742 $ 61,301 $ 580,326 $ 1,512,683 $ 1,546,282 $ 546,727 Work In Process $ 24,511 $ 26,544 Finished Goods $ 6,090 $ $ 2,497,121 Made $ 2,497,121 Sold 6,090 Exhibit 2: Cost Sheets Answer Average Table: Quantity 12 Direct Materials: Cherry Wood Glass Clear Coating Total Direct Materials: Cost Per $ 8.40 $ 7.50 $ 22.00 71 0.80 Total Cost $ 100.80 $ 52.50 $ 17.60 $ 170.901 Cost per Hour Total Cost $ 4.901 Hours Required to Direct Labor: Make 1 Table Cut Wood 0.35 Carve Wood 2.30 Assemble and Coat 0.70 Total Direct Labor: 3.35 $ 14.00 $ 24.50 $ 12.00 $ 56.35 $ 8.401 $ 69.65) Total Cost Manufacturing Overhead Costs: Variable Fixed Total Manufacturing Overhead Costs: Rate per Direct Total Direct Labor Hour Labor Hours per (Task 2) Unit $ 5.09 3.35 $7.09 3.35 $ 17.05 $ 23.75 $ 40.80 Total Cost to Manufacture an Average Table: $ 281.35 Exhibit 3: Actual General Ledger Sales: 4-1000 Sales - 2' x 2 Tables 4-2000 Sales - 3" x 2" Tables 4-3000 Sales - 5'X2' Tables Custom Size Actual Amount in Dollars $ 731,676 $ 1,162,548 $ 1,554,861 $ 208,692 $ 3,657,777 2,651 3,004 2,667 306 Tables Tables Tables $ 276 Average Price $ 387 Average Price $ 583 Average Price $ 682 Average Price Tables Variable MOH Fixed MOH 22,673 15,400 Manufacturing Costs: 5-1000 Cherry Wood - Purchases 5-1020 Glass - Purchases 5-1040 Clear Coating - Purchases 5-2000 Indirect Materials / Supplies 5-3000 Wages - Cutting 5-3010 Wages - Carving 5-3020 Wages - Assemble and Coat 5-4000 Depreciation - Mfg. Equipment & Fixtures 5-4010 Manufacturing Maintenance 5-5000 Utilities - Manufacturing 5-5050 Janitor Service - Manufacturing 5-6000 Plant Manager 5-6060 Payroll Taxes - Manufacturing Salaries 5-6065 Payroll Taxes - Manufacturing Wages 5-6080 Health Insurance (Amounts from Task 1) 5-7000 Rent - Manufacturing 5-7020 Property Taxes -Manufacturing 5-9050 Computer Costs - Manufacturing DM DL 872,000 x 493,680 x 147,003 x 22,673 47,264 457,812 X 84,729 15,400 6,324 28,621 27,200 74,625 6,343 50,133 45,494 72,000 3,219 11,035 6,324 28,621 27,200 74,625 6,343 50,133 40,269 5,225 72,000 3,219 11,035 Total Indirect Manufacturing Costs: $ 148,020 $ 215,047 Variable Warehouse Expenses: Salaries - Purchasing, Receiving, 8-1000 Inventory 8-1050 Warehouse Payroll Tax, Benefits 8-2000 Depreciation - Equipment/Racks 8-3000 Rent - Warehouse 8-3050 Utilities - Warehouse 139,148 20,828 3,500 12,000 5,212 Fixed 139,148 20,828 3,500 12,000 5,212 Total Warehouse Expenses: SO $ 180,688 Fixed Variable 244,690 33,156 213,458 146,311 Selling Expenses: 6-1000 Shipping 6-2000 Direct Advertising 6-3010 Sales Manager Salaries 6-3020 Sales People Commissions 6-3030 Sales Manager Payroll Taxes 6-4000 Home Office Reimbursement 6-5000 Bad Debt Expense 6-6000 Sales Managers Travel Allowance 6-7000 Sales Managers Health Insurance 244,690 33,156 213,458 146,311 18,144 30,000 38,369 72,000 18,000 18,144 30,000 38,369 72,000 18,000 Total Selling Expenses: $ 391,001 $ 423,127 Variable Administrative Expenses: 7-1010 Office Supplies/Postage 7-1030 Payroll Processing Fees 7-1040 Legal and Other Professional 7-1050 Meals & Entertainment 7-1070 Telephone/Cell Phones 7-2000 Executive Management Salaries 7-3010 Accounting Salaries 7-4000 Human Resource Salaries 7-4020 Payroll Taxes - Administrative 7-4030 Health Insurance - Administrative 7-5010 Depreciation - Furniture and Equipment 7-5040 Utilities - Administrative Office 7-5050 Rent - Administrative Office 7-6060 General Business Insurance 5,129 3,893 21,945 4,965 5,215 200,000 136,452 48,750 32,742 19,100 7,725 3,904 14,400 12,000 Fixed 5,129 3,893 21,945 4,965 5,215 200,000 136,452 48,750 32,742 19,100 7,725 3,904 14,400 12,000 Total Administrative Expenses: SO $ 516,220 $ 391,001 $ 1,120,035 Total Period Costs: Total Company Indirect Costs (excluding direct material and direct labor): $539,021 $ 1,335,082 1. Calculate the budgeted cost of goods manufactured for the year. 0 0 Average Table Direct Materials Used 0 + Direct Labor: All 3 Types + Variable Manufacturing Overhead (Total) 0 + Fixed Manufacturing Overhead (Total) = Total Costs $0 + Beginning Work In Process 24,511 - Ending Work In Process (100 Uncarved at Stnd) -22,500 = Cost of Goods Manufactured $2,011 Note: For direct costs, the budget amount = standard cost for 1 average table x tables made 2. Determine the budgeted value of ending finished goods for an average table. Average Table Beginning Finished Goods Inventory (Quantity) + Units Made -Units Sold = Ending Finished Goods Inventory (Quantity) x Cost per 1 Average Table = Total Cost of Finished Goods Inventory 0 SO 3. Calculate the budgeted cost of goods sold for the total company for the year. Average Table Beginning Finished Goods (Below) + Cost of Goods Manufactured - Ending Finished Goods = Cost of Goods Sold SO Beginning Finished Goods in Units x Budget Cost for 1 Table = Total Budget Finished Goods S SON 4. Prepare a total company budgeted income statement using cost of goods sold calculated above. SON Sales - Cost of Goods Sold = Gross Profit - Operating Expenses Warehouse Selling Admin = Operating Income SO 5. Calculate the actual cost of goods manufactured for the year. Use Exhibit 3 and the actual inventory report Beginning Direct Materials (Total) + Purchases of Direct Materials (Total) - Ending Direct Materials (Total) = Total Direct Materials Used SO + Direct Labor. All 3 Types + Variable Manufacturing Overhead (Total) + Fixed Manufacturing Overhead (Total) = Total Costs + Beginning Work In Process - Ending Work In Process SO = Cost of Goods Manufactured (Finished Products) SO 6. Calculate the actual cost of goods sold for the company for the year. Beginning Finished Goods + Cost of Goods Manufactured - Ending Finished Goods = Cost of Goods Sold SO 7. Prepare an actual income statement using cost of goods sold calculated above. SO Sales - Cost of Goods Sold = Gross Profit - Operating Expenses: Administrative Expenses Warehouse Expenses Selling Expenses = Operating Income/(Loss) Actual Information for the Current Year (Use for Tasks 5 through 10): The company actually manufactured and sold 8,628 custom tables consisting of Quantity Average Price Total Sales 2' x 2' tables 3' x 2' tables 5' x 2' tables Custom Size Total 2,651 3,004 2,667 306 8,628 $276 $387 $583 $682 $731,676 $1,162,548 $1,554,861 $208,692 $3,657,777 Actual direct labor hours worked making tables this year were: Cut Wood to size Carve Wood Assemble and Coat Total 3,216 19,124 6,892 29,232 The company tracks how many carving hours are required for each table. All other data is gathered in total for all tables made only. Actual Inventory on Hand on December 31st of the Current Year: Description 101 102 103 Cherry Wood Glass Clear Coating Total Direct Materials Quantity On Hand 33,794 26,273 2,648 Average Cost Per: $ 8.72 $ 7.26 $ 23.15 Total Inventory $ 294,684 $ 190,742 $ 61,301 $ 546,727 Work In Process (Uncarved Tables) 112 $ 237 $ 26,544 21 $ 290 $ 6,090 Finished Goods (Tables ready to be shipped) Total Inventory $ 579,361 Actual Inventory Changes in Quantity During the Current Year: Description 101 102 103 Cherry Wood Glass Clear Coating Beginning Inventory 43,354 20,305 2,370 Quantity Purchased 100,000 68,000 6,350 Quantity Used 109,560 62,032 6,072 Ending Inventory 33,794 26,273 2,648 Finished Goods Tables 21 8,628 8,628 21 Actual Inventory Changes in Dollars During the Current Year: Inventory Cherry Wood Glass Clear Coating Total Direct Materials January 1 $ 378,047 $ 147,414 $ 54,865 Dollars Purchased $ 872,000 $ 493,680 $ 147,003 Dollars Used $ 955,363 $ 450,352 $ 140,567 December 31 $ 294,684 $ 190,742 $ 61,301 $ 580,326 $ 1,512,683 $ 1,546,282 $ 546,727 Work In Process $ 24,511 $ 26,544 Finished Goods $ 6,090 $ $ 2,497,121 Made $ 2,497,121 Sold 6,090 Exhibit 2: Cost Sheets Answer Average Table: Quantity 12 Direct Materials: Cherry Wood Glass Clear Coating Total Direct Materials: Cost Per $ 8.40 $ 7.50 $ 22.00 71 0.80 Total Cost $ 100.80 $ 52.50 $ 17.60 $ 170.901 Cost per Hour Total Cost $ 4.901 Hours Required to Direct Labor: Make 1 Table Cut Wood 0.35 Carve Wood 2.30 Assemble and Coat 0.70 Total Direct Labor: 3.35 $ 14.00 $ 24.50 $ 12.00 $ 56.35 $ 8.401 $ 69.65) Total Cost Manufacturing Overhead Costs: Variable Fixed Total Manufacturing Overhead Costs: Rate per Direct Total Direct Labor Hour Labor Hours per (Task 2) Unit $ 5.09 3.35 $7.09 3.35 $ 17.05 $ 23.75 $ 40.80 Total Cost to Manufacture an Average Table: $ 281.35 Exhibit 3: Actual General Ledger Sales: 4-1000 Sales - 2' x 2 Tables 4-2000 Sales - 3" x 2" Tables 4-3000 Sales - 5'X2' Tables Custom Size Actual Amount in Dollars $ 731,676 $ 1,162,548 $ 1,554,861 $ 208,692 $ 3,657,777 2,651 3,004 2,667 306 Tables Tables Tables $ 276 Average Price $ 387 Average Price $ 583 Average Price $ 682 Average Price Tables Variable MOH Fixed MOH 22,673 15,400 Manufacturing Costs: 5-1000 Cherry Wood - Purchases 5-1020 Glass - Purchases 5-1040 Clear Coating - Purchases 5-2000 Indirect Materials / Supplies 5-3000 Wages - Cutting 5-3010 Wages - Carving 5-3020 Wages - Assemble and Coat 5-4000 Depreciation - Mfg. Equipment & Fixtures 5-4010 Manufacturing Maintenance 5-5000 Utilities - Manufacturing 5-5050 Janitor Service - Manufacturing 5-6000 Plant Manager 5-6060 Payroll Taxes - Manufacturing Salaries 5-6065 Payroll Taxes - Manufacturing Wages 5-6080 Health Insurance (Amounts from Task 1) 5-7000 Rent - Manufacturing 5-7020 Property Taxes -Manufacturing 5-9050 Computer Costs - Manufacturing DM DL 872,000 x 493,680 x 147,003 x 22,673 47,264 457,812 X 84,729 15,400 6,324 28,621 27,200 74,625 6,343 50,133 45,494 72,000 3,219 11,035 6,324 28,621 27,200 74,625 6,343 50,133 40,269 5,225 72,000 3,219 11,035 Total Indirect Manufacturing Costs: $ 148,020 $ 215,047 Variable Warehouse Expenses: Salaries - Purchasing, Receiving, 8-1000 Inventory 8-1050 Warehouse Payroll Tax, Benefits 8-2000 Depreciation - Equipment/Racks 8-3000 Rent - Warehouse 8-3050 Utilities - Warehouse 139,148 20,828 3,500 12,000 5,212 Fixed 139,148 20,828 3,500 12,000 5,212 Total Warehouse Expenses: SO $ 180,688 Fixed Variable 244,690 33,156 213,458 146,311 Selling Expenses: 6-1000 Shipping 6-2000 Direct Advertising 6-3010 Sales Manager Salaries 6-3020 Sales People Commissions 6-3030 Sales Manager Payroll Taxes 6-4000 Home Office Reimbursement 6-5000 Bad Debt Expense 6-6000 Sales Managers Travel Allowance 6-7000 Sales Managers Health Insurance 244,690 33,156 213,458 146,311 18,144 30,000 38,369 72,000 18,000 18,144 30,000 38,369 72,000 18,000 Total Selling Expenses: $ 391,001 $ 423,127 Variable Administrative Expenses: 7-1010 Office Supplies/Postage 7-1030 Payroll Processing Fees 7-1040 Legal and Other Professional 7-1050 Meals & Entertainment 7-1070 Telephone/Cell Phones 7-2000 Executive Management Salaries 7-3010 Accounting Salaries 7-4000 Human Resource Salaries 7-4020 Payroll Taxes - Administrative 7-4030 Health Insurance - Administrative 7-5010 Depreciation - Furniture and Equipment 7-5040 Utilities - Administrative Office 7-5050 Rent - Administrative Office 7-6060 General Business Insurance 5,129 3,893 21,945 4,965 5,215 200,000 136,452 48,750 32,742 19,100 7,725 3,904 14,400 12,000 Fixed 5,129 3,893 21,945 4,965 5,215 200,000 136,452 48,750 32,742 19,100 7,725 3,904 14,400 12,000 Total Administrative Expenses: SO $ 516,220 $ 391,001 $ 1,120,035 Total Period Costs: Total Company Indirect Costs (excluding direct material and direct labor): $539,021 $ 1,335,082

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started