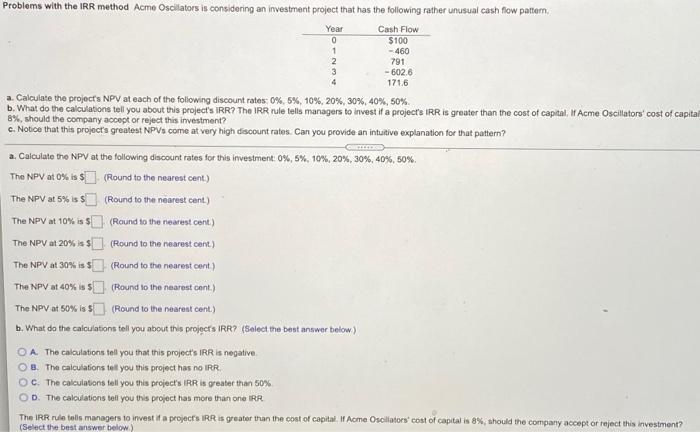

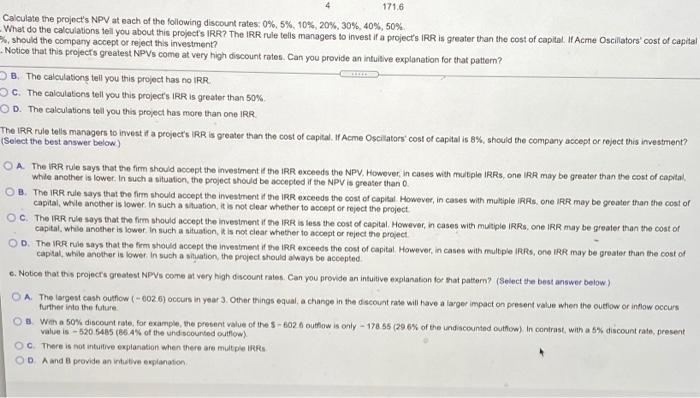

Problems with the IRR method Acme Oscilators is considering an investment project that has the following rather unusual cash flow pattern Year Cash Flow 0 $100 1 - 460 2 791 3 -602.6 4 171.6 a. Calculate the project's NPV at each of the following discount rates: 0% 5%, 10%, 20%, 30%, 40%, 50% b. What do the calculations tell you about this project's IRR? The IRR rule tells managers to invest if a project's IRR is greater than the cost of capital, Acme Oscillators' cost of capital 8%, should the company accept or reject this investment? c. Notice that this project's greatest NPVs come at very high discount rates. Can you provide an intuitive explanation for that pattern? a. Calculate the NPV at the following discount rates for this investment: 0%, 5%, 10%, 20%, 30%, 40%, 50%, The NPV at 0% is $(Round to the nearest cent) The NPV at 5% is (Round to the nearest cent) The NPV at 10% is $(Round to the nearest cent.) The NPV at 20% (Round to the nearest cent) The NPV 4430% iss (Round to the nearest cent The NPV at 40% is 5 (Round to the nearest cont.) The NPV at 50% in $(Round to the nearest cent) b. What do the calculations tell you about this projects IRR? (Select the best answer below) O A The calculations tell you that this project's IRR is negative OB. The calculations tell you this project has no RR OC. The calculations tell you this project's IRR is greater than 50% OD. The calculations tell you this project has more than one IRR The IRR rule tols managers to invest if a project's IRR is greater than the cost of capital. Acme Oscillators' cost of capital is 8% should the company accept or reject this investment? (Select the best answer below) 171.6 Calculate the project's NPV at each of the following discount rates: 0% 5% 10% 20% 30% 40%, 50% - What do the calculations tell you about this project's IRR? The IRR rule tells managers to invest if a project's IRR is greater than the cost of capital. If Acme Oscillators' cost of capital %, should the company accept or reject this investment? Notice that this project's greatest NPVs come at very high discount rates. Can you provide an intuitive explanation for that pattern? B. The calculations tell you this project has no RR c. The calculations tell you this project's IRR is greater than 50% D. The calculations tell you this project has more than one IRR The IRR rule tels managers to invest if a project's IRR is greater than the cost of capital. Acme Oscilators cost of capital is 8%, should the company accept or reject this investment? (Select the best answer below) O A The IRR rue says that the firm should accept the investment if the IRR exceeds the NPV. However, in cases with multiple IRRs, one IRR may be greater than the cost of capital, whle another is lower In such a situation, the project should be accepted the NPV is greater than 0. OB. The IRR rule says that the firm should accept the investment if the IRR exceeds the cost of capital. However, in cases with multiple IRR one IRR may be greater than the cost of capital, while another is lower. In such a situation, it is not clear whether to accept or reject the project OC. The IRR rule says that the firm should accept the investment if the IRR is less the cost of capital. However, in cases with multiple IRRs One IRR may be greater than the cost of capital, while another is lower in such a situation is not clear whether to accept or reject the project OD. The IRR rule says that the firm should accept the investment if the IRR exceeds the cost of capital. However, in cases with multiple IRRS, OR IRR may be greater than the cost of capital, while another is lower in such a situation, the project should always be accepted e. Notice that this project's greatest NPVs come at very high discount rates Can you provide an intuitive explanation for at pattern? (Select the best answer below) O A The largest eush outflow ( -402.6) occurs in year 3. Other things equal, a change in the discount rate will have a larger impact on present value when the outlow or inflow occurs further into the future OB. wm a 50% discount rate, for example, the procent value of the 5-6026 outflow is only - 17865 (290% of the undiscounted out ow). In contrast, with a 5% discount rate, present valueis-520 5485 (86.4% of the undiscounted outflow) OC. There is not intuitive explanation when there are multiple RR OD A and provide an intuitive explanation