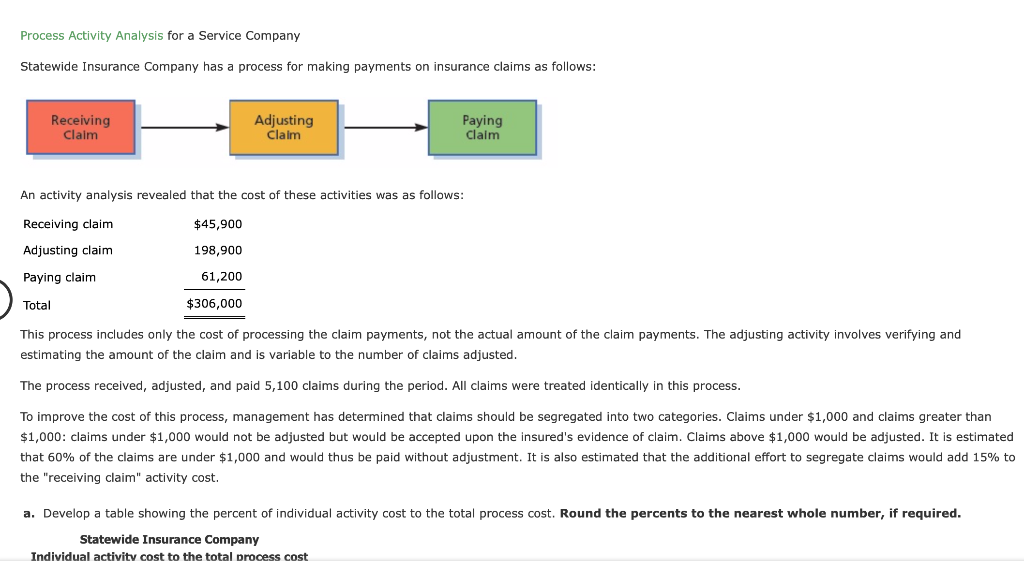

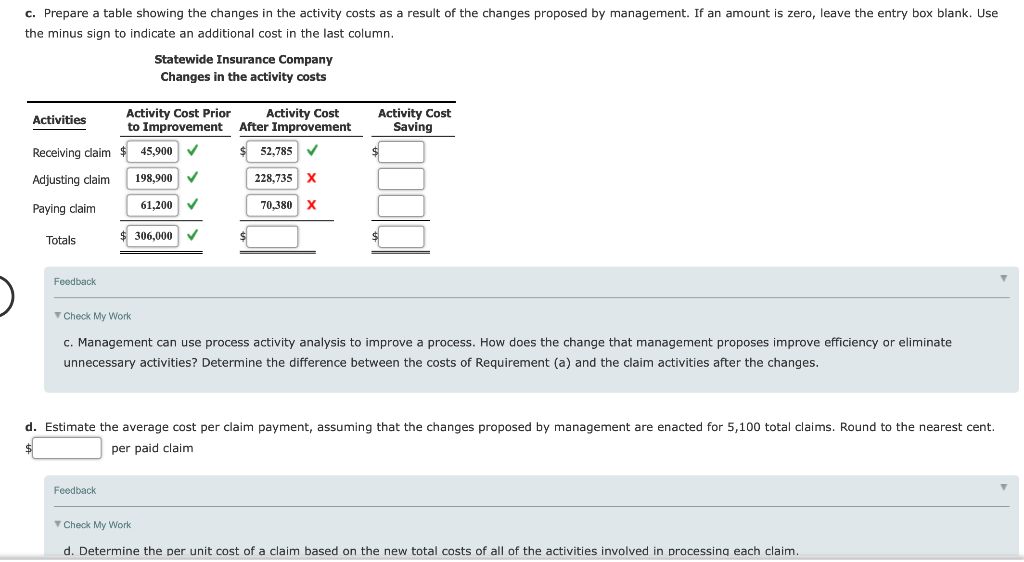

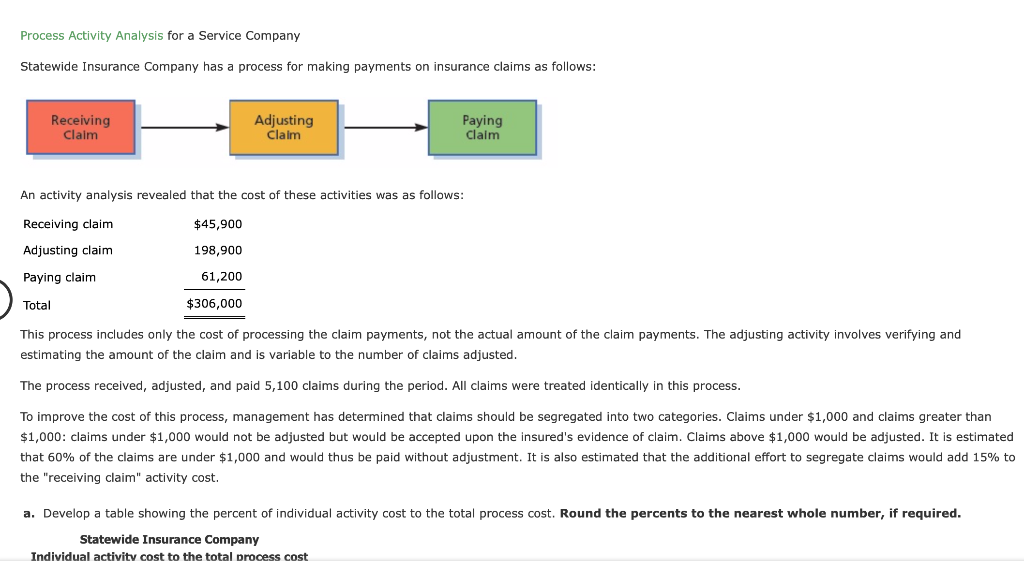

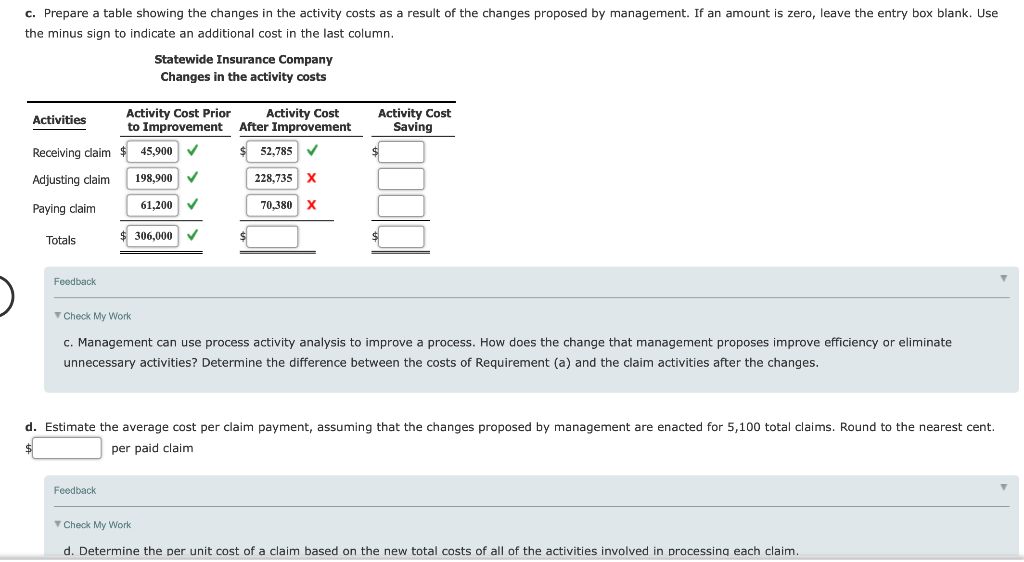

Process Activity Analysis for a Service Company Statewide Insurance Company has a process for making payments on insurance claims as follows: Receiving Claim Adjusting Claim Paying Claim An activity analysis revealed that the cost of these activities was as follows: Receiving claim $45,900 Adjusting claim 198,900 Paying claim 61,200 Total $306,000 This process includes only the cost of processing the claim payments, not the actual amount of the claim payments. The adjusting activity involves verifying and estimating the amount of the claim and is variable to the number of claims adjusted. The process received, adjusted, and paid 5,100 claims during the period. All claims were treated identically in this process. To improve the cost of this process, management has determined that claims should be segregated into two categories. Claims under $1,000 and claims greater than $1,000: claims under $1,000 would not be adjusted but would be accepted upon the insured's evidence of claim. Claims above $1,000 would be adjusted. It is estimated that 60% of the claims are under $1,000 and would thus be paid without adjustment. It is also estimated that the additional effort to segregate claims would add 15% to the "receiving claim" activity cost. a. Develop a table showing the percent of individual activity cost to the total process cost. Round the percents to the nearest whole number, if required. Statewide Insurance Company Individual activity cost to the total process cost c. Prepare a table showing the changes in the activity costs as a result of the changes proposed by management. If an amount is zero, leave the entry box blank. Use the minus sign to indicate an additional cost in the last column. Statewide Insurance Company Changes in the activity costs Activities Activity Cost Saving Receiving claim Activity Cost Prior Activity Cost to Improvement After Improvement $ 45,900 $ 52,785 198,900 228,735 x 61,200 70,380 x Adjusting claim Paying claim Totals $ 306,000 Feedback Check My Work c. Management can use process activity analysis to improve a process. How does the change that management proposes improve efficiency or eliminate unnecessary activities? Determine the difference between the costs of Requirement (a) and the claim activities after the changes. d. Estimate the average cost per claim payment, assuming that the changes proposed by management are enacted for 5,100 total claims. Round to the nearest cent. per paid claim Feedback Check My Work d. Determine the per unit cost of a claim based on the new total costs of all of the activities involved in processing each claim. Process Activity Analysis for a Service Company Statewide Insurance Company has a process for making payments on insurance claims as follows: Receiving Claim Adjusting Claim Paying Claim An activity analysis revealed that the cost of these activities was as follows: Receiving claim $45,900 Adjusting claim 198,900 Paying claim 61,200 Total $306,000 This process includes only the cost of processing the claim payments, not the actual amount of the claim payments. The adjusting activity involves verifying and estimating the amount of the claim and is variable to the number of claims adjusted. The process received, adjusted, and paid 5,100 claims during the period. All claims were treated identically in this process. To improve the cost of this process, management has determined that claims should be segregated into two categories. Claims under $1,000 and claims greater than $1,000: claims under $1,000 would not be adjusted but would be accepted upon the insured's evidence of claim. Claims above $1,000 would be adjusted. It is estimated that 60% of the claims are under $1,000 and would thus be paid without adjustment. It is also estimated that the additional effort to segregate claims would add 15% to the "receiving claim" activity cost. a. Develop a table showing the percent of individual activity cost to the total process cost. Round the percents to the nearest whole number, if required. Statewide Insurance Company Individual activity cost to the total process cost c. Prepare a table showing the changes in the activity costs as a result of the changes proposed by management. If an amount is zero, leave the entry box blank. Use the minus sign to indicate an additional cost in the last column. Statewide Insurance Company Changes in the activity costs Activities Activity Cost Saving Receiving claim Activity Cost Prior Activity Cost to Improvement After Improvement $ 45,900 $ 52,785 198,900 228,735 x 61,200 70,380 x Adjusting claim Paying claim Totals $ 306,000 Feedback Check My Work c. Management can use process activity analysis to improve a process. How does the change that management proposes improve efficiency or eliminate unnecessary activities? Determine the difference between the costs of Requirement (a) and the claim activities after the changes. d. Estimate the average cost per claim payment, assuming that the changes proposed by management are enacted for 5,100 total claims. Round to the nearest cent. per paid claim Feedback Check My Work d. Determine the per unit cost of a claim based on the new total costs of all of the activities involved in processing each claim