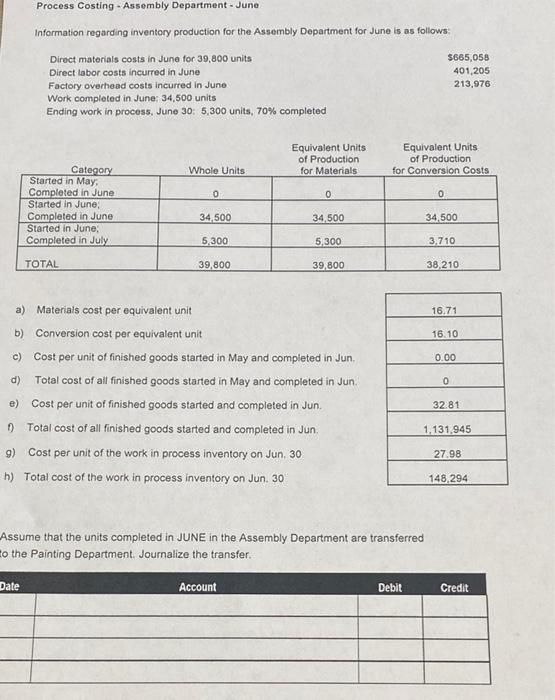

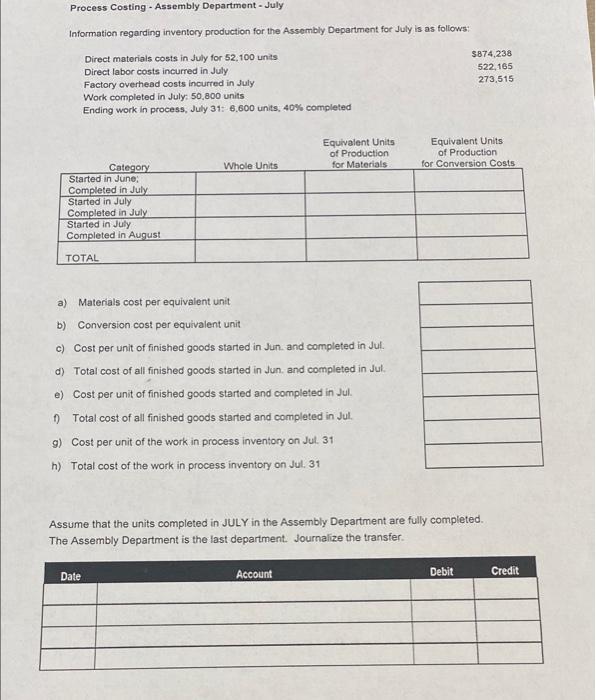

Process Costing - Assembly Department - June Information regarding inventory production for the Assembly Department for June is as follows: Direct materials costs in June for 39,800 units $665,055 Direct labor costs incurred in June 401,205 Factory overhead costs incurred in June 213,976 Work completed in June: 34,500 units Ending work in process, June 30: 5,300 units, 70% completed Equivalent Units of Production for Materials Equivalent Units of Production for Conversion Costs Whole Units 0 0 0 Category Started in May Completed in June Started in June Completed in June Started in June Completed in July 34,500 34,500 34,500 5,300 5,300 3.710 TOTAL 39,800 39,800 38,210 16.71 16.10 0.00 0 a) Materials cost per equivalent unit b) Conversion cost per equivalent unit c) Cost per unit of finished goods started in May and completed in Jun. d) Total cost of all finished goods started in May and completed in Jun. e) Cost per unit of finished goods started and completed in Jun Total cost of all finished goods started and completed in Jun 9) Cost per unit of the work in process inventory on Jun 30 h) Total cost of the work in process inventory on Jun. 30 32.81 0 1,131,945 27.98 148,294 Assume that the units completed in JUNE in the Assembly Department are transferred to the Painting Department. Journalize the transfer. Date Account Debit Credit Process Costing - Assembly Department - July Information regarding inventory production for the Assembly Department for July is as follows: $874.238 522,165 273,515 Direct materials costs in July for 52,100 units Direct labor costs incurred in July Factory overhead costs incurred in July Work completed in July: 50,800 units Ending work in process, July 31: 6,600 units, 40% completed Equivalent Units of Production for Materials Equivalent Units of Production for Conversion Costs Whole Units Category Started in June Completed in July Started in July Completed in July Started in July Completed in August TOTAL a) Materials cost per equivalent unit b) Conversion cost per equivalent unit c) Cost per unit of finished goods started in Jun, and completed in Jul d) Total cost of all finished goods started in Jun, and completed in Jul e) Cost per unit of finished goods started and completed in Jul Total cost of all finished goods started and completed in Jul. 9) Cost per unit of the work in process inventory on Jul. 31 h) Total cost of the work in process inventory on Jul. 31 Assume that the units completed in JULY in the Assembly Department are fully completed. The Assembly Department is the last department. Journalize the transfer Date Account Debit Credit