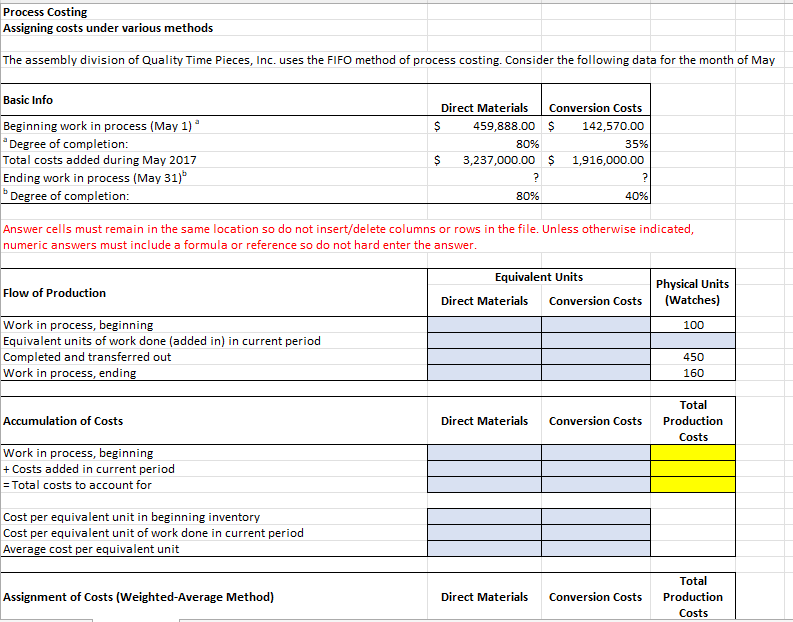

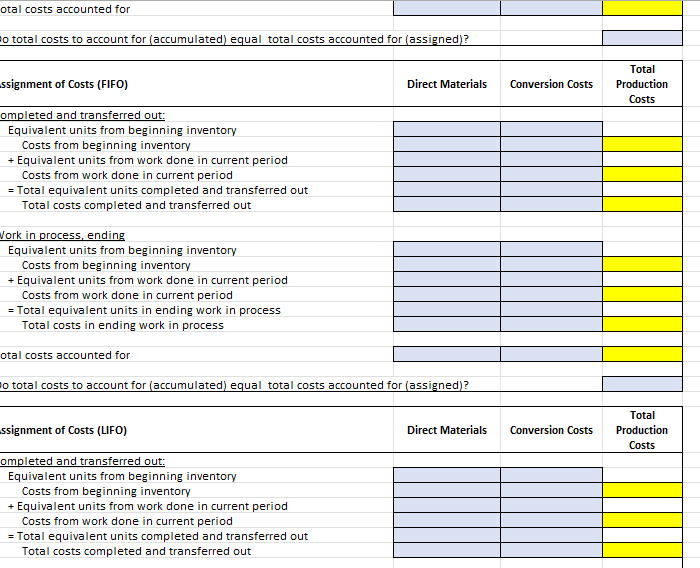

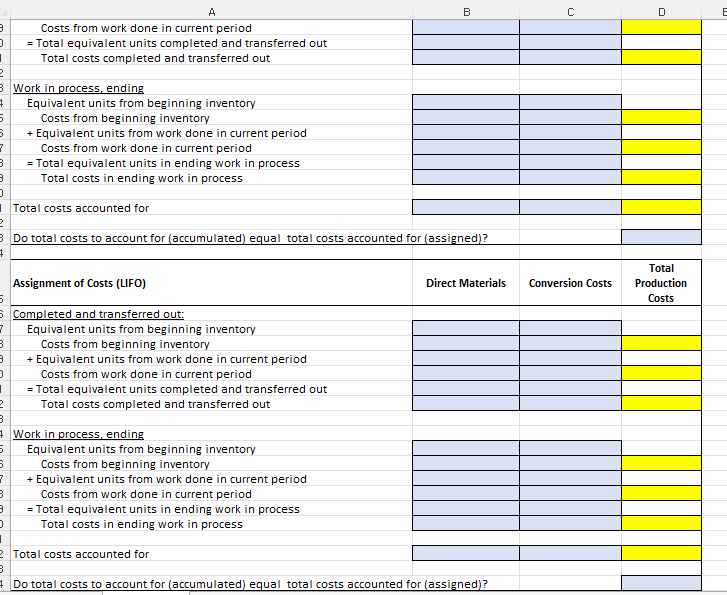

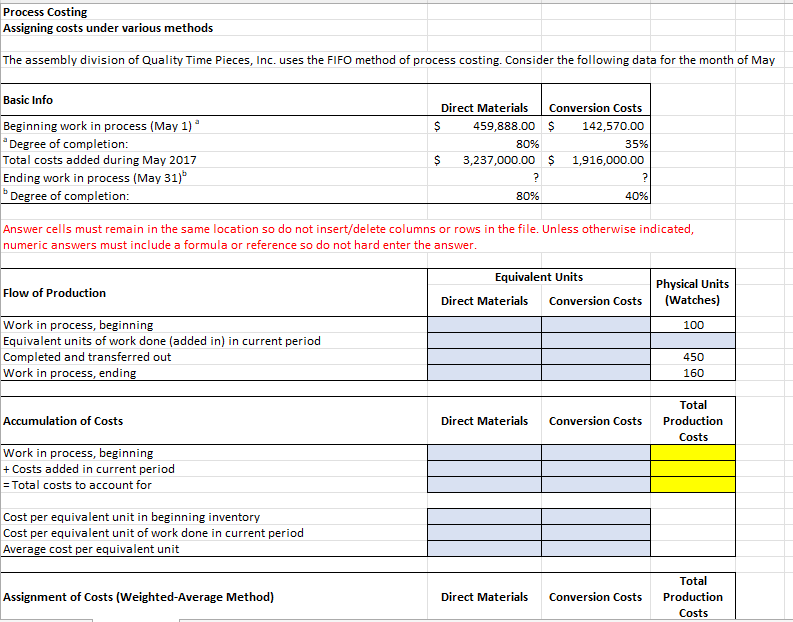

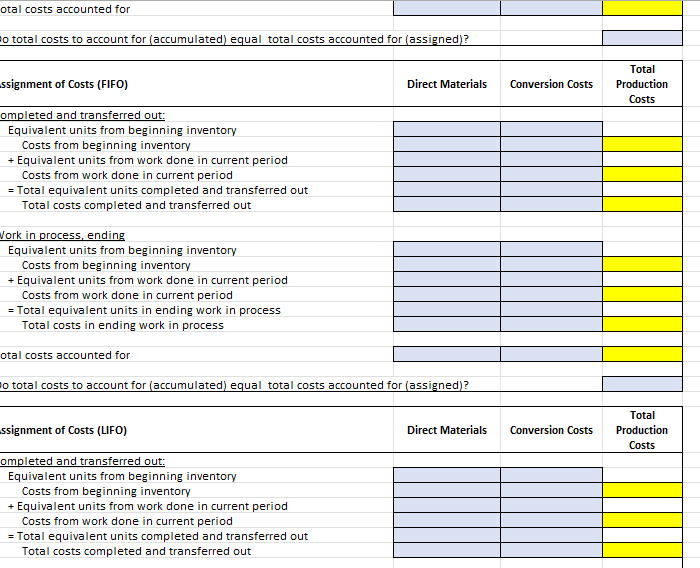

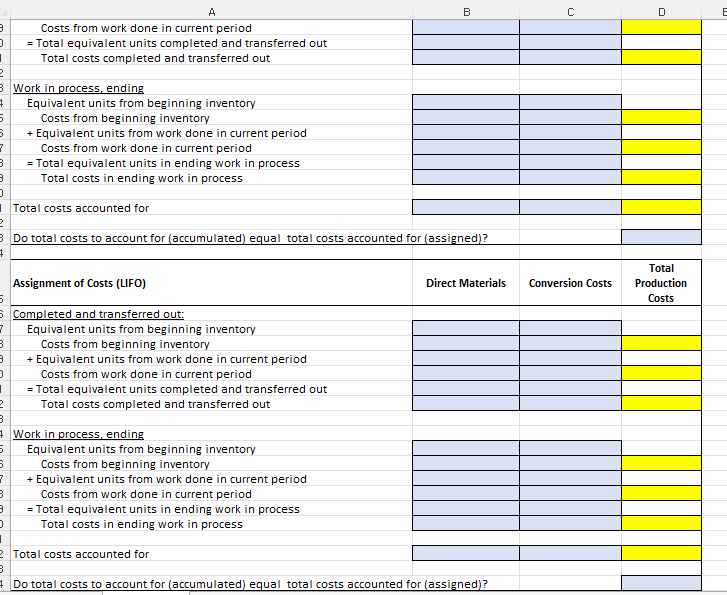

Process Costing Assigning costs under various methods The assembly division of Quality Time Pieces, Inc. uses the FIFO method of process costing. Consider the following data for the month of May Basic Info Beginning work in process (May 1) Degree of completion: Total costs added during May 2017 Ending work in process (May 31) Degree of completion: Direct Materials Conversion Costs $ 459,888.00 $ 142,570.00 80% 35% $ 3,237,000.00 $ 1,916,000.00 ? ? 80% 40% Answer cells must remain in the same location so do not insert/delete columns or rows in the file. Unless otherwise indicated, numeric answers must include a formula or reference so do not hard enter the answer. Equivalent Units Flow of Production Physical Units (Watches) Direct Materials Conversion Costs 100 Work in process, beginning Equivalent units of work done (added in) in current period Completed and transferred out Work in process, ending 450 160 Accumulation of Costs Direct Materials Conversion Costs Total Production Costs Work in process, beginning + Costs added in current period = Total costs to account for Cost per equivalent unit in beginning inventory Cost per equivalent unit of work done in current period Average cost per equivalent unit Assignment of Costs (Weighted Average Method) Direct Materials Conversion Costs Total Production Costs otal costs accounted for o total costs to account for (accumulated) equal total costs accounted for (assigned)? ssignment of Costs (FIFO) Direct Materials Conversion Costs Total Production Costs ompleted and transferred out: Equivalent units from beginning inventory Costs from beginning inventory + Equivalent units from work done in current period Costs from work done in current period = Total equivalent units completed and transferred out Total costs completed and transferred out Work in process, ending Equivalent units from beginning inventory Costs from beginning inventory + Equivalent units from work done in current period Costs from work done in current period = Total equivalent units in ending work in process Total costs in ending work in process otal costs accounted for o total costs to account for (accumulated) equal total costs accounted for (assigned)? ssignment of Costs (LIFO) Direct Materials Conversion Costs Total Production Costs ompleted and transferred out: Equivalent units from beginning inventory Costs from beginning inventory + Equivalent units from work done in current period Costs from work done in current period = Total equivalent units completed and transferred out Total costs completed and transferred out = B D 3 ) 1 2 A Costs from work done in current period = Total equivalent units completed and transferred out Total costs completed and transferred out 7 5 5 7 3 Work in process, ending Equivalent units from beginning inventory Costs from beginning inventory + Equivalent units from work done in current period Costs from work done in current period = Total equivalent units in ending work in process Total costs in ending work in process + ) Total costs accounted for 2 Do total costs to account for (accumulated) equal total costs accounted for (assigned)? 7 Assignment of Costs (LIFO) Direct Materials Conversion Costs Total Production Costs 7 3 3 Completed and transferred out: Equivalent units from beginning inventory Costs from beginning inventory + Equivalent units from work done in current period Costs from work done in current period = Total equivalent units completed and transferred out Total costs completed and transferred out 1 2 3 Work in process, ending Equivalent units from beginning inventory Costs from beginning inventory + Equivalent units from work done in current period Costs from work done in current period = Total equivalent units in ending work in process Total costs in ending work in process 5 5 7 3 3 ) 1 + Total costs accounted for 3 + Do total costs to account for (accumulated) equal total costs accounted for (assigned)