Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Process Plant Economics Question 3 An economic feasibility study is carried out for a plant to produce an industrial chemical in Northern Australia. The plant

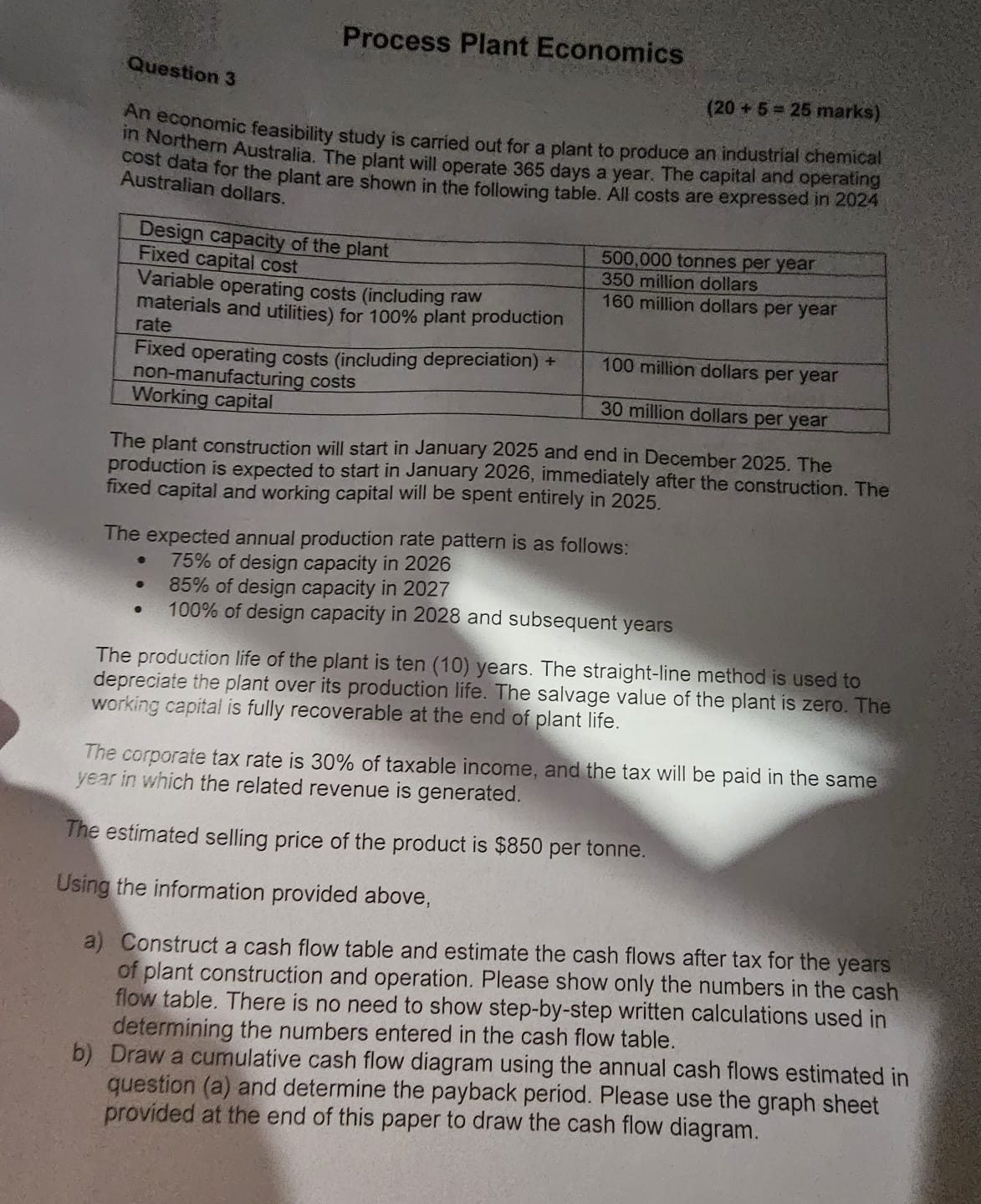

Process Plant Economics

Question

An economic feasibility study is carried out for a plant to produce an industrial chemical

in Northern Australia. The plant will operate days a year. The capital and operating

cost data for the plant are shown in the following table. All costs are expressed in

Australian dollars.

The plant construction will start in January and end in December The

production is expected to start in January immediately after the construction. The

fixed capital and working capital will be spent entirely in

The expected annual production rate pattern is as follows:

of design capacity in

of design capacity in

of design capacity in and subsequent years

The production life of the plant is ten years. The straightline method is used to

depreciate the plant over its production life. The salvage value of the plant is zero. The

working capital is fully recoverable at the end of plant life.

The corporate tax rate is of taxable income, and the tax will be paid in the same

year in which the related revenue is generated.

The estimated selling price of the product is $ per tonne.

Using the information provided above,

a Construct a cash flow table and estimate the cash flows after tax for the years

of plant construction and operation. Please show only the numbers in the cash

flow table. There is no need to show stepbystep written calculations used in

determining the numbers entered in the cash flow table.

b Draw a cumulative cash flow diagram using the annual cash flows estimated in

question a and determine the payback period. Please use the graph sheet

provided at the end of this paper to draw the cash flow diagram.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started