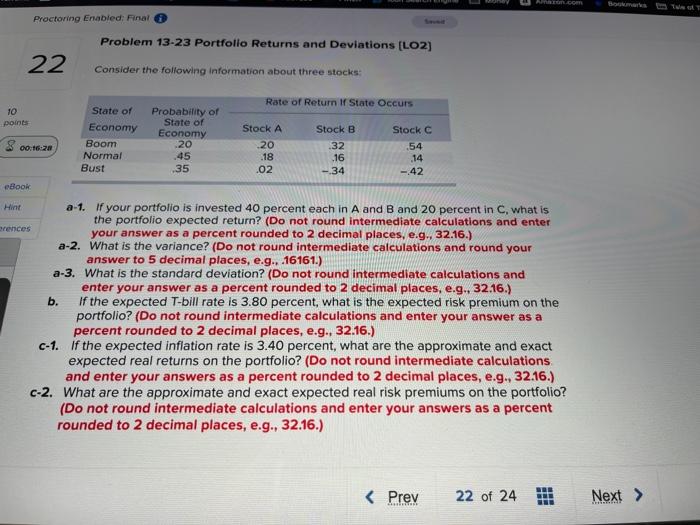

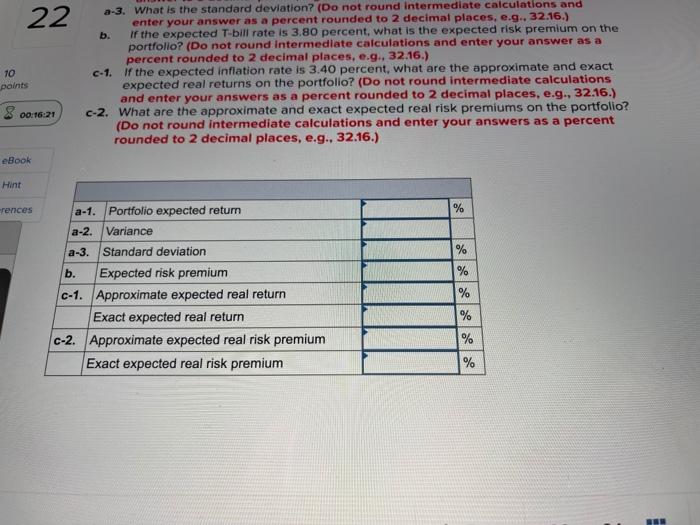

Proctoring Enabled: Final Problem 13-23 Portfolio Returns and Deviations (LO2) 22 Consider the following information about three stocks: Rate of Return of State Occurs 10 points State of Economy Boom Normal Bust Probability of State of Economy 20 45 8 00:16:20 Stock A 20 .18 .02 Stock B 32 16 -34 Stock C .54 14 -42 35 eBook Hint rences b a-1. If your portfolio is invested 40 percent each in A and B and 20 percent in C, what is the portfolio expected return? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a-2. What is the variance? (Do not round intermediate calculations and round your answer to 5 decimal places, e.g. 16161.) a-3. What is the standard deviation? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g.. 32.16.) b. If the expected T-bill rate is 3.80 percent, what is the expected risk premium on the portfolio? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g.. 32.16.) c-1. If the expected inflation rate is 3.40 percent, what are the approximate and exact expected real returns on the portfolio? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) c-2. What are the approximate and exact expected real risk premiums on the portfolio? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) un 22 10 points a-3. What is the standard deviation? (Do not round Intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g.. 32.16.) b. If the expected T-bill rate is 3.80 percent, what is the expected risk premium on the portfolio? (Do not round Intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g.. 32.16.) c-1. If the expected inflation rate is 3.40 percent, what are the approximate and exact expected real returns on the portfolio? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) c-2. What are the approximate and exact expected real risk premiums on the portfolio? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) 2 00:16:21 eBook Hint rences % % % a-1. Portfolio expected return a-2. Variance a-3. Standard deviation b. Expected risk premium C-1. Approximate expected real return Exact expected real return C-2. Approximate expected real risk premium Exact expected real risk premium % % de la % % INN