Answered step by step

Verified Expert Solution

Question

1 Approved Answer

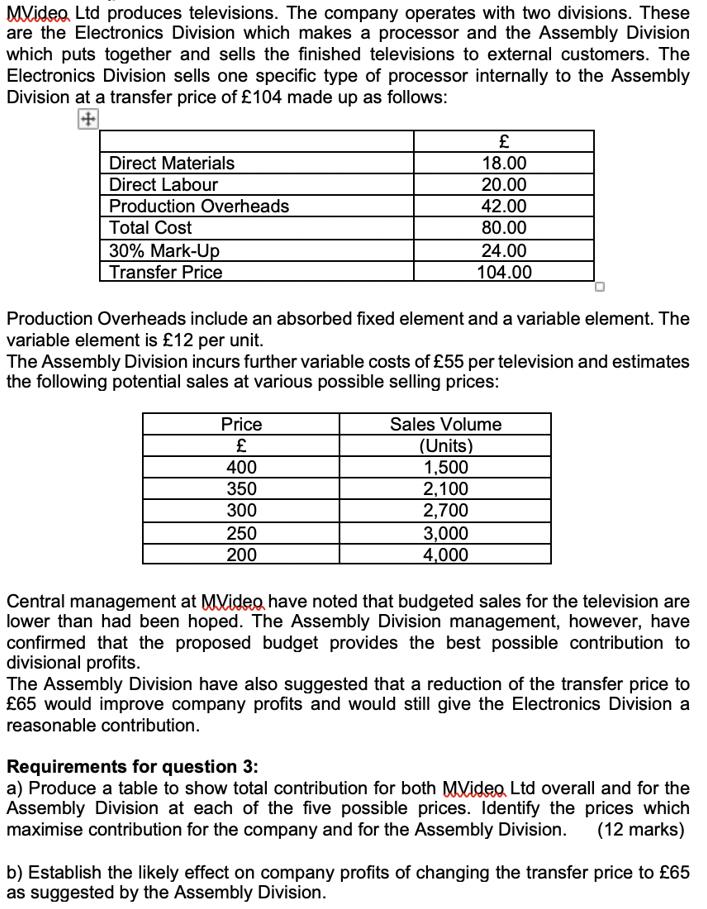

MVideo, Ltd produces televisions. The company operates with two divisions. These are the Electronics Division which makes a processor and the Assembly Division which

MVideo, Ltd produces televisions. The company operates with two divisions. These are the Electronics Division which makes a processor and the Assembly Division which puts together and sells the finished televisions to external customers. The Electronics Division sells one specific type of processor internally to the Assembly Division at a transfer price of 104 made up as follows: Direct Materials Direct Labour 18.00 20.00 Production Overheads Total Cost 42.00 80.00 30% Mark-Up Transfer Price 24.00 104.00 Production Overheads include an absorbed fixed element and a variable element. The variable element is 12 per unit. The Assembly Division incurs further variable costs of 55 per television and estimates the following potential sales at various possible selling prices: Price Sales Volume (Units) 1,500 2,100 2,700 3,000 4,000 400 350 300 250 200 Central management at MVideo have noted that budgeted sales for the television are lower than had been hoped. The Assembly Division management, however, have confirmed that the proposed budget provides the best possible contribution to divisional profits. The Assembly Division have also suggested that a reduction of the transfer price to 65 would improve company profits and would still give the Electronics Division a reasonable contribution. Requirements for question 3: a) Produce a table to show total contribution for both MVideo Ltd overall and for the Assembly Division at each of the five possible prices. Identify the prices which maximise contribution for the company and for the Assembly Division. (12 marks) b) Establish the likely effect on company profits of changing the transfer price to 65 as suggested by the Assembly Division.

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a Electronics Division COST Direct material 18 Direct Labour 20 Production Overheads Variable Element 12 Fixed Element 30 Total Costunit 80 INCOME 30 Markup 24 Transfer Price 104 Assembly Division COS...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started