Answered step by step

Verified Expert Solution

Question

1 Approved Answer

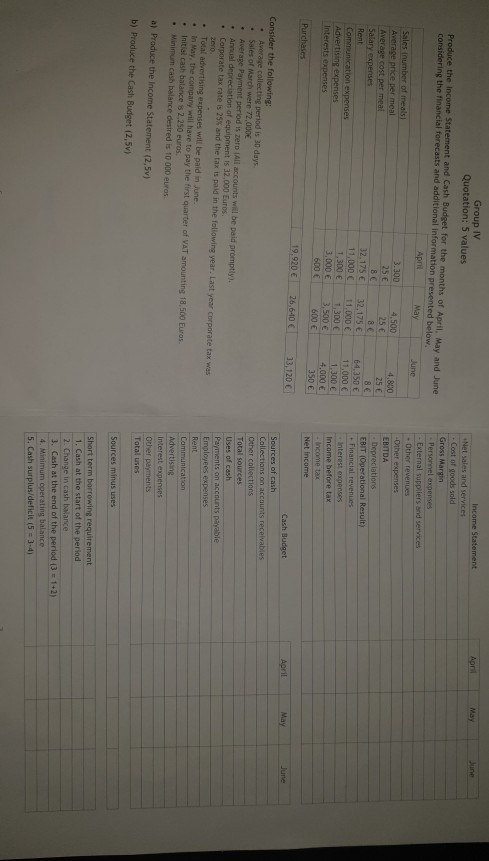

Produce the income statement and cash budget for the months of april, may and june considering the financial forecasts and additional information presented below Aor!

Produce the income statement and cash budget for the months of april, may and june considering the financial forecasts and additional information presented below

Aor! May June Group IV Quotation: 5 values Produce the income Statement and Cash Budget for the months of April, May and June considering the financial forecasts and additional information presented below. April June Sales number of meals 3.300 4,500 4,800 Average price per meal 25 25 25 Average cost per meal 8 8 BE Salary expenses 32.175 32.175 Rent 64,350 11,000 11,000 Communication expenses 11,000 1.300 1 300 Advertising expenses 1.300 3,000 3.500 Interests expenses 4,000 600 600 350 Income Statement Net sales and services Cost of goods sold Gross Margin Personnel expenses - External suppliers and services - Other revenues Other expenses EBITDA Depreciations EBIT (Operational Result - Financial revenues Interest expenses Income before tax Income tax Net Income Purchases 19.920 26,640 13.120 April May June Consider the following: Average collecting period is 30 days Sales of March were 72.000 Average Payment period is zero (All accounts will be paid promptly. Annual depreciation of equipment is 32.000 Euros Corporate tax rate is 255 and the tax is paid in the following year. Last year corporate tax was Zero Total advertising expenses will be paid in June In May, the company will have to pay the first quarter of VAT amounting 18.500 Euros Initial cash balance 8 2,250 euros Minimum cash balance desired is 10 000 euros Cash Budget Sources of cash Collections on accounts receivables Other collections Total sources Uses of cash Payments on accounts payable Employees expenses Rent Communication Advertising Interest expenses Other payments Total uses a) Produce the income Statement (2.5v) b) Produce the Cash Budget (2,5v) Sources minus uses Short term borrowing requirement 1. Cash at the start of the period 2. Change in cash balance 3. Cash at the end of the period ( 312) 4. Minimum operating balance 5. Cash surplus/deficit (5 = 3-4)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started