Answered step by step

Verified Expert Solution

Question

1 Approved Answer

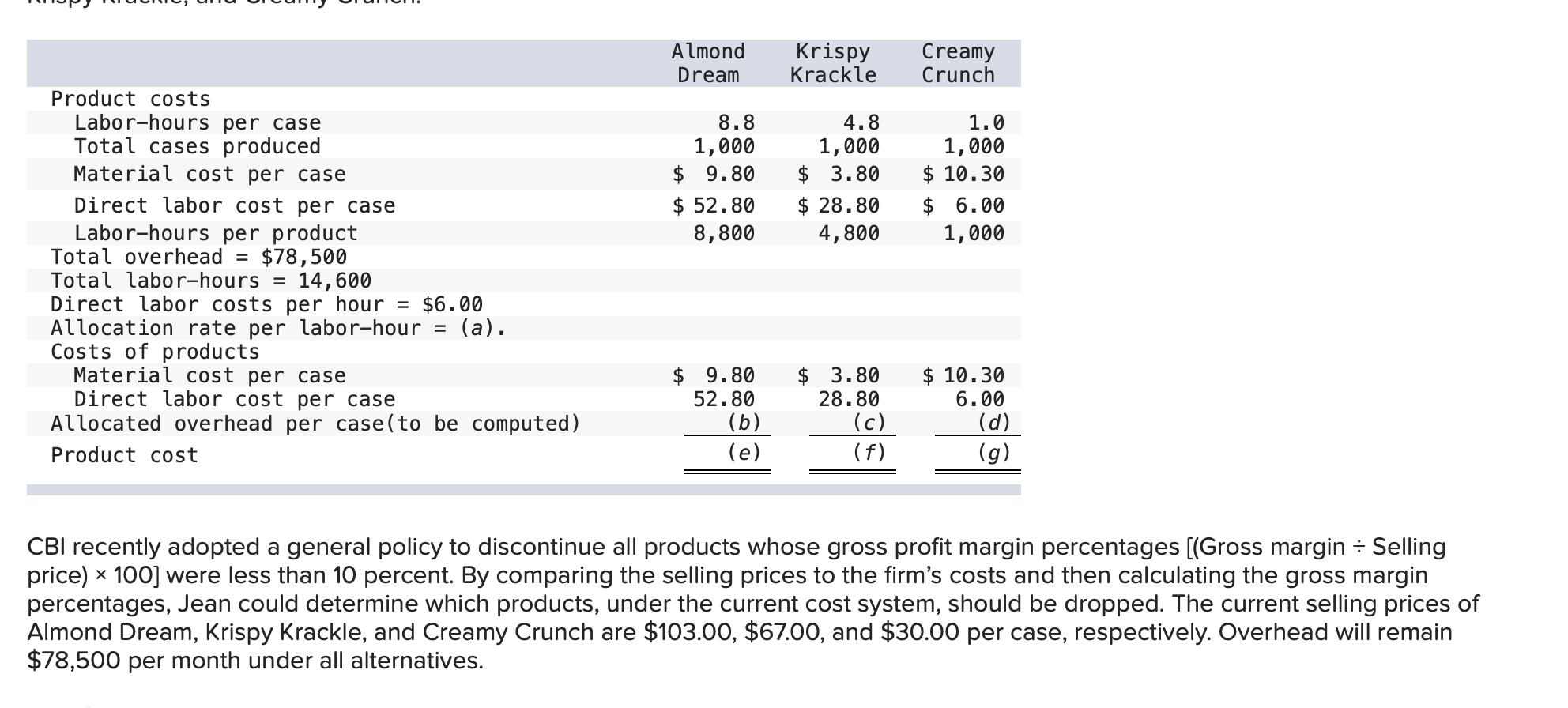

Product costs Labor-hours per case Total cases produced Material cost per case Direct labor cost per case Labor-hours per product Almond Dream Krispy Creamy

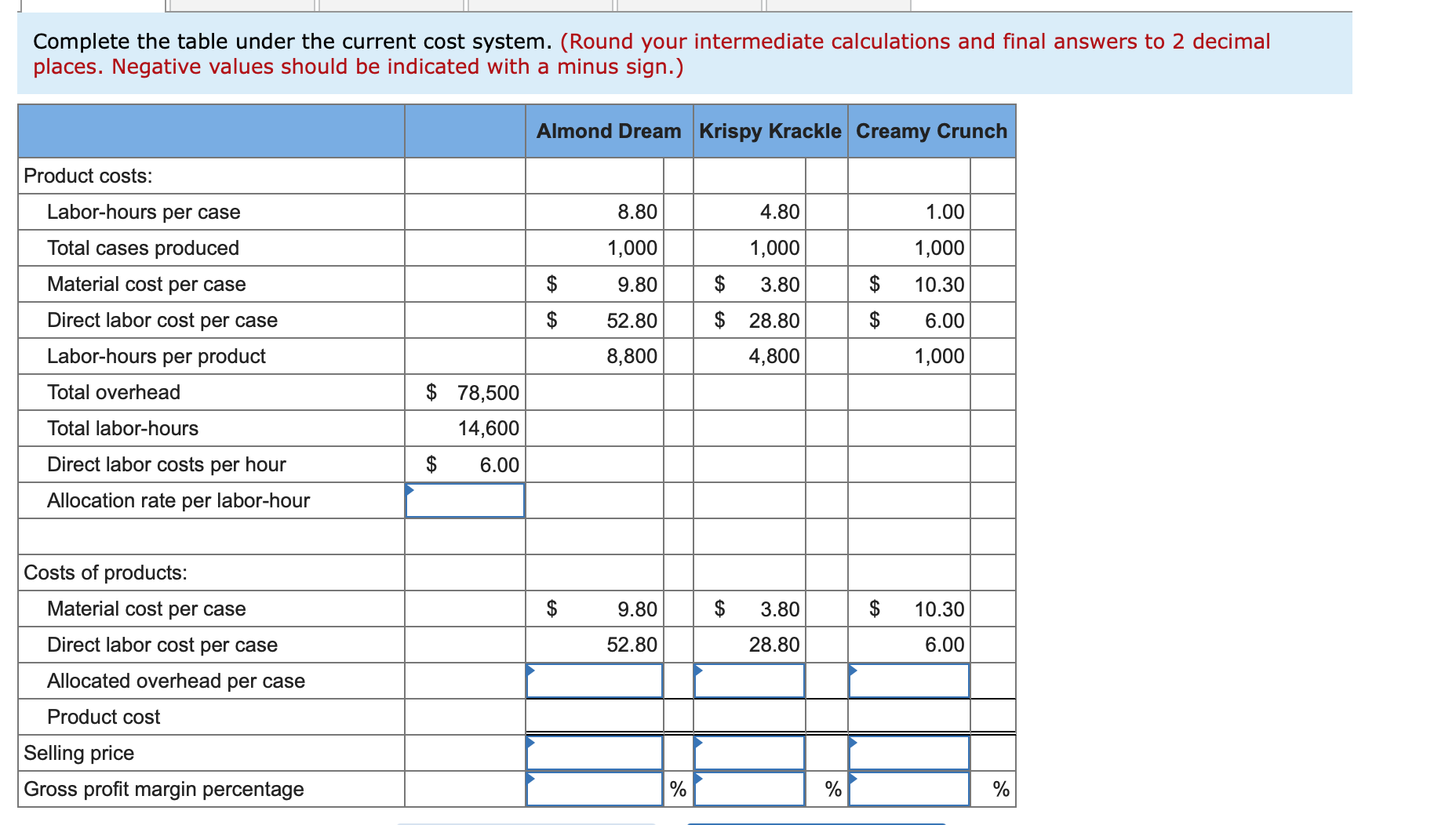

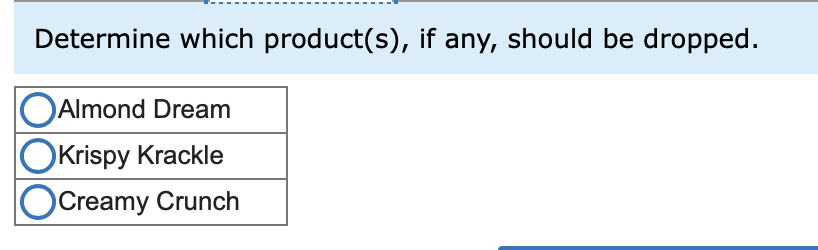

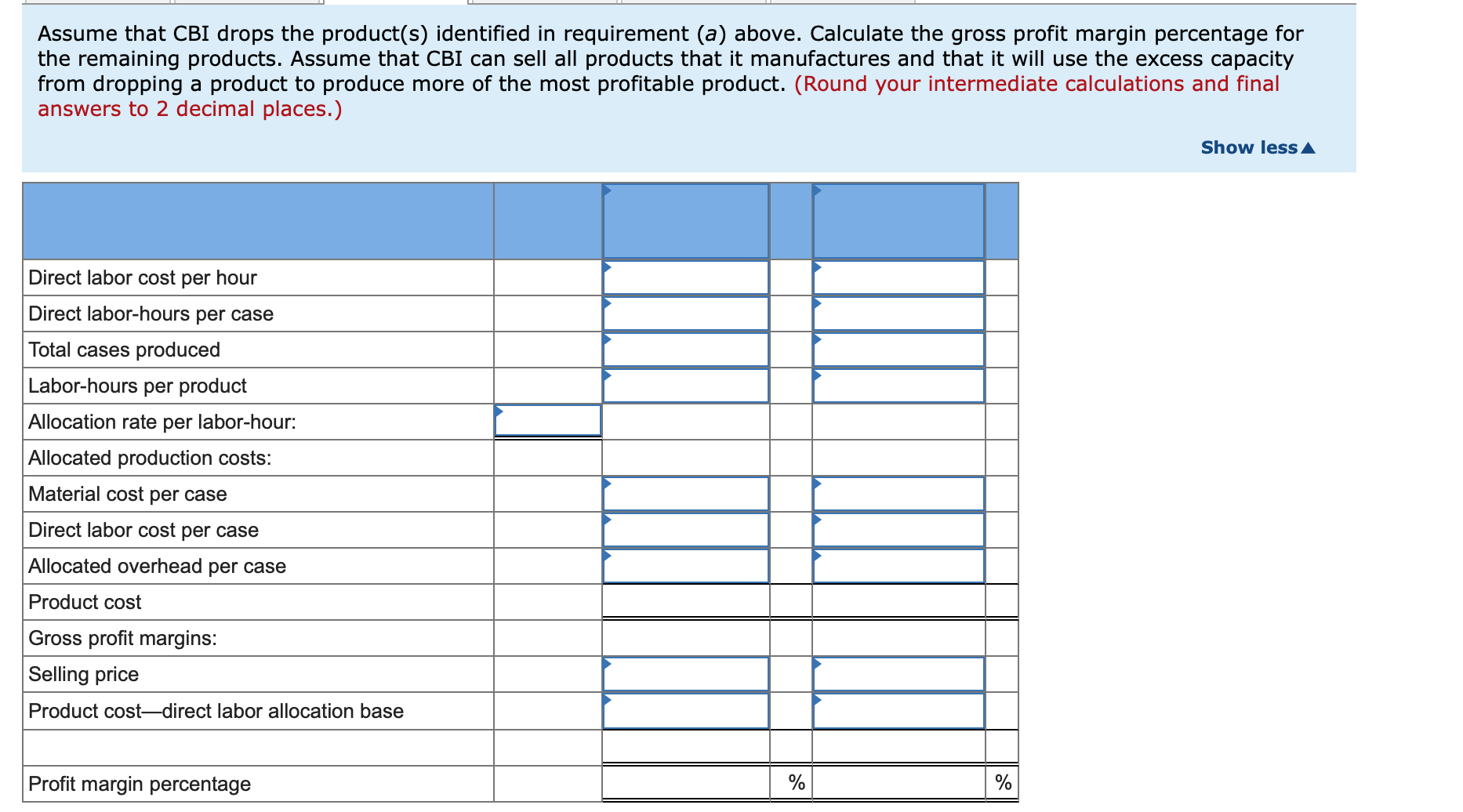

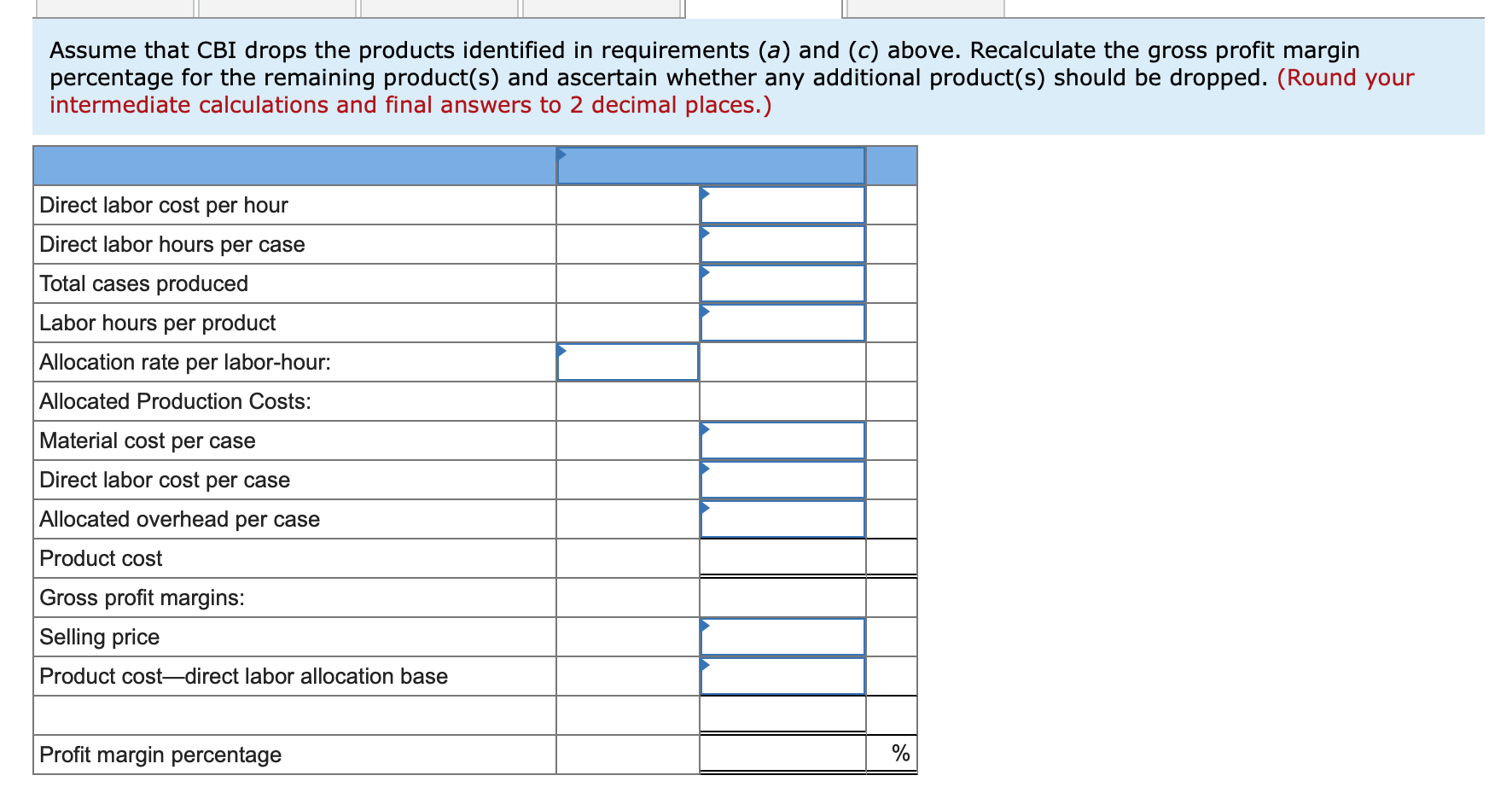

Product costs Labor-hours per case Total cases produced Material cost per case Direct labor cost per case Labor-hours per product Almond Dream Krispy Creamy Krackle Crunch 8.8 4.8 1,000 1,000 1.0 1,000 $ 9.80 $ 3.80 $ 10.30 $ 52.80 8,800 $ 28.80 $ 6.00 4,800 1,000 Total overhead = $78,500 Total labor-hours = 14,600 Direct labor costs per hour $6.00 Allocation rate per labor-hour (a). Costs of products Material cost per case Direct labor cost per case $ 9.80 52.80 Allocated overhead per case(to be computed) Product cost $ 3.80 $ 10.30 28.80 (c) 6.00 (d) 444 (b) (e) (f) (g) CBI recently adopted a general policy to discontinue all products whose gross profit margin percentages [(Gross margin + Selling price) 100] were less than 10 percent. By comparing the selling prices to the firm's costs and then calculating the gross margin percentages, Jean could determine which products, under the current cost system, should be dropped. The current selling prices of Almond Dream, Krispy Krackle, and Creamy Crunch are $103.00, $67.00, and $30.00 per case, respectively. Overhead will remain $78,500 per month under all alternatives. Complete the table under the current cost system. (Round your intermediate calculations and final answers to 2 decimal places. Negative values should be indicated with a minus sign.) Almond Dream Krispy Krackle Creamy Crunch Product costs: Labor-hours per case Total cases produced 8.80 4.80 1.00 1,000 1,000 1,000 Material cost per case 9.80 $ 3.80 $ 10.30 Direct labor cost per case 52.80 $ 28.80 $ 6.00 Labor-hours per product 8,800 4,800 1,000 Total overhead $ 78,500 Total labor-hours 14,600 Direct labor costs per hour $ 6.00 Allocation rate per labor-hour Costs of products: Material cost per case 9.80 $ 3.80 $ 10.30 Direct labor cost per case 52.80 28.80 6.00 Allocated overhead per case Product cost Selling price Gross profit margin percentage % % % Determine which product(s), if any, should be dropped. Almond Dream Krispy Krackle Creamy Crunch Assume that CBI drops the product(s) identified in requirement (a) above. Calculate the gross profit margin percentage for the remaining products. Assume that CBI can sell all products that it manufactures and that it will use the excess capacity from dropping a product to produce more of the most profitable product. (Round your intermediate calculations and final answers to 2 decimal places.) Direct labor cost per hour Direct labor-hours per case Total cases produced Labor-hours per product Allocation rate per labor-hour: Allocated production costs: Material cost per case Direct labor cost per case Allocated overhead per case Product cost Gross profit margins: Selling price Product cost-direct labor allocation base Profit margin percentage % % Show less If CBI maintains its current rule about dropping products, which additional products, if any, should CBI drop under the existing cost system? Almond Dream Krispy Krackle Creamy Crunch Assume that CBI drops the products identified in requirements (a) and (c) above. Recalculate the gross profit margin percentage for the remaining product(s) and ascertain whether any additional product(s) should be dropped. (Round your intermediate calculations and final answers to 2 decimal places.) Direct labor cost per hour Direct labor hours per case Total cases produced Labor hours per product Allocation rate per labor-hour: Allocated Production Costs: Material cost per case Direct labor cost per case Allocated overhead per case Product cost Gross profit margins: Selling price Product cost-direct labor allocation base Profit margin percentage % Which additional products, if any, should CBI drop under the existing cost system? Almond Dream Krispy Krackle Creamy Crunch

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started