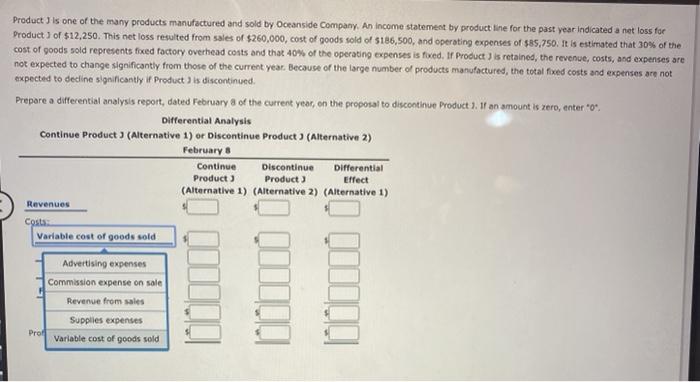

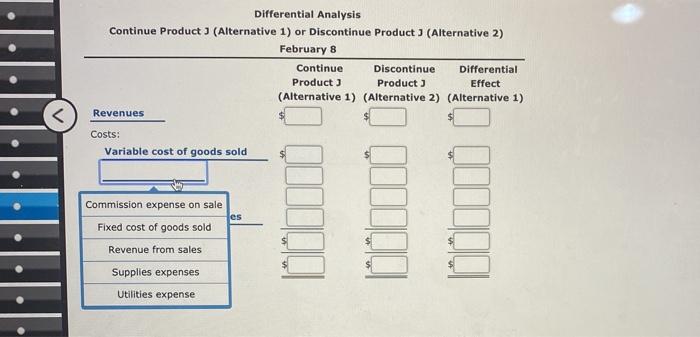

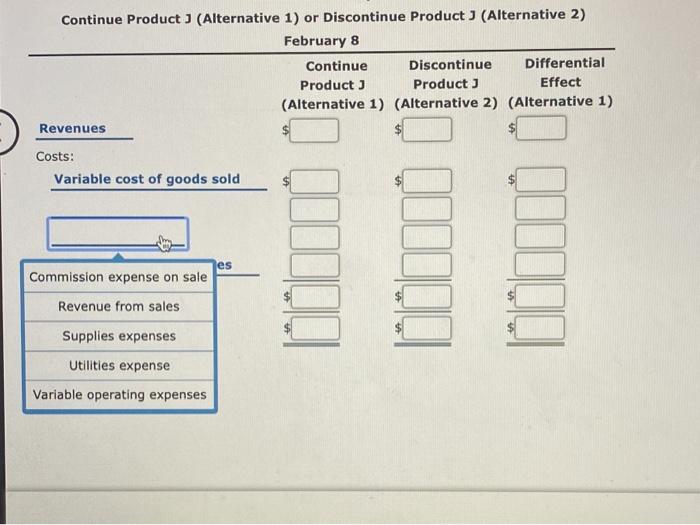

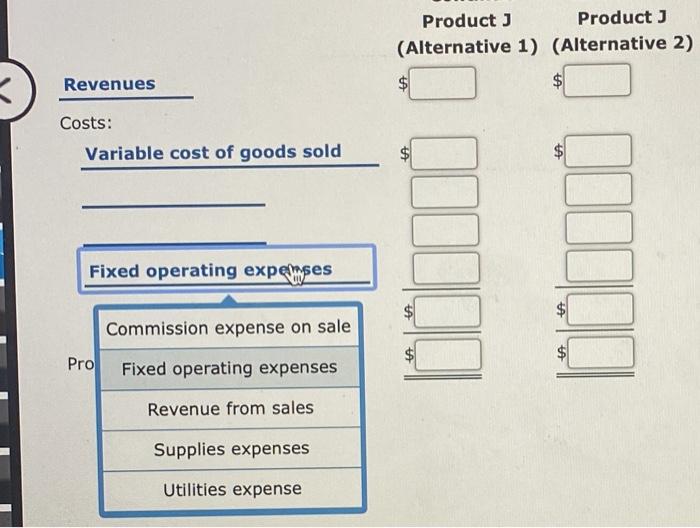

Product is one of the many products manufactured and sold by Oceanside Company. An income statement by product line for the past year indicated a net loss for Product 3 of $12,250. This net loss resulted from sales of $260,000, cost of goods sold of 5186,500, and operating expenses of $85,750. It is estimated that 30% of the cost of goods sold represents foxed factory overhead costs and that 40% of the operating expenses is fixed. If Product ) is retained, the revenue, costs, and expenses are not expected to change significantly from those of the current year. Because of the large number of products manufactured, the total fixed costs and expenses are not expected to decline significantly if Product ) is discontinued. Prepare a differential analysis report, dated February 8 of the current year, on the proposal to discontinue Product ). 16 an amount is zero, enter "o". Differential Analysis Continue Product 3 (Alternative 1) or Discontinue Product 3 (Alternative 2) February Continue Differential Product (Alternative 1) (Alternative 2) (Alternative 1) Revenues Costs: Variable cost of goods sold Discontinue Product Effect Advertising expenses Commission expense on sale Revenue from sales Prof Supplies expenses Variable cost of goods sold Differential Analysis Continue Product 3 (Alternative 1) or Discontinue Product 3 (Alternative 2) February 8 Continue Discontinue Differential Product Product 3 Effect (Alternative 1) (Alternative 2) (Alternative 1) Revenues Costs: Variable cost of goods sold W Commission expense on sale Fixed cost of goods sold es Revenue from sales Supplies expenses Utilities expense Continue Product 3 (Alternative 1) or Discontinue Product 3 (Alternative 2) February 8 Continue Discontinue Differential Product 3 Product Effect (Alternative 1) (Alternative 2) (Alternative 1) Revenues Costs: Variable cost of goods sold es 1000 Commission expense on sale Revenue from sales Supplies expenses Utilities expense Variable operating expenses Product J Product ) (Alternative 1) (Alternative 2) Revenues Costs: Variable cost of goods sold $ Fixed operating expenses Commission expense on sale Pro Fixed operating expenses Revenue from sales Supplies expenses Utilities expense