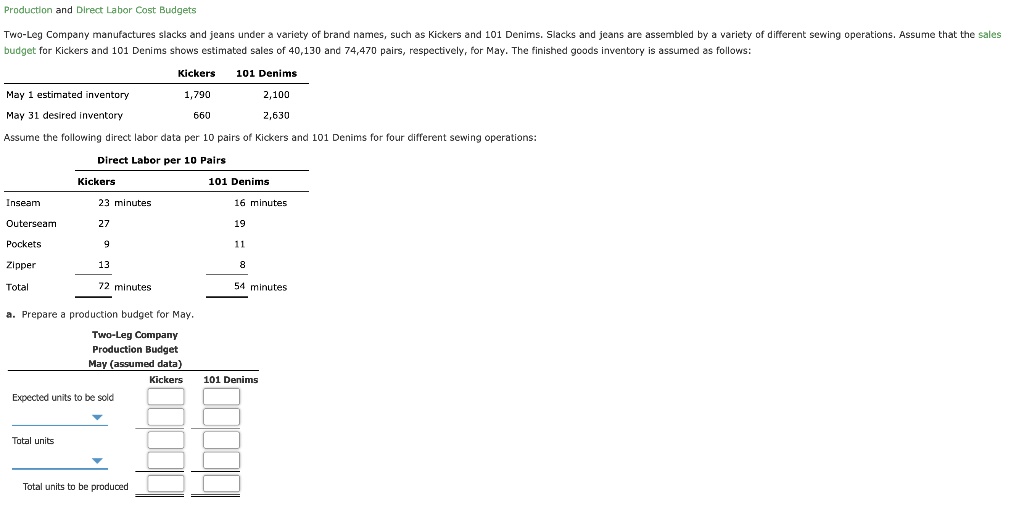

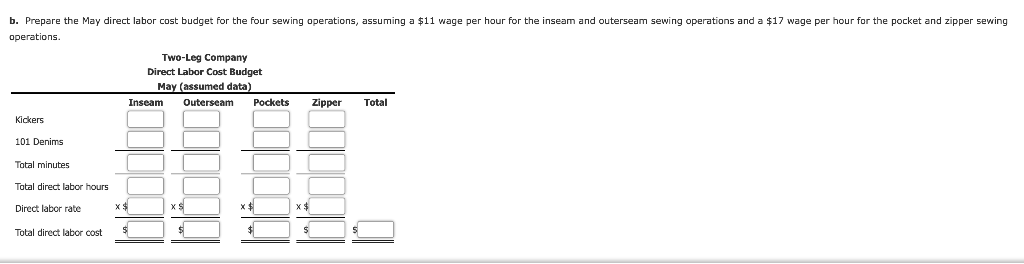

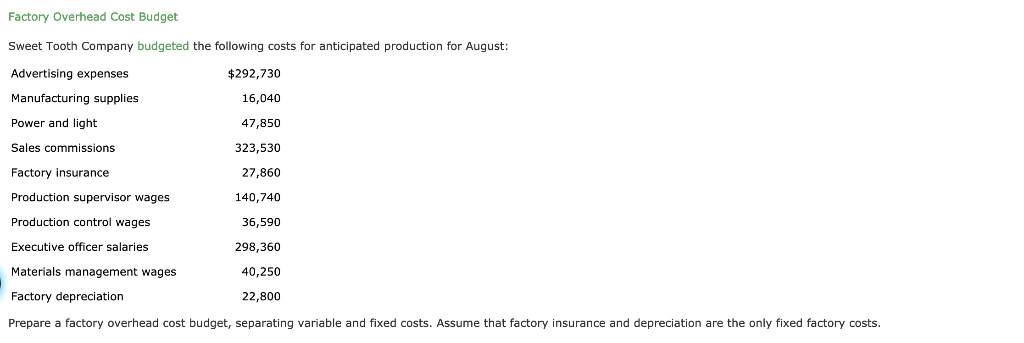

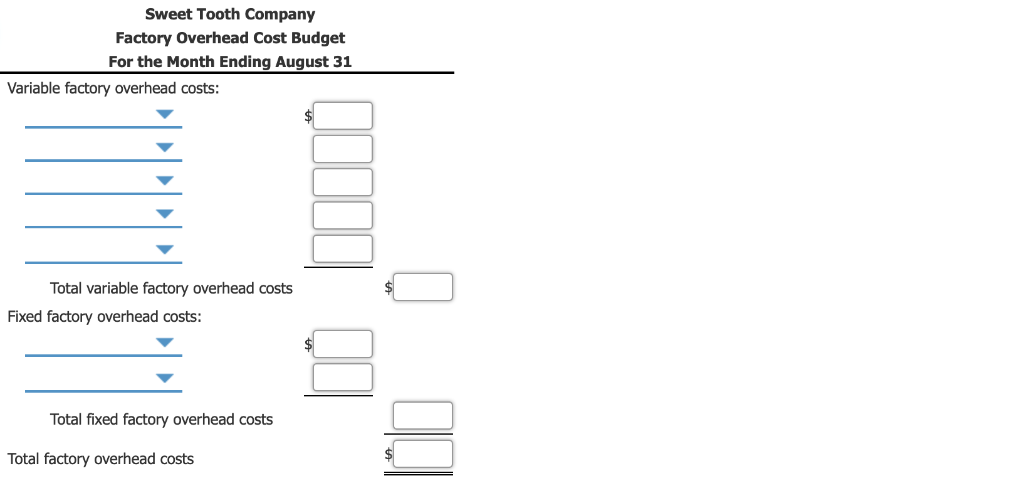

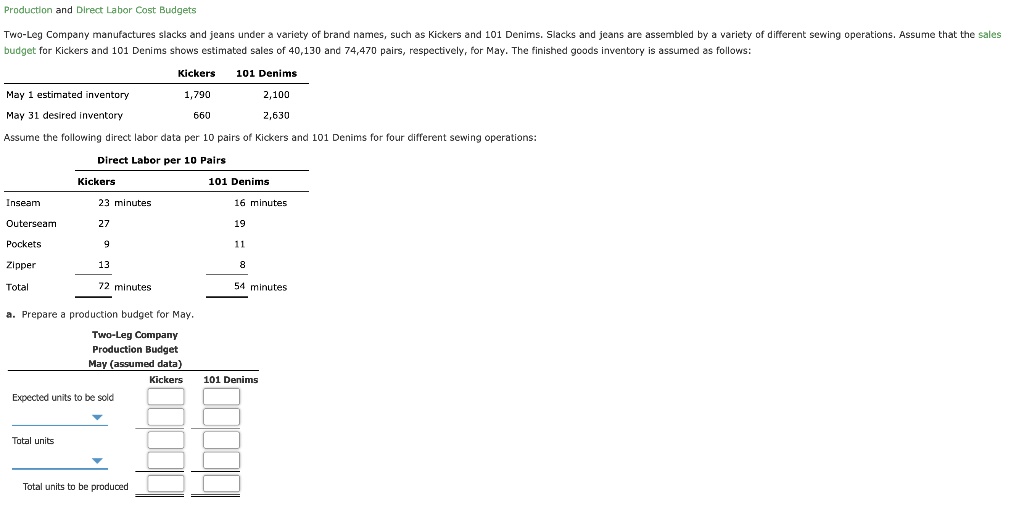

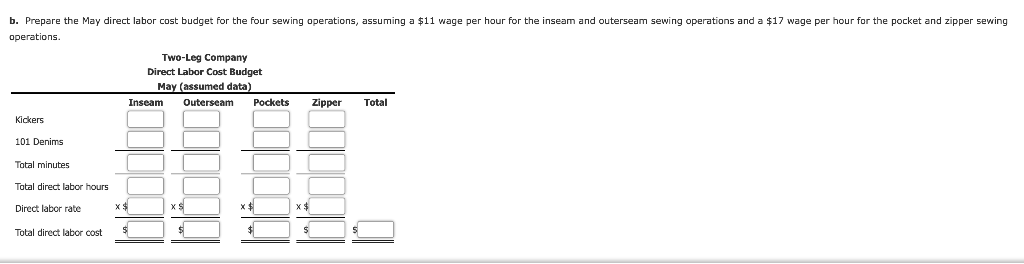

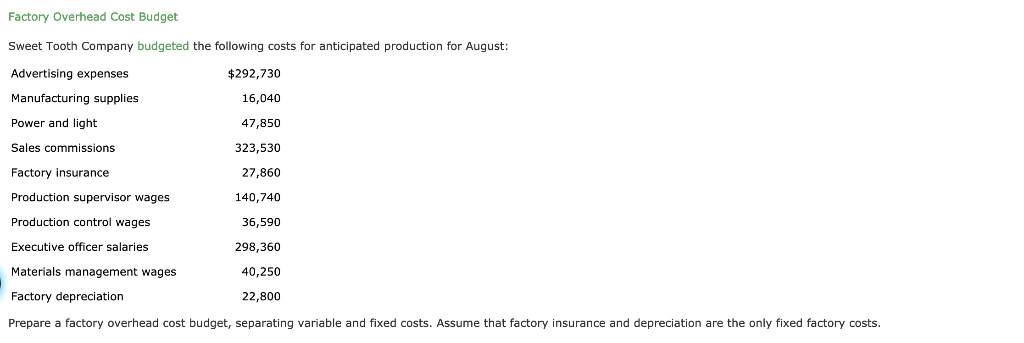

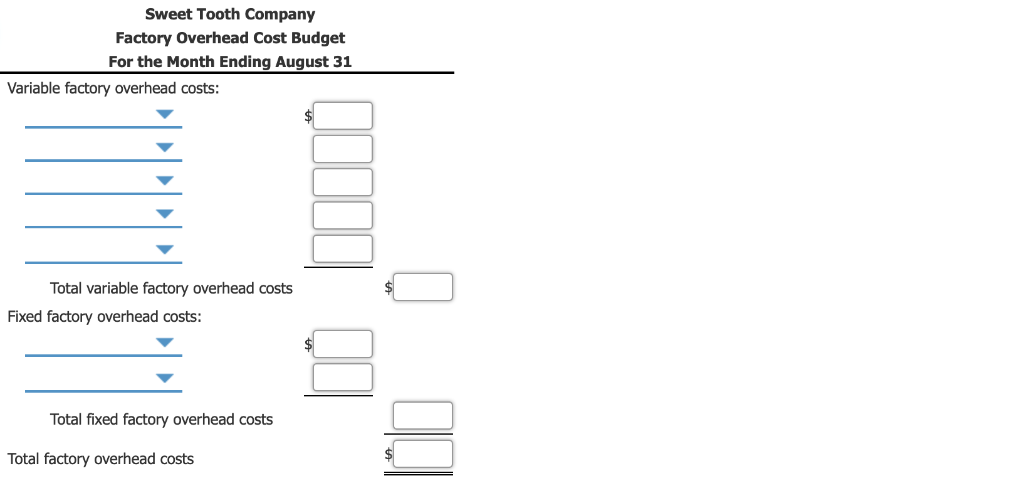

Production and Direct Labor Cost Budgets Two-Leg Company manufactures slacks and jeans under a variety of brand names, such as Kickers and 101 Denims. Slacks and jeans are assembled by a variety of different sewing operations. Assume that the sales budget for Kickers and 101 Denims shows estimated sales of 40,130 and 74,470 pairs, respectively, for May. The finished goods inventory is assumed as follows: Kickers 101 Denims May 1 estimated inventory May 31 desired inventory Assume the following direct labor data per 10 pairs of Kickers and 101 Denims for four different sewing operations: 1,790 2,100 660 2,630 Direct Labor per 10 Pairs Kickers 101 Denims Inseam Outerseam Pockets Zipper Total 23 minutes 16 minutes 27 19 13 72 minutes 54 minutes a. Prepare a production budget for May Two-Leg Company Production Budget May (assumed data) Kickers 101 Denims Expected units to be scld Total units Total units to be produced b. Prepare the May direct labor cost budget for the four sewing operations, assuming a $11 wage per hour for the inseam and outerseam sewing operations and a $17 wage per hour for the pocket and zipper sewing operations. Two-Leg Company Direct Labor Cost Budget May (assumed data) Inseam terseam Pockets Zipper Total Kickers 101 Denims Total minutes Total direct labor hours Direct labor rate Total direct labor cost Factory Overhead Cost Budget Sweet Tooth Company budgeted the following costs for anticipated production for August: Advertising expenses Manufacturing supplies Power and light Sales commissions Factory insurance Production supervisor wages Production control wages Executive officer salaries Materials management wages Factory depreciation Prepare a factory overhead cost budget, separating variable and fixed costs. Assume that factory insurance and depreciation are the only fixed factory costs. $292,730 16,040 47,850 323,530 27,860 140,740 36,590 298,360 40,250 22,800 Sweet Tooth Company Factory Overhead Cost Budget For the Month Ending August 31 Variable factory overhead costs: Total variable factory overhead costs Fixed factory overhead costs Total fixed factory overhead costs Total factory overhead costs