Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Production and sales (units) Materials cost ($) Labour cost per unit ($) at $12 per hour Machine hours (per unit) Total no. of production

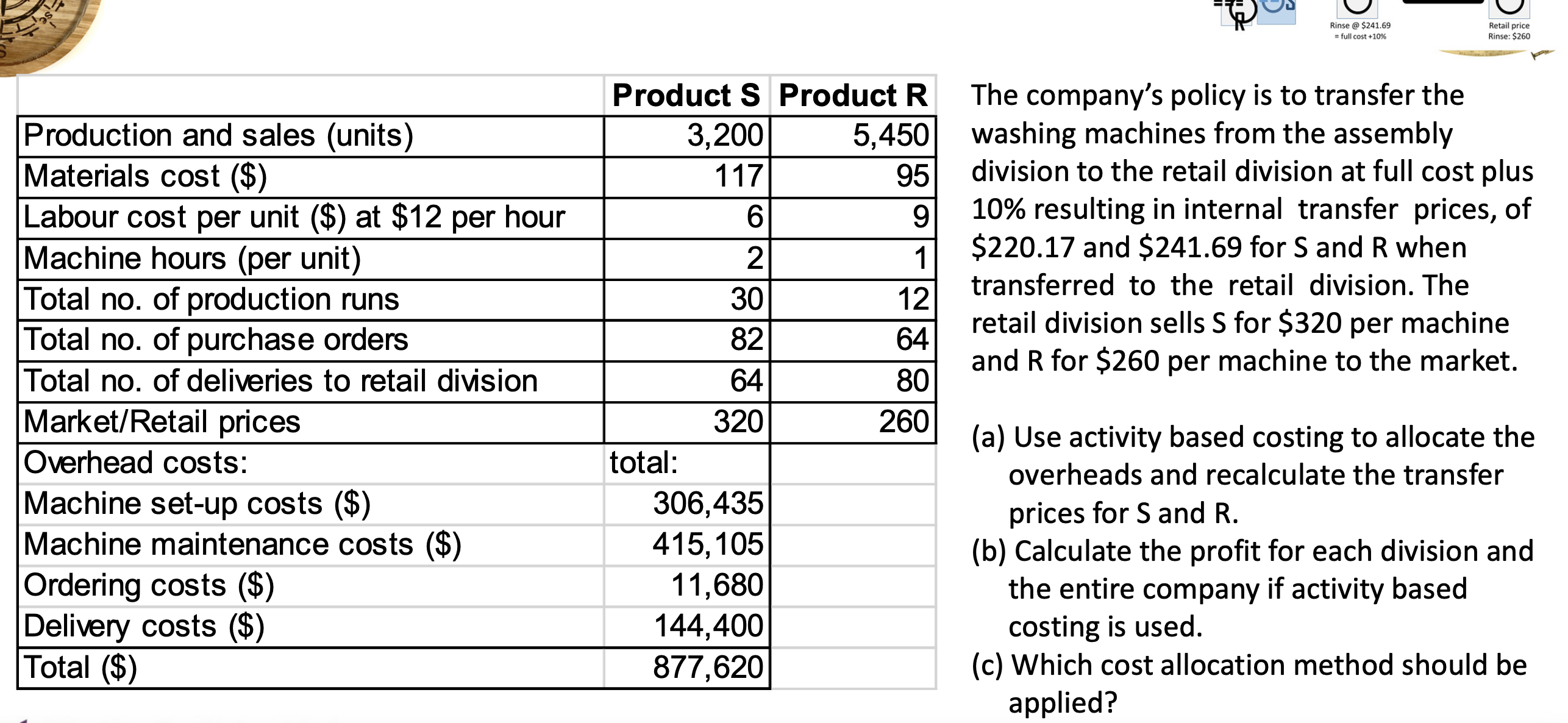

Production and sales (units) Materials cost ($) Labour cost per unit ($) at $12 per hour Machine hours (per unit) Total no. of production runs Total no. of purchase orders Total no. of deliveries to retail division Market/Retail prices Overhead costs: Machine set-up costs ($) Machine maintenance costs ($) Ordering costs ($) Delivery costs ($) Total ($) Product S Product R 3,200 5,450 117 95 9 1 12 64 80 260 total: 6 2 30 82 64 320 306,435 415,105 11,680 144,400 877,620 Rinse @ $241.69 = full cost +10% oll Retail price Rinse: $260 The company's policy is to transfer the washing machines from the assembly division to the retail division at full cost plus 10% resulting in internal transfer prices, of $220.17 and $241.69 for S and R when transferred to the retail division. The retail division sells S for $320 per machine and R for $260 per machine to the market. (a) Use activity based costing to allocate the overheads and recalculate the transfer prices for S and R. (b) Calculate the profit for each division and the entire company if activity based costing is used. (c) Which cost allocation method should be applied?

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer a Activity Based Costing ABC Allocation of Overheads Machine Setup Costs Total production runs 30 S 12 R 42 runs Machine setup cost per run 306...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started