Answered step by step

Verified Expert Solution

Question

1 Approved Answer

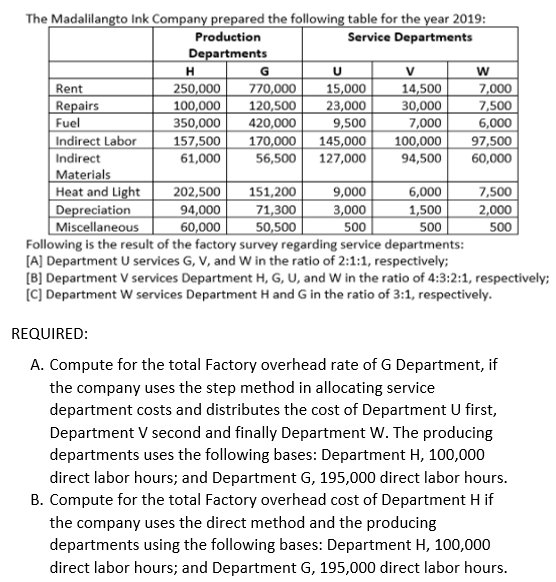

Production Departments The Madalilangto Ink Company prepared the following table for the year 2019: Service Departments H G U v W Rent 250,000 770,000

Production Departments The Madalilangto Ink Company prepared the following table for the year 2019: Service Departments H G U v W Rent 250,000 770,000 15,000 14,500 7,000 Repairs 100,000 120,500 23,000 30,000 7,500 Fuel 350,000 420,000 9,500 7,000 6,000 Indirect Labor 157,500 170,000 145,000 100,000 97,500 Indirect 61,000 56,500 127,000 94,500 60,000 Materials Heat and Light 202,500 151,200 9,000 6,000 7,500 Depreciation 94,000 71,300 3,000 1,500 2,000 Miscellaneous 60,000 50,500 500 500 500 Following is the result of the factory survey regarding service departments: [A] Department U services G, V, and W in the ratio of 2:1:1, respectively; [B] Department V services Department H, G, U, and W in the ratio of 4:3:2:1, respectively; [C] Department W services Department H and G in the ratio of 3:1, respectively. REQUIRED: A. Compute for the total Factory overhead rate of G Department, if the company uses the step method in allocating service department costs and distributes the cost of Department U first, Department V second and finally Department W. The producing departments uses the following bases: Department H, 100,000 direct labor hours; and Department G, 195,000 direct labor hours. B. Compute for the total Factory overhead cost of Department H if the company uses the direct method and the producing departments using the following bases: Department H, 100,000 direct labor hours; and Department G, 195,000 direct labor hours.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To find the present value of cash flows you can use the formula for calculating the present v...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started