Answered step by step

Verified Expert Solution

Question

1 Approved Answer

production manager is anticipating inflation and other increases that will result in total variable expenses increasing by 20%. Remember to calculate this change to

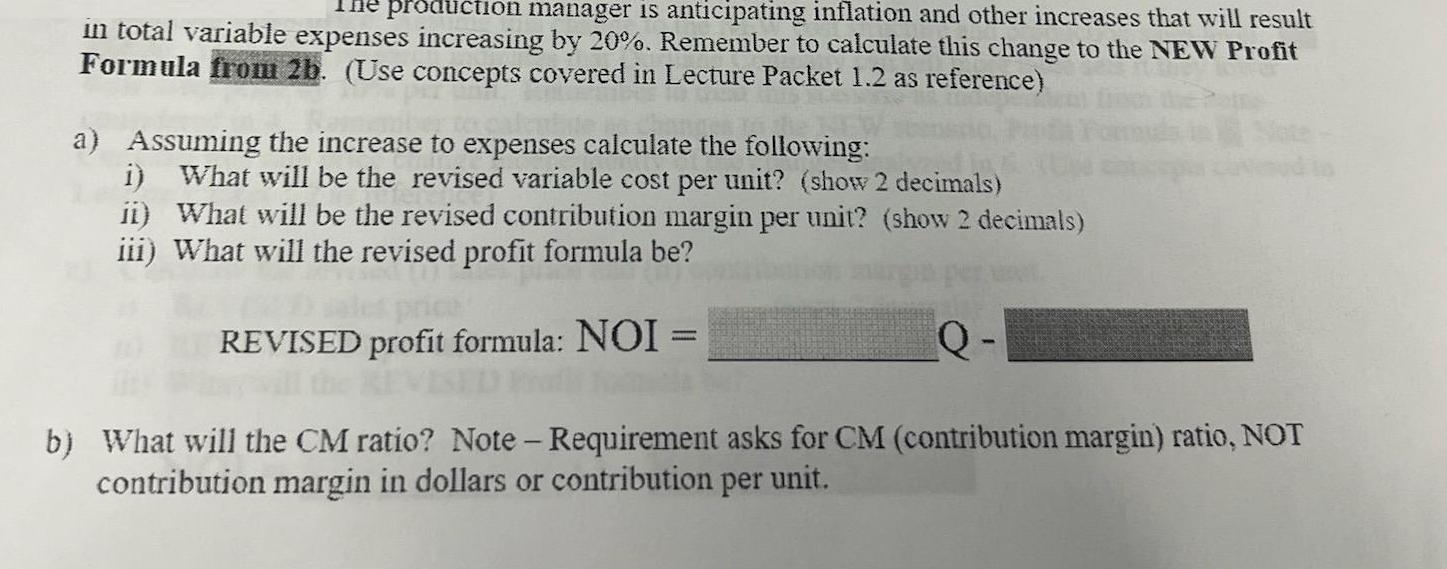

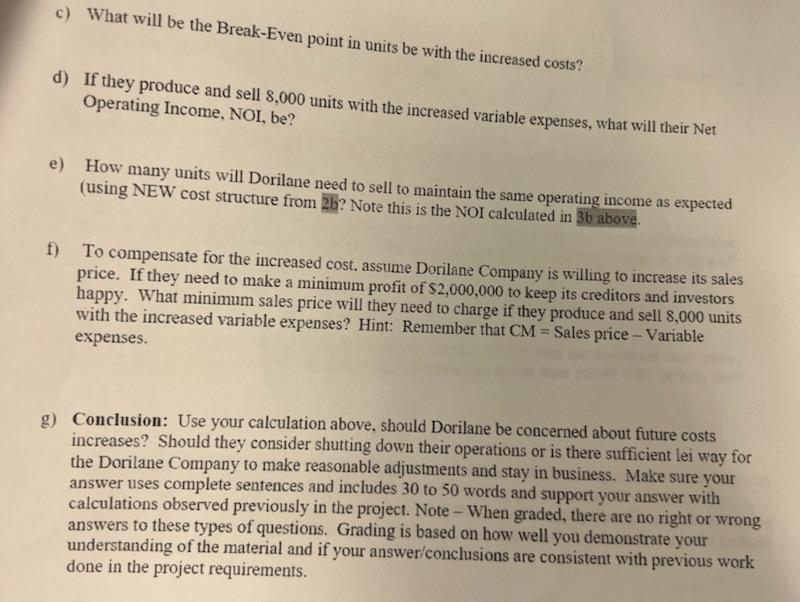

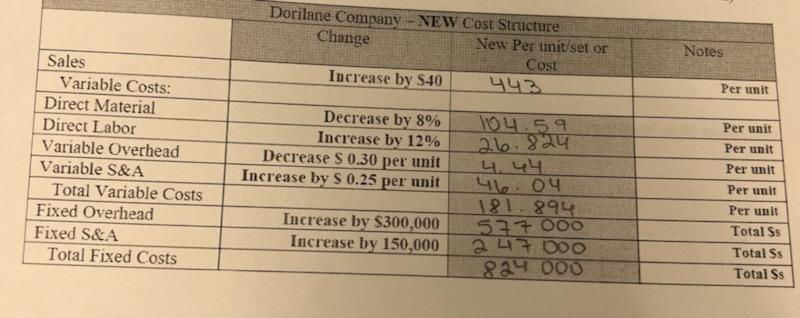

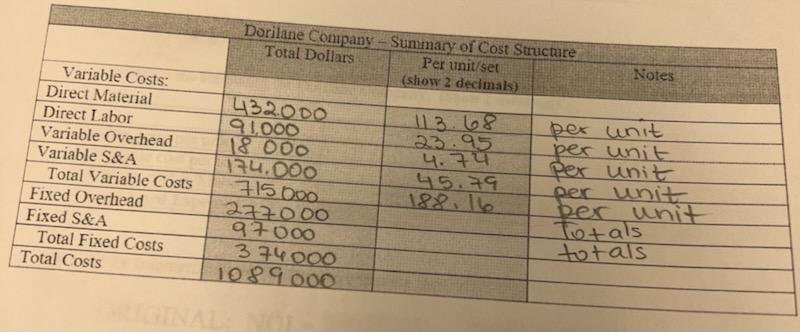

production manager is anticipating inflation and other increases that will result in total variable expenses increasing by 20%. Remember to calculate this change to the NEW Profit Formula from 2b. (Use concepts covered in Lecture Packet 1.2 as reference) a) Assuming the increase to expenses calculate the following: i) What will be the revised variable cost per unit? (show 2 decimals) ii) What will be the revised contribution margin per unit? (show 2 decimals) iii) What will the revised profit formula be? REVISED profit formula: NOI = Q- b) What will the CM ratio? Note - Requirement asks for CM (contribution margin) ratio, NOT contribution margin in dollars or contribution per unit. c) What will be the Break-Even point in units be with the increased costs? d) If they produce and sell 8,000 units with the increased variable expenses, what will their Net Operating Income, NOI, be? e) How many units will Dorilane need to sell to maintain the same operating income as expected (using NEW cost structure from 2b? Note this is the NOI calculated in 3b above. f) To compensate for the increased cost, assume Dorilane Company is willing to increase its sales price. If they need to make a minimum profit of $2,000,000 to keep its creditors and investors happy. What minimum sales price will they need to charge if they produce and sell 8,000 units with the increased variable expenses? Hint: Remember that CM = Sales price - Variable expenses. g) Conclusion: Use your calculation above, should Dorilane be concerned about future costs increases? Should they consider shutting down their operations or is there sufficient lei way for the Dorilane Company to make reasonable adjustments and stay in business. Make sure your answer uses complete sentences and includes 30 to 50 words and support your answer with calculations observed previously in the project. Note - When graded, there are no right or wrong answers to these types of questions. Grading is based on how well you demonstrate your understanding of the material and if your answer/conclusions are consistent with previous work done in the project requirements. Sales Variable Costs: Direct Material Direct Labor Variable Overhead Variable S&A Total Variable Costs Fixed Overhead Fixed S&A Total Fixed Costs Dorilane Company-NEW Cost Structure Change Increase by $40 Decrease by 8% Increase by 12% Decrease $ 0.30 per unit Increase by $ 0.25 per unit Increase by $300,000 Increase by 150,000 New Per unit/set or Cost 443 104.59 26.824 4.44 46.04 181.894 577 000 247000 824 000 Notes Per unit Per unit Per unit Per unit Per unit Per unit Total Ss Total Ss Total Ss Variable Costs: Direct Material Direct Labor Variable Overhead Variable S&A Total Variable Costs Fixed Overhead Fixed S&A Total Fixed Costs Total Costs Dorilane Company - Summary of Cost Structure Total Dollars Per unit/set (show 2 decimals) 432000 91,000 18 000 174.000 715 000 277000 97000 374000 1089000 113.68 23.95 4.74 45.79 188,16 Notes per unit per unit Per unit per unit per unit Totals tot als

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a Assuming the increase to expenses calculate the following I 169...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started