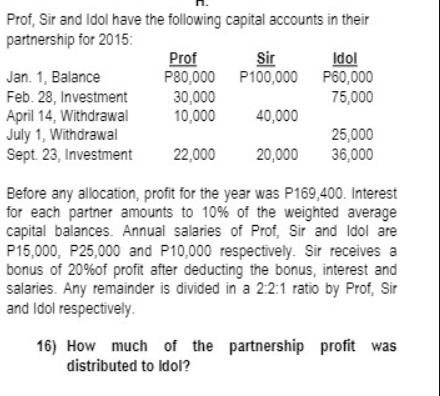

Prof, Sir and Idol have the following capital accounts in their partnership for 2015: Jan. 1, Balance Feb. 28, Investment April 14, Withdrawal July

Prof, Sir and Idol have the following capital accounts in their partnership for 2015: Jan. 1, Balance Feb. 28, Investment April 14, Withdrawal July 1, Withdrawal Sept. 23, Investment Prof P80,000 30,000 10,000 Idol P60,000 75,000 Sir P100,000 40,000 25,000 20,000 36,000 22,000 Before any allocation, profit for the year was P169,400. Interest for each partner amounts to 10% of the weighted average capital balances. Annual salaries of Prof, Sir and Idol are P15,000, P25,000 and P10,000 respectively. Sir receives a bonus of 20%of profit after deducting the bonus, interest and salaries. Any remainder is divided in a 2:2:1 ratio by Prof, Sir and Idol respectively. 16) How much of the partnership profit was distributed to Idol? Emo and Ted are partners engaged in a manufacturing business. Transactions affecting the partners' capital accounts in 2015 are as follows: Jan., Bal. April 1 June 30 Sept. 1 Oct. 1 Debit Emo P 25,000 45,000 Credit P 50,000 Ted Debit 30,000 P 20,000 Credit P 70,000 50,000 60,000 70,000 40,000 The income summary account has a debit balance of P45,000. The agreement between Emo and Ted include the following terms: Interest on average capital at 8%; Salaries of P25,000 and P35,000 are given to Emo and Ted, respectively; Bonus to Ted at 25% of net income after deducting interest and salaries but before deducting the bonus; and Balance is to be divided equally. 17) How much is the net increase/decrease in Ted's capital account during 2015?

Step by Step Solution

3.48 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculate how much of the partnership profit was distributed to Idol we need to follow these steps Calculate the weighted average capital balances f...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started