Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Professional background (1) (2) (3) (4) Mr 123 was a business development manager employed by Uniqlo (Singapore) Pte. Ltd. He graduated from the Singapore

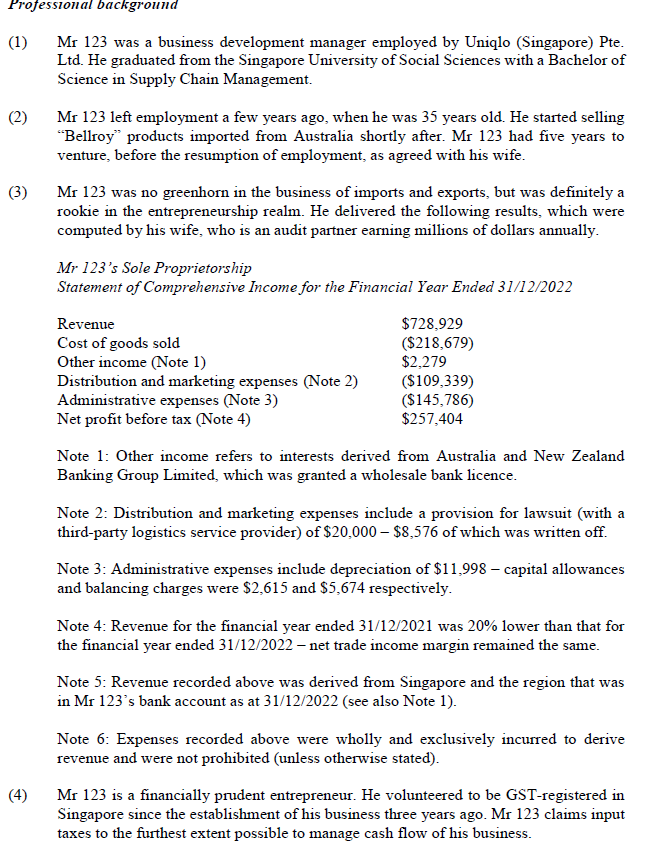

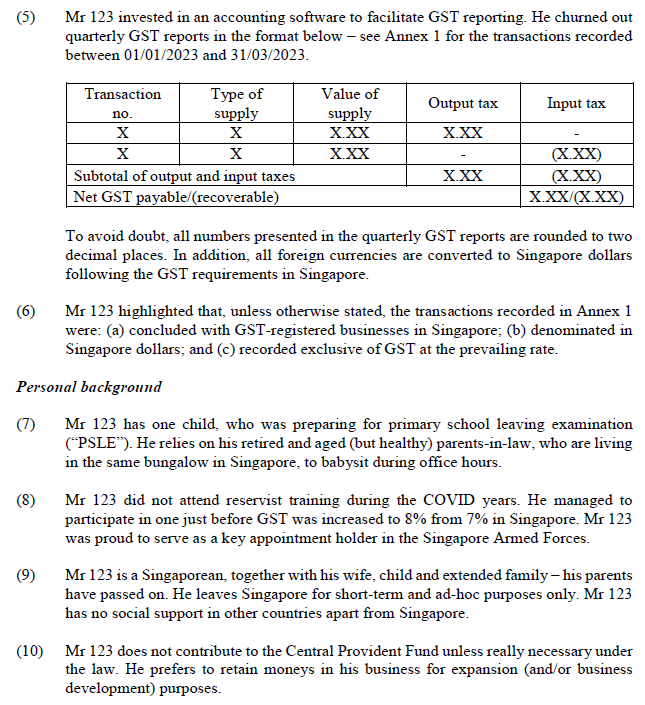

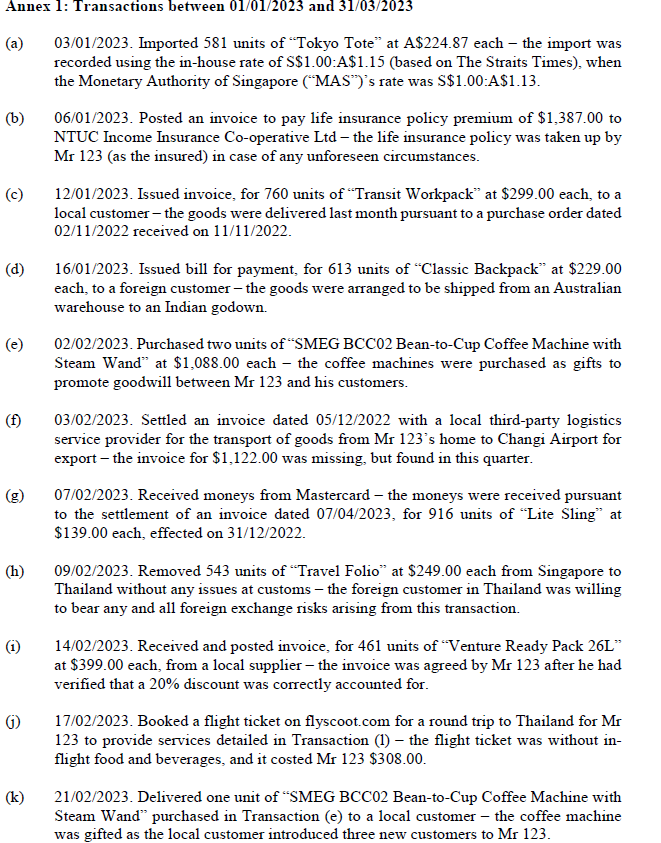

Professional background (1) (2) (3) (4) Mr 123 was a business development manager employed by Uniqlo (Singapore) Pte. Ltd. He graduated from the Singapore University of Social Sciences with a Bachelor of Science in Supply Chain Management. Mr 123 left employment a few years ago, when he was 35 years old. He started selling "Bellroy" products imported from Australia shortly after. Mr 123 had five years to venture, before the resumption of employment, as agreed with his wife. Mr 123 was no greenhorn in the business of imports and exports, but was definitely a rookie in the entrepreneurship realm. He delivered the following results, which were computed by his wife, who is an audit partner earning millions of dollars annually. Mr 123's Sole Proprietorship Statement of Comprehensive Income for the Financial Year Ended 31/12/2022 Revenue Cost of goods sold Other income (Note 1) Distribution and marketing expenses (Note 2) Administrative expenses (Note 3) Net profit before tax (Note 4) $728,929 ($218,679) $2,279 ($109,339) ($145,786) $257,404 Note 1: Other income refers to interests derived from Australia and New Zealand Banking Group Limited, which was granted a wholesale bank licence. Note 2: Distribution and marketing expenses include a provision for lawsuit (with a third-party logistics service provider) of $20,000 - $8,576 of which was written off. Note 3: Administrative expenses include depreciation of $11,998 - capital allowances and balancing charges were $2,615 and $5,674 respectively. Note 4: Revenue for the financial year ended 31/12/2021 was 20% lower than that for the financial year ended 31/12/2022 - net trade income margin remained the same. Note 5: Revenue recorded above was derived from Singapore and the region that was in Mr 123's bank account as at 31/12/2022 (see also Note 1). Note 6: Expenses recorded above were wholly and exclusively incurred to derive revenue and were not prohibited (unless otherwise stated). Mr 123 is a financially prudent entrepreneur. He volunteered to be GST-registered in Singapore since the establishment of his business three years ago. Mr 123 claims input taxes to the furthest extent possible to manage cash flow of his business. (5) Mr 123 invested in an accounting software to facilitate GST reporting. He churned out quarterly GST reports in the format below - see Annex 1 for the transactions recorded between 01/01/2023 and 31/03/2023. Transaction no. X X Type of supply Value of Output tax Input tax supply X X.XX X.XX X X.XX (XXX) Subtotal of output and input taxes X.XX Net GST payable/(recoverable) (X.XX) X.XX/(XXX) (6) To avoid doubt, all numbers presented in the quarterly GST reports are rounded to two decimal places. In addition, all foreign currencies are converted to Singapore dollars following the GST requirements in Singapore. Mr 123 highlighted that, unless otherwise stated, the transactions recorded in Annex 1 were: (a) concluded with GST-registered businesses in Singapore; (b) denominated in Singapore dollars; and (c) recorded exclusive of GST at the prevailing rate. Personal background (7) (8) (9) Mr 123 has one child, who was preparing for primary school leaving examination (*"*PSLE"). He relies on his retired and aged (but healthy) parents-in-law, who are living in the same bungalow in Singapore, to babysit during office hours. Mr 123 did not attend reservist training during the COVID years. He managed to participate in one just before GST was increased to 8% from 7% in Singapore. Mr 123 was proud to serve as a key appointment holder in the Singapore Armed Forces. Mr 123 is a Singaporean, together with his wife, child and extended family - his parents have passed on. He leaves Singapore for short-term and ad-hoc purposes only. Mr 123 has no social support in other countries apart from Singapore. (10) Mr 123 does not contribute to the Central Provident Fund unless really necessary under the law. He prefers to retain moneys in his business for expansion (and/or business development) purposes. Annex 1: Transactions between 01/01/2023 and 31/03/2023 (b) (c) (d) (e) (f) (g) (h) (i) (j) (k) 03/01/2023. Imported 581 units of "Tokyo Tote" at A$224.87 each the import was recorded using the in-house rate of $$1.00 A$1.15 (based on The Straits Times), when the Monetary Authority of Singapore ("MAS")'s rate was $$1.00:A$1.13. 06/01/2023. Posted an invoice to pay life insurance policy premium of $1,387.00 to NTUC Income Insurance Co-operative Ltd - the life insurance policy was taken up by Mr 123 (as the insured) in case of any unforeseen circumstances. 12/01/2023. Issued invoice, for 760 units of Transit Workpack at $299.00 each, to a local customer- the goods were delivered last month pursuant to a purchase order dated 02/11/2022 received on 11/11/2022. 16/01/2023. Issued bill for payment, for 613 units of "Classic Backpack" at $229.00 each, to a foreign customer - the goods were arranged to be shipped from an Australian warehouse to an Indian godown. 02/02/2023. Purchased two units of "SMEG BCC02 Bean-to-Cup Coffee Machine with Steam Wand" at $1,088.00 each the coffee machines were purchased as gifts to promote goodwill between Mr 123 and his customers. 03/02/2023. Settled an invoice dated 05/12/2022 with a local third-party logistics service provider for the transport of goods from Mr 123's home to Changi Airport for export - the invoice for $1,122.00 was missing, but found in this quarter. 07/02/2023. Received moneys from Mastercard - the moneys were received pursuant to the settlement of an invoice dated 07/04/2023, for 916 units of Lite Sling" at $139.00 each, effected on 31/12/2022. 09/02/2023. Removed 543 units of "Travel Folio" at $249.00 each from Singapore to Thailand without any issues at customs - the foreign customer in Thailand was willing to bear any and all foreign exchange risks arising from this transaction. 14/02/2023. Received and posted invoice, for 461 units of "Venture Ready Pack 26L" at $399.00 each, from a local supplier - the invoice was agreed by Mr 123 after he had verified that a 20% discount was correctly accounted for. 17/02/2023. Booked a flight ticket on flyscoot.com for a round trip to Thailand for Mr 123 to provide services detailed in Transaction (1) - the flight ticket was without in- flight food and beverages, and it costed Mr 123 $308.00. 21/02/2023. Delivered one unit of "SMEG BCC02 Bean-to-Cup Coffee Machine with Steam Wand" purchased in Transaction (e) to a local customer - the coffee machine was gifted as the local customer introduced three new customers to Mr 123. (1) 22/02/2023. Billed the foreign customer in Transaction (h) a customisation service fee of $5,000.00 (inclusive of GST) - the foreign customer was billed as Mr 123 flew to Thailand to imprint names on 200 units of "Travel Folio". (m) (n) (0) (p) (a) (r) (s) (t) 23/02/2023. Issued credit note, for 116 units of "Tokyo Tote", to the foreign supplier in Transaction (a) - the credit note was issued due to certain goods being returned as they were damaged during shipping. 08/03/2023. Paid Singtel $20.00 for data roaming charges incurred in Thailand (see Transaction (1) for the relevant details) - the data roaming charges were borne by Mr 123 as the foreign customer was not agreeable to a reimbursement. 09/03/2023. Effected refund of $19,375.20 to the local customer in Transaction (c) - the refund was effected due to an erroneous order placed by the local customer, resulting in a partial return of goods. 16/03/2023. Supplied 450 units of "Slim Sleeve" at $119.00 each to Singapore Airlines Limited's warehouse in Changi (with proper documentation) - the goods were meant for sale by retail to persons on board the SQ flights. 17/03/2023. Paid a refundable security deposit of $1,062.00 to JustCo (Singapore) Pte. Ltd. the refundable security deposit was paid by Mr 123 to demonstrate his commitment to lease a private office space at 120 Robinson Road. 29/03/2023. Leased a container, and paid a local supplier $8,751.00, to facilitate Transaction (t) the container conformed to the relevant standards imposed by the International Air Transport Association. 30/03/2023. Recorded a foreign exchange gain of $55.00 when changing excess Australian dollars back to Singapore dollars with a money changer - the foreign exchange gain was given to Mr 123's child as pocket money. 31/03/2023. Exported 882 units of "Tech Kit at $109.00 each to a foreign customer the transaction documents were issued on the same date, but the transport documents were issued on 30/05/2023, as the goods were removed from Singapore then. Question 1 Apply the principles of individual income tax and compute Mr 123's chargeable income and net individual income tax payable for the relevant year of assessment in a way that would minimise his individual income tax exposure in Singapore (as a household together with his spouse). Show all workings and account for all income and deductions by way of tax adjustments, where applicable - for example, if an income is taxable, an expense is deductible or a personal relief is not claimable, tax adjustments relating to that income, expense or personal relief must be indicated as "$0" in the income tax computation. State reasonable assumption(s) if any of the facts presented is/are unclear - to avoid doubt, new fact(s) may not be introduced. (20 marks) Question 2 Describe, explain and outline how Singapore would be affected economically and socially if GST is to be removed from the country's tax system. Responses shall be supported by research and shall not exceed two (2) pages. (20 marks) Question 3 Apply the principles of GST and calculate Mr 123's net amount of GST payable to (or recoverable from) the Inland Revenue Authority of Singapore ("IRAS") for the accounting period from 01/01/2023 to 31/03/2023. Show all workings and adopt the format of the quarterly GST reports churned out by Mr 123's accounting software. State reasonable assumption(s) if any of the facts presented is/are unclear - to avoid doubt, new fact(s) may not be introduced. (60 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

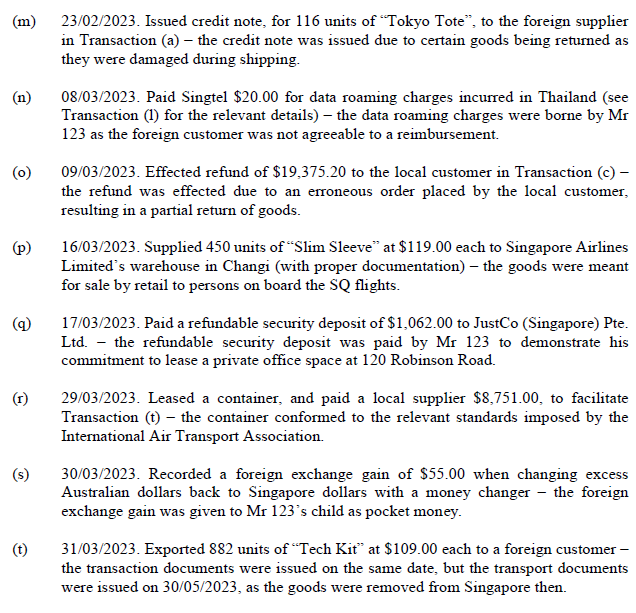

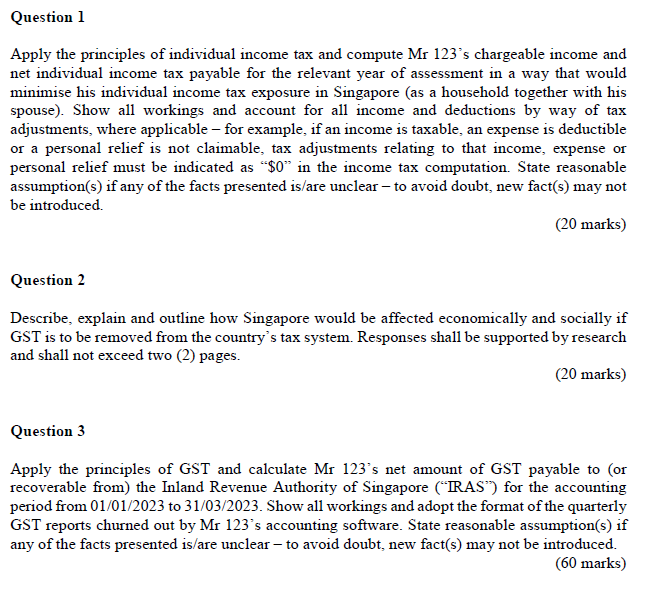

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started