Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Professional-T's opened a new custom organic t-shirt shop and during its first month of operation, the company had the following information regarding the buying

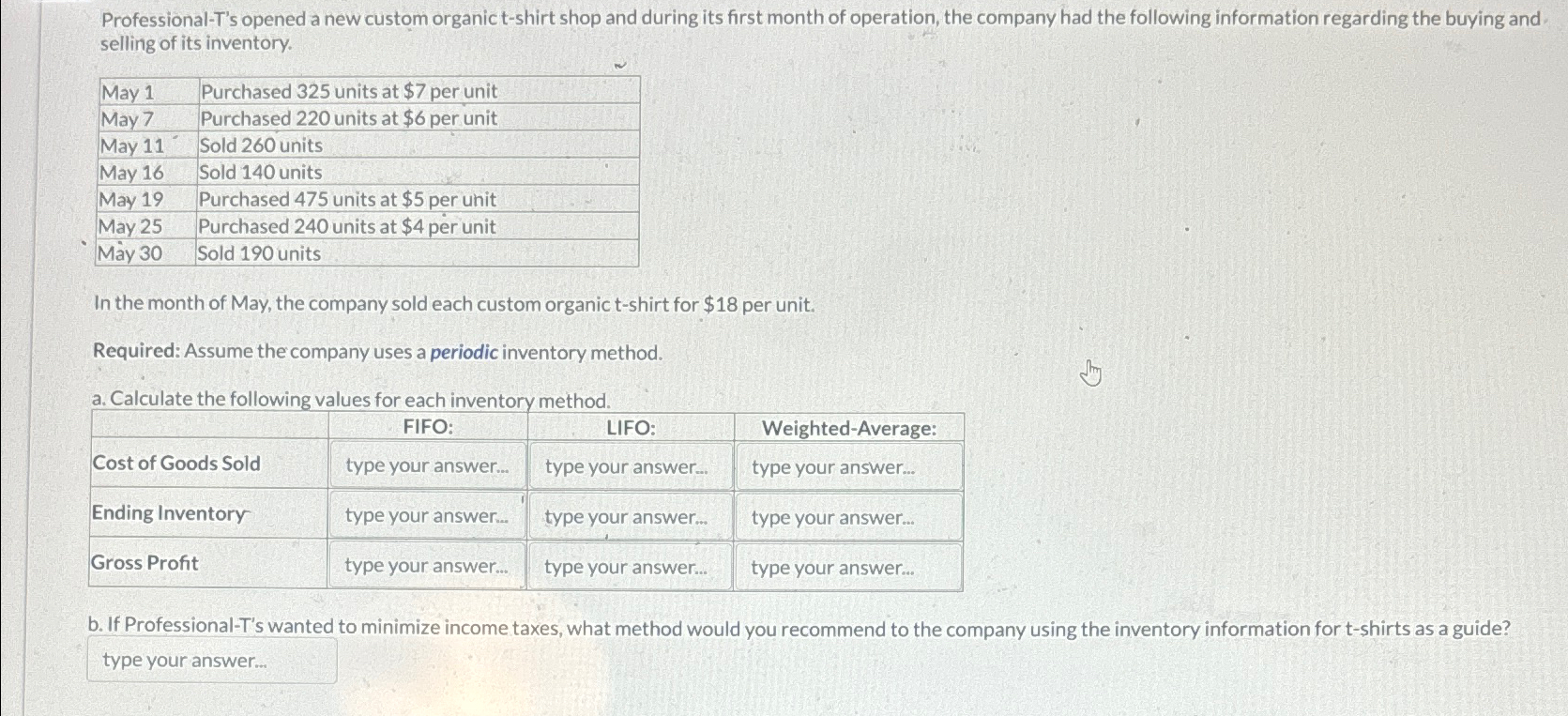

Professional-T's opened a new custom organic t-shirt shop and during its first month of operation, the company had the following information regarding the buying and. selling of its inventory. Purchased 325 units at $7 per unit Purchased 220 units at $6 per unit May 1 May 7 May 11 Sold 260 units May 16 Sold 140 units May 19 Purchased 475 units at $5 per unit May 25 May 30 Purchased 240 units at $4 per unit Sold 190 units In the month of May, the company sold each custom organic t-shirt for $18 per unit. Required: Assume the company uses a periodic inventory method. a. Calculate the following values for each inventory method. FIFO: LIFO: Weighted-Average: Cost of Goods Sold type your answer... type your answer... type your answer... Ending Inventory type your answer... type your answer... type your answer... Gross Profit type your answer... type your answer... type your answer... b. If Professional-T's wanted to minimize income taxes, what method would you recommend to the company using the inventory information for t-shirts as a guide? type your answer...

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Calculations under each inventory method FIFO Beginning inventory 0 units Purchases 325 units at 7 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e5ec287d1c_957438.pdf

180 KBs PDF File

663e5ec287d1c_957438.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started