Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Professor B Notes: . For questions 1, 2, and 3, be sure to watch Professor B's YouTube videos for explanations. The links for the videos

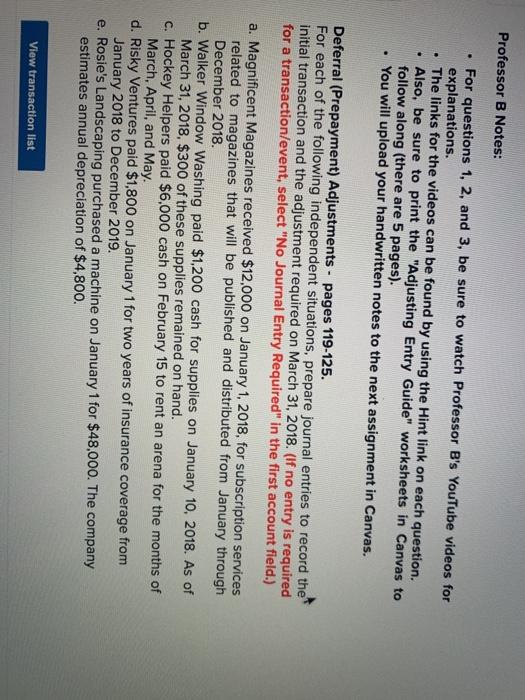

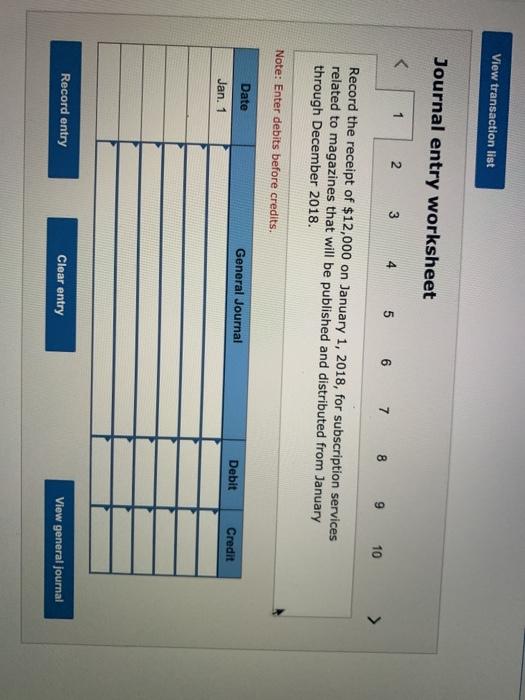

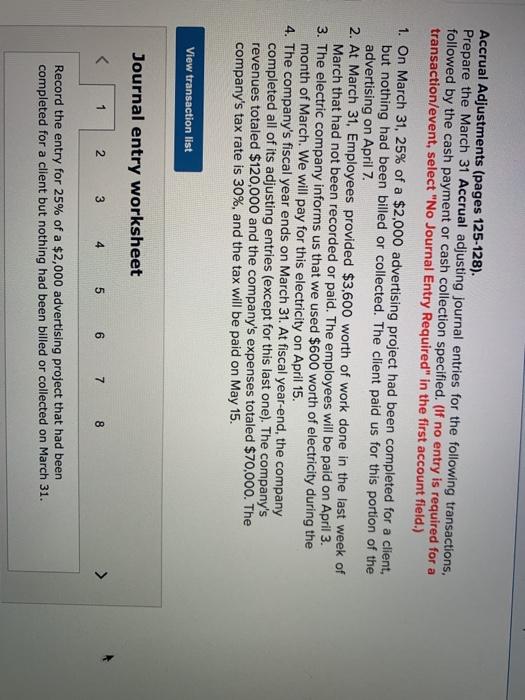

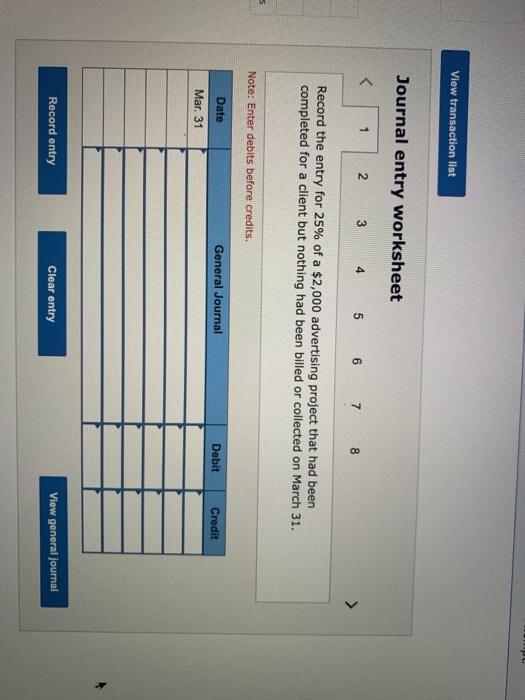

Professor B Notes: . For questions 1, 2, and 3, be sure to watch Professor B's YouTube videos for explanations. The links for the videos can be found by using the Hint link on each question. Also, be sure to print the "Adjusting Entry Guide" worksheets in Canvas to follow along (there are 5 pages). You will upload your handwritten notes to the next assignment in Canvas. . Deferral (Prepayment) Adjustments - pages 119-125. For each of the following independent situations, prepare journal entries to record the initial transaction and the adjustment required on March 31, 2018. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) a. Magnificent Magazines received $12,000 on January 1, 2018, for subscription services related to magazines that will be published and distributed from January through December 2018 b. Walker Window Washing paid $1,200 cash for supplies on January 10, 2018. As of March 31, 2018, $300 of these supplies remained on hand. c. Hockey Helpers paid $6,000 cash on February 15 to rent an arena for the months of March, April, and May. d. Risky Ventures paid $1,800 on January 1 for two years of insurance coverage from January 2018 to December 2019. e. Rosie's Landscaping purchased a machine on January 1 for $48,000. The company estimates annual depreciation of $4,800. View transaction list View transaction list Journal entry worksheet 1 2 3 4 5 6 7 8 9 10 Record the receipt of $12,000 on January 1, 2018, for subscription services related to magazines that will be published and distributed from January through December 2018. Note: Enter debits before credits. Date General Journal Debit Credit Jan. 1 Record entry Clear entry View general Journal Accrual Adjustments (pages 125-128). Prepare the March 31 Accrual adjusting journal entries for the following transactions, followed by the cash payment or cash collection specified. (If no entry is required for a transaction/event, select "No Journal Entry Required in the first account field.) 1. On March 31, 25% of a $2,000 advertising project had been completed for a client, but nothing had been billed or collected. The client paid us for this portion of the advertising on April 7. 2. At March 31, Employees provided $3,600 worth of work done in the last week of March that had not been recorded or paid. The employees will be paid on April 3. 3. The electric company informs us that we used $600 worth of electricity during the month of March. We will pay for this electricity on April 15. 4. The company's fiscal year ends on March 31. At fiscal year-end, the company completed all of its adjusting entries (except for this last one). The company's revenues totaled $120,000 and the company's expenses totaled $70,000. The company's tax rate is 30%, and the tax will be paid on May 15. View transaction list Journal entry worksheet 1 2 3 4 5 6 7 8 Record the entry for 25% of a $2,000 advertising project that had been completed for a client but nothing had been billed or collected on March 31. L. View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started