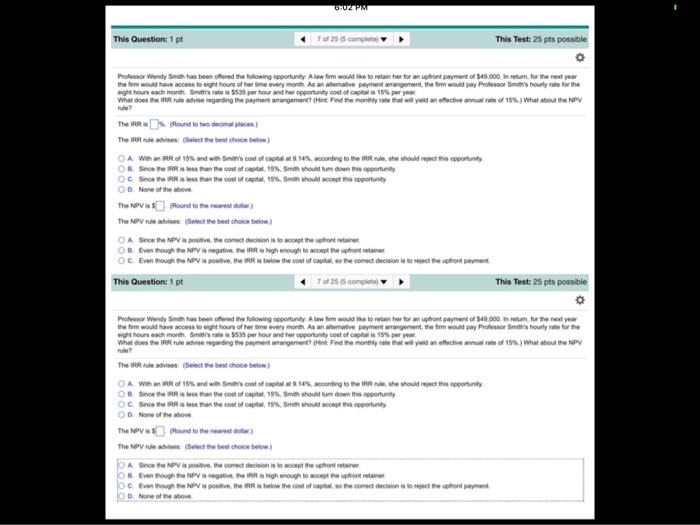

Professor Wendy Smith has been offered the following opportunity. A law firm would like to retain her for an upfront payment of $49,000. In return, for the next year the firm would have access to eight hours of her time every month. As an alternative payment arrangement, the firm would pay Professor Smith's hourly rate for the eight hours each month. Smith's rate is $535 per hour and her opportunity cost of capital is 15% per year. What does the rule advice regarding the payment arrangement? The IRR is The IRR rule advices: With an IRR of 15% and with Smith's cost of capital at 9.14%, according to the IRR rule, she should reject this opportunity. Since the IRR is less than the cost of capital, 15%, Smith should turn down this opportunity. Since the IRR is less than the cost of capital, 15%, Smith should accept this opportunity. None of the above. The NPV rule advises: Since the NPV is positive, the correct decision is to accept the upfront retainer. Even though the NPV is negative, the IRR is high enough to accept the upfront retainer. Even through the NPV is positive, the IRR is below the cost of capital, to the correct decision is to reject the upfront payment. Professor Wendy Smith has been offered the following opportunity. A law firm would like to retain for an upfront payment of $49,000. In return, for the next year the firm would have access to eight hours of her time every month. As an alternative payment arrangement, the firm would pay Professor Smith's hourly rate for the eight hours each month. Smith's rate is $535 per hour and her opportunity cost of capital is 15% per year. What does the IRR rule advice regarding the payment arrangement? The IRR rule advises: With an IRR of 15% and with Smith's cost of capital at 9.14%, according to the IRR rule, she should reject this opportunity. Since the IRR is less than the cost of capital, 15%, Smith should turn down this opportunity. Since the IRR is less than the cost of capital, 15%, Smith should accept this opportunity. None of the above. The NPV is The NPV rule advises: Since the NPV is positive, the correct decision is to accept the upfront retainer. Even though the NPV is negative, the IRR is high enough to accept the upfront retainer. Even through the NPV is positive, the IRR is below the cost of capital, to the correct decision is to reject the upfront payment. None of the above