profit and loss statement and financial position

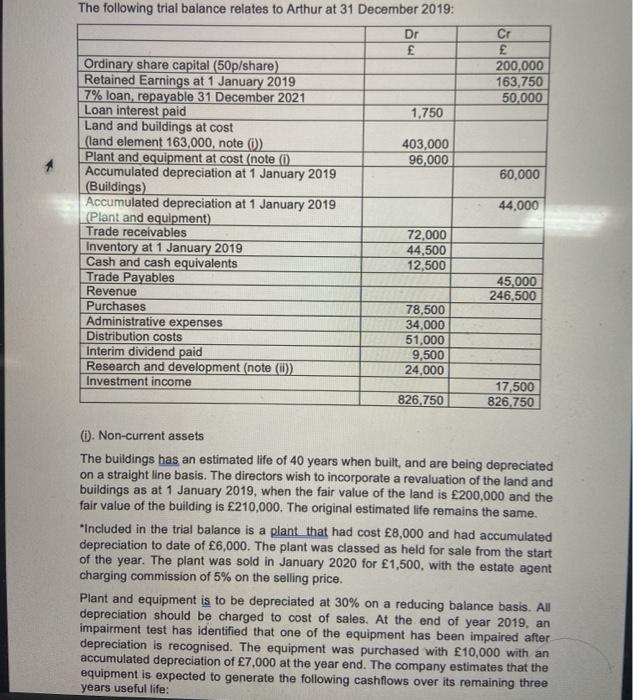

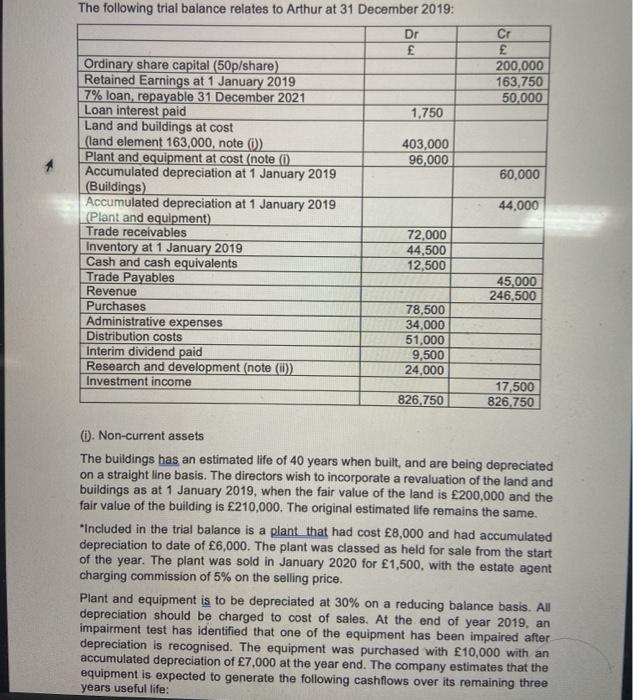

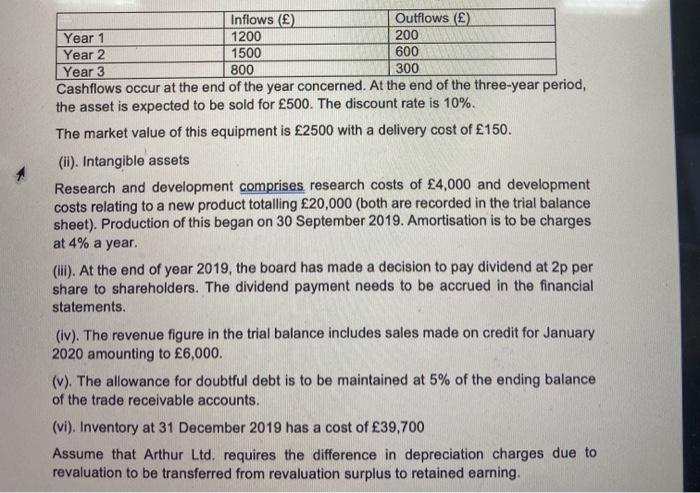

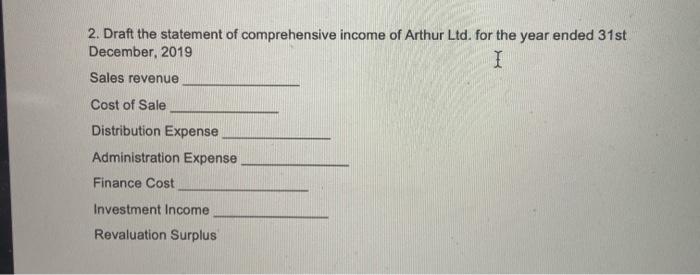

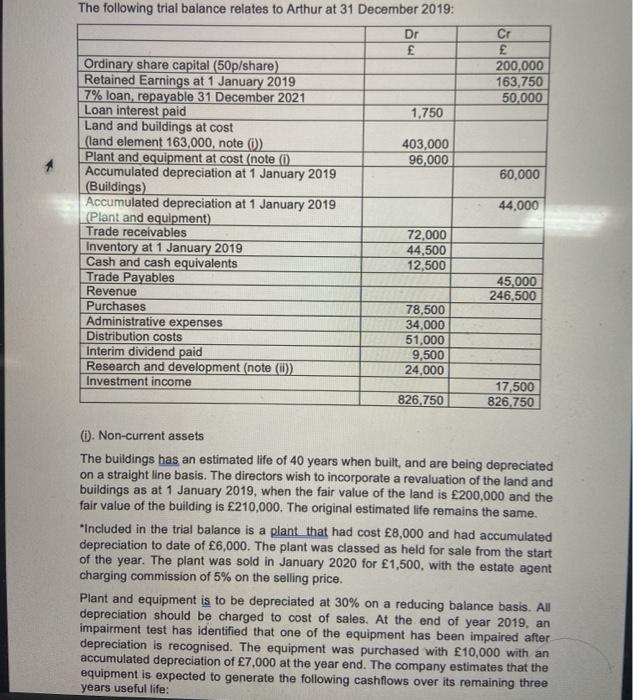

The following trial balance relates to Arthur at 31 December 2019: Dr Cr E 200,000 163,750 50,000 1,750 403,000 96,000 60,000 44,000 Ordinary share capital (50p/share) Retained Earnings at 1 January 2019 7% loan, repayable 31 December 2021 Loan interest paid Land and buildings at cost (land element 163,000, note() Plant and equipment at cost (note ( Accumulated depreciation at 1 January 2019 (Buildings) Accumulated depreciation at 1 January 2019 (Plant and equipment) Trade receivables Inventory at 1 January 2019 Cash and cash equivalents Trade Payables Revenue Purchases Administrative expenses Distribution costs Interim dividend paid Research and development (note (0) Investment income 72,000 44,500 12,500 45,000 246,500 78,500 34,000 51,000 9,500 24,000 826.750 17,500 826.750 (i). Non-current assets The buildings has an estimated life of 40 years when built, and are being depreciated on a straight line basis. The directors wish to incorporate a revaluation of the land and buildings as at 1 January 2019, when the fair value of the land is 200,000 and the fair value of the building is 210,000. The original estimated life remains the same. "Included in the trial balance is a plant that had cost 8,000 and had accumulated depreciation to date of 6,000. The plant was classed as held for sale from the start of the year. The plant was sold in January 2020 for 1,500, with the estate agent charging commission of 5% on the selling price. Plant and equipment is to be depreciated at 30% on a reducing balance basis. All depreciation should be charged to cost of sales. At the end of year 2019, an impairment test has identified that one of the equipment has been impaired after depreciation is recognised. The equipment was purchased with 10,000 with an accumulated depreciation of 7,000 at the year end. The company estimates that the equipment is expected to generate the following cashflows over its remaining three years useful life: Inflows () Outflows () Year 1 1200 200 Year 2 1500 600 Year 3 800 300 Cashflows occur at the end of the year concerned. At the end of the three-year period, the asset is expected to be sold for 500. The discount rate is 10%. The market value of this equipment is 2500 with a delivery cost of 150. (ii). Intangible assets Research and development comprises research costs of 4,000 and development costs relating to a new product totalling 20,000 (both are recorded in the trial balance sheet). Production of this began on 30 September 2019. Amortisation is to be charges at 4% a year. (IL). At the end of year 2019, the board has made a decision to pay dividend at 2p per share to shareholders. The dividend payment needs to be accrued in the financial statements. (iv). The revenue figure in the trial balance includes sales made on credit for January 2020 amounting to 6,000. (v). The allowance for doubtful debt is to be maintained at 5% of the ending balance of the trade receivable accounts. (vi). Inventory at 31 December 2019 has a cost of 39,700 Assume that Arthur Ltd. requires the difference in depreciation charges due to revaluation to be transferred from revaluation surplus to retained earning. 2. Draft the statement of comprehensive income of Arthur Ltd. for the year ended 31st December, 2019 I Sales revenue Cost of Sale Distribution Expense Administration Expense Finance Cost Investment Income Revaluation Surplus The following trial balance relates to Arthur at 31 December 2019: Dr Cr E 200,000 163,750 50,000 1,750 403,000 96,000 60,000 44,000 Ordinary share capital (50p/share) Retained Earnings at 1 January 2019 7% loan, repayable 31 December 2021 Loan interest paid Land and buildings at cost (land element 163,000, note() Plant and equipment at cost (note ( Accumulated depreciation at 1 January 2019 (Buildings) Accumulated depreciation at 1 January 2019 (Plant and equipment) Trade receivables Inventory at 1 January 2019 Cash and cash equivalents Trade Payables Revenue Purchases Administrative expenses Distribution costs Interim dividend paid Research and development (note (0) Investment income 72,000 44,500 12,500 45,000 246,500 78,500 34,000 51,000 9,500 24,000 826.750 17,500 826.750 (i). Non-current assets The buildings has an estimated life of 40 years when built, and are being depreciated on a straight line basis. The directors wish to incorporate a revaluation of the land and buildings as at 1 January 2019, when the fair value of the land is 200,000 and the fair value of the building is 210,000. The original estimated life remains the same. "Included in the trial balance is a plant that had cost 8,000 and had accumulated depreciation to date of 6,000. The plant was classed as held for sale from the start of the year. The plant was sold in January 2020 for 1,500, with the estate agent charging commission of 5% on the selling price. Plant and equipment is to be depreciated at 30% on a reducing balance basis. All depreciation should be charged to cost of sales. At the end of year 2019, an impairment test has identified that one of the equipment has been impaired after depreciation is recognised. The equipment was purchased with 10,000 with an accumulated depreciation of 7,000 at the year end. The company estimates that the equipment is expected to generate the following cashflows over its remaining three years useful life: Inflows () Outflows () Year 1 1200 200 Year 2 1500 600 Year 3 800 300 Cashflows occur at the end of the year concerned. At the end of the three-year period, the asset is expected to be sold for 500. The discount rate is 10%. The market value of this equipment is 2500 with a delivery cost of 150. (ii). Intangible assets Research and development comprises research costs of 4,000 and development costs relating to a new product totalling 20,000 (both are recorded in the trial balance sheet). Production of this began on 30 September 2019. Amortisation is to be charges at 4% a year. (IL). At the end of year 2019, the board has made a decision to pay dividend at 2p per share to shareholders. The dividend payment needs to be accrued in the financial statements. (iv). The revenue figure in the trial balance includes sales made on credit for January 2020 amounting to 6,000. (v). The allowance for doubtful debt is to be maintained at 5% of the ending balance of the trade receivable accounts. (vi). Inventory at 31 December 2019 has a cost of 39,700 Assume that Arthur Ltd. requires the difference in depreciation charges due to revaluation to be transferred from revaluation surplus to retained earning. 2. Draft the statement of comprehensive income of Arthur Ltd. for the year ended 31st December, 2019 I Sales revenue Cost of Sale Distribution Expense Administration Expense Finance Cost Investment Income Revaluation Surplus