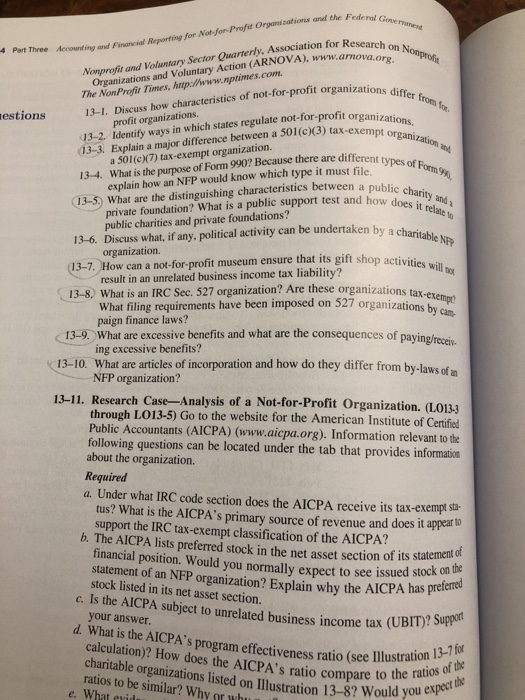

Profit Orgarnizat ions and the Federal Quarterly, Association for R 4 Part Three Accounting ond Financial Reporting for Not-Jor- Association for Research on Prof Organizations and Voluntary 13-1. Discuss how characteristies of not-for-profit organizations 3-2. Identify ways in which states regulate not-for-profit organiz Nonprofit and Voluntary Sector izations and Voluntary Action (ARNOVA), www.arno The Non Profit Times, http:www.mptimes.com differ from fo estions profit organizations organization and 13-3. Explain a major difference between a 501(c)(3) tax-ex a 501 (c)(7) tax-exempt organization. of Fom explain how an NFP would know which type it must file. 13-5) What are the distinguishing characteristics between a public che 13-4. What is the purpose of Form 990? Because there are di does it relate t private foundation? What is a public support test andhowey and public charities and private foundations? 13-6. Discuss what, if any, political activity can be undertaken by a ch organization. 3-7. How can a not-for-profit museum ensure that its gift shop activi result in an unrelated business income tax liability? 13-8) What is an IRC Sec. 527 organization? Are these organizations tax-exemmnt What filing requirements have been imposed on 527 organizations by can 13-9, What are excessive benefits and what are the consequences of paying/receiu 13-10. What are articles of incorporation and how do they differ from by-laws of a 13-11. Research Case-Analysis of a Not-for-Profit Organization. (L0133 paign finance laws? ing excessive benefits? NFP organization? through LO13-5) Go to the website for the American Institute of Certified Public Accountants (AICPA) (www.aicpa.org). Information relevant to the following questions can be located under the tab that provides information about the organization. Required a. Under what IRC code section does the AICPA receive its tax-exempt sta- tus? What is the AICPA's primary source of revenue and does it appear ta support the IRC tax-exempt classification of the AICPA? b. The AICPA lists preferred stock in the net financial position. Would you normally expect to see ied asset section of its statement of issued stock on the atement of an NFP organization? Explain why the AICPA has pre stock listed in its net asset section. your answer calculation)? How does the AICPA's ratio compare to the preferred c. Is the AICPA subject to unrelated business income tax (UBII) h the AlCPA d. What is the AICPA's program effectiveness ratio (see Illustration i of tbhe 13-7 for charitable organizations listed on Illustration 13-8? Would you ratios to be similar? Why or whu e. What evid expect the Profit Orgarnizat ions and the Federal Quarterly, Association for R 4 Part Three Accounting ond Financial Reporting for Not-Jor- Association for Research on Prof Organizations and Voluntary 13-1. Discuss how characteristies of not-for-profit organizations 3-2. Identify ways in which states regulate not-for-profit organiz Nonprofit and Voluntary Sector izations and Voluntary Action (ARNOVA), www.arno The Non Profit Times, http:www.mptimes.com differ from fo estions profit organizations organization and 13-3. Explain a major difference between a 501(c)(3) tax-ex a 501 (c)(7) tax-exempt organization. of Fom explain how an NFP would know which type it must file. 13-5) What are the distinguishing characteristics between a public che 13-4. What is the purpose of Form 990? Because there are di does it relate t private foundation? What is a public support test andhowey and public charities and private foundations? 13-6. Discuss what, if any, political activity can be undertaken by a ch organization. 3-7. How can a not-for-profit museum ensure that its gift shop activi result in an unrelated business income tax liability? 13-8) What is an IRC Sec. 527 organization? Are these organizations tax-exemmnt What filing requirements have been imposed on 527 organizations by can 13-9, What are excessive benefits and what are the consequences of paying/receiu 13-10. What are articles of incorporation and how do they differ from by-laws of a 13-11. Research Case-Analysis of a Not-for-Profit Organization. (L0133 paign finance laws? ing excessive benefits? NFP organization? through LO13-5) Go to the website for the American Institute of Certified Public Accountants (AICPA) (www.aicpa.org). Information relevant to the following questions can be located under the tab that provides information about the organization. Required a. Under what IRC code section does the AICPA receive its tax-exempt sta- tus? What is the AICPA's primary source of revenue and does it appear ta support the IRC tax-exempt classification of the AICPA? b. The AICPA lists preferred stock in the net financial position. Would you normally expect to see ied asset section of its statement of issued stock on the atement of an NFP organization? Explain why the AICPA has pre stock listed in its net asset section. your answer calculation)? How does the AICPA's ratio compare to the preferred c. Is the AICPA subject to unrelated business income tax (UBII) h the AlCPA d. What is the AICPA's program effectiveness ratio (see Illustration i of tbhe 13-7 for charitable organizations listed on Illustration 13-8? Would you ratios to be similar? Why or whu e. What evid expect the