Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Happy Nails is a locally owned nail salon that is in its first year of business. The nail salon employs 8 ral technicians that

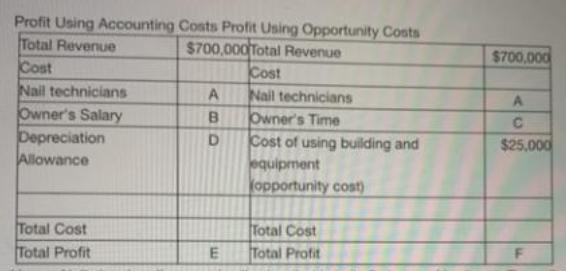

Happy Nails is a locally owned nail salon that is in its first year of business. The nail salon employs 8 ral technicians that are paid $31,250 each and the owner's is paid $75,000. H the owner did not own Happy Nals, she would work for a competitor for $85,000. At the beginning of the year, the building and the salon equipment are worth $100.000 and at the end of the year, they are worth $85,000. The accountant for Happy Nails uses straight-line depreciation for the 15-year life of the building and salon equipment. The table above provides some additional infomation on revenue and the opportunity cost of using the building and equipment. Profit Using Accounting Costs Profit Using Opportunity Costs $700,000 Total Revenue Cost Nail technicians Owner's Time Total Revenue Cost Nail technicians Owner's Salary Depreciation Allowance $700,000 A B. Cost of using building and $25,000 equipment opportunity cost) Total Cost Total Profit Total Cost Total Profit Refer to the table above. What is the value of A? O 331,250 O S312.500 O $260.000 O S02.500

Step by Step Solution

★★★★★

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started