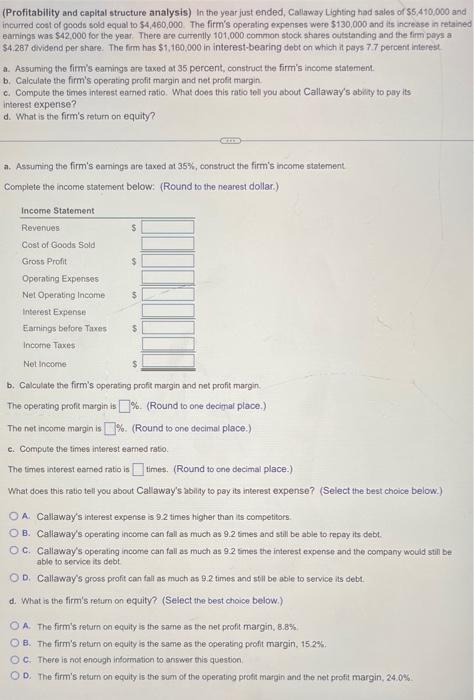

(Profitability and caplal structure analysis) In the year just ended, Callaway Lighting had sales of $5,410,000 and incurred cost of goods sold equal to $4,460,000. The firm's operating expenses were $130,000 and its increase in retained eamings was $42,000 for the year. There are currently 101,000 common stock shares outstanding and the firm pays a $4.287 dividend per share: The firm has $1,160,000 in interest-bearing debt on which it pays 7.7 percent interest a. Assuming the firm's eamings are taxed at 35 percent, construct the firm's income statement. b. Calculate the firm's operating profit margin and net profit margin. c. Compute the times interest eamed ratio. What does this rato tell you about Callaway's abilit to pay its: interest expense? d. What is the firm's return on equity? a. Assuming the firm's eamings are taxed at 35\%, construct the firm's income statement. Complete the income statement below: (Round to the nearest dollar.) b. Calculate the firm's operating profit margin and net profit margin. The operating profit margin is %. (Round to one decimat place.) The net income margin is %. (Round to one decimal place.) c. Compute the times interest eamed ratio. The times interest eamed ratio is times. (Round to one decimal place.) What does this ratio tell you about Callaway's abiliy to pay its interest expense? (Select the best choice below.) A. Callaway's interest expense is 9.2 times higher than its competitors. B. Callaway's operating income can fall as much as 9.2 times and still be able to repay its debt. C. Callaway's operating income can fall as much as 92 times the interest expense and the company would still be able to service its debt D. Callaway's gross profit can fall as much as 9.2 times and stil be able to service its debt. d. What is the firm's retum on equity? (Select the best choice below.) A. The firm's return on equity is the same as the net profit margin, 8.8% B. The firm's return on equity is the same as the operating profit margin, 15.2%. C. There is not enough information to answer this question, D. The firm's return on equity is the sum of the opecating proff margin and the net profit margin, 24.045