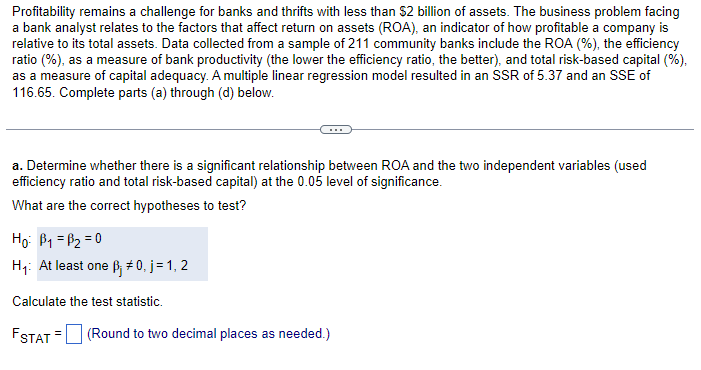

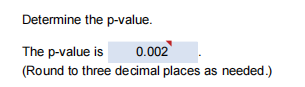

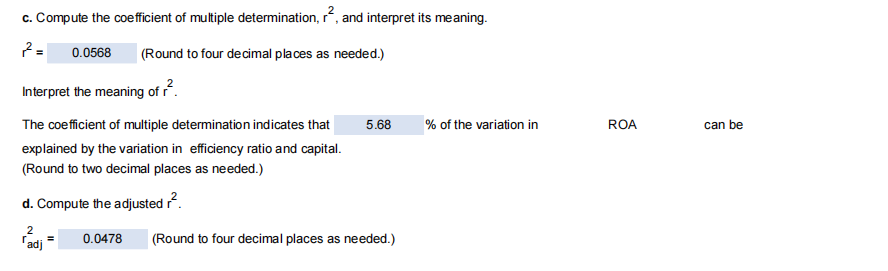

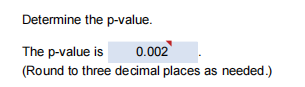

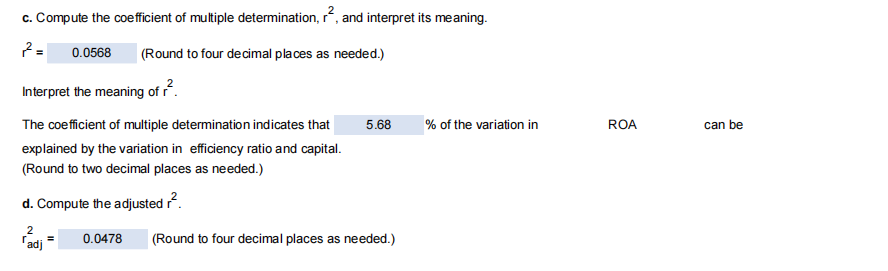

Profitability remains a challenge for banks and thrifts with less than $2 billion of assets. The business problem facing a bank analyst relates to the factors that affect return on assets (ROA), an indicator of how profitable a company is relative to its total assets. Data collected from a sample of 211 community banks include the ROA (\%), the efficiency ratio (\%), as a measure of bank productivity (the lower the efficiency ratio, the better), and total risk-based capital (\%), as a measure of capital adequacy. A multiple linear regression model resulted in an SSR of 5.37 and an SSE of 116.65. Complete parts (a) through (d) below. a. Determine whether there is a significant relationship between ROA and the two independent variables (used efficiency ratio and total risk-based capital) at the 0.05 level of significance. What are the correct hypotheses to test? H0:1=2=0 H1: At least one j=0,j=1,2 Calculate the test statistic. FSTAT= (Round to two decimal places as needed.) Determine the p-value. The p-value is (Round to three decimal places as needed.) c. Compute the coefficient of multiple determination, r2, and interpret its meaning. r2= (Round to four decimal places as needed.) Interpret the meaning of r2. The coefficient of multiple determination indicates that % of the variation in ROA can be explained by the variation in efficiency ratio and capital. (Round to two decimal places as needed.) d. Compute the adjusted r2. radj2= (Round to four decimal places as needed.) Profitability remains a challenge for banks and thrifts with less than $2 billion of assets. The business problem facing a bank analyst relates to the factors that affect return on assets (ROA), an indicator of how profitable a company is relative to its total assets. Data collected from a sample of 211 community banks include the ROA (\%), the efficiency ratio (\%), as a measure of bank productivity (the lower the efficiency ratio, the better), and total risk-based capital (\%), as a measure of capital adequacy. A multiple linear regression model resulted in an SSR of 5.37 and an SSE of 116.65. Complete parts (a) through (d) below. a. Determine whether there is a significant relationship between ROA and the two independent variables (used efficiency ratio and total risk-based capital) at the 0.05 level of significance. What are the correct hypotheses to test? H0:1=2=0 H1: At least one j=0,j=1,2 Calculate the test statistic. FSTAT= (Round to two decimal places as needed.) Determine the p-value. The p-value is (Round to three decimal places as needed.) c. Compute the coefficient of multiple determination, r2, and interpret its meaning. r2= (Round to four decimal places as needed.) Interpret the meaning of r2. The coefficient of multiple determination indicates that % of the variation in ROA can be explained by the variation in efficiency ratio and capital. (Round to two decimal places as needed.) d. Compute the adjusted r2. radj2= (Round to four decimal places as needed.)