Answered step by step

Verified Expert Solution

Question

1 Approved Answer

profitable, so it has paid an average of only 2 0 % in taxes during the last several years. In addition, it uses little debt,

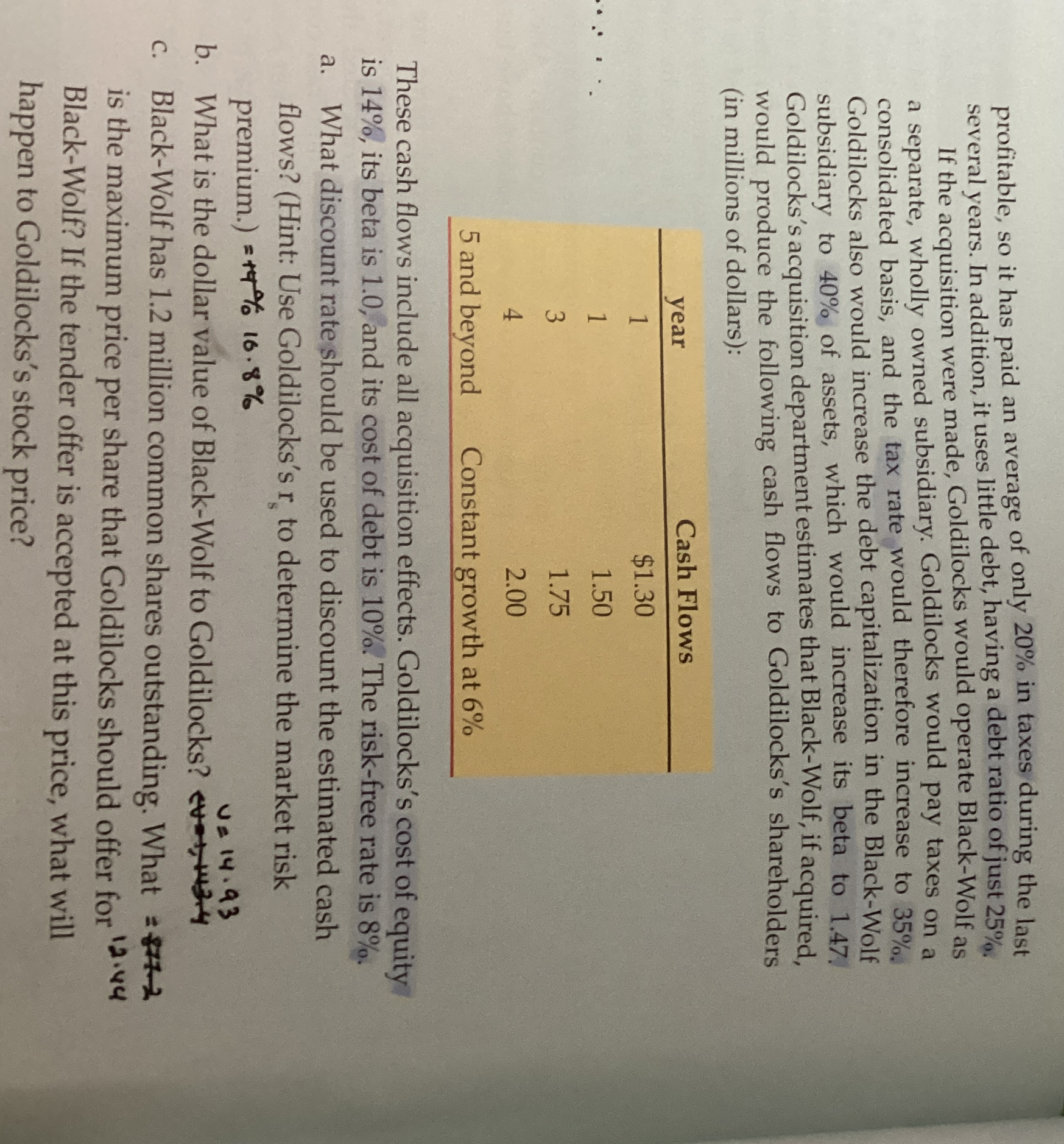

profitable, so it has paid an average of only in taxes during the last several years. In addition, it uses little debt, having a debt ratio of just If the acquisition were made, Goldilocks would operate BlackWolf as a separate, wholly owned subsidiary. Goldilocks would pay taxes on a consolidated basis, and the tax rate would therefore increase to Goldilocks also would increase the debt capitalization in the BlackWolf subsidiary to of assets, which would increase its beta to Goldilocks's acquisition department estimates that BlackWolf, if acquired, would produce the following cash flows to Goldilocks's shareholders in millions of dollars:

tableyearCash Flows$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started