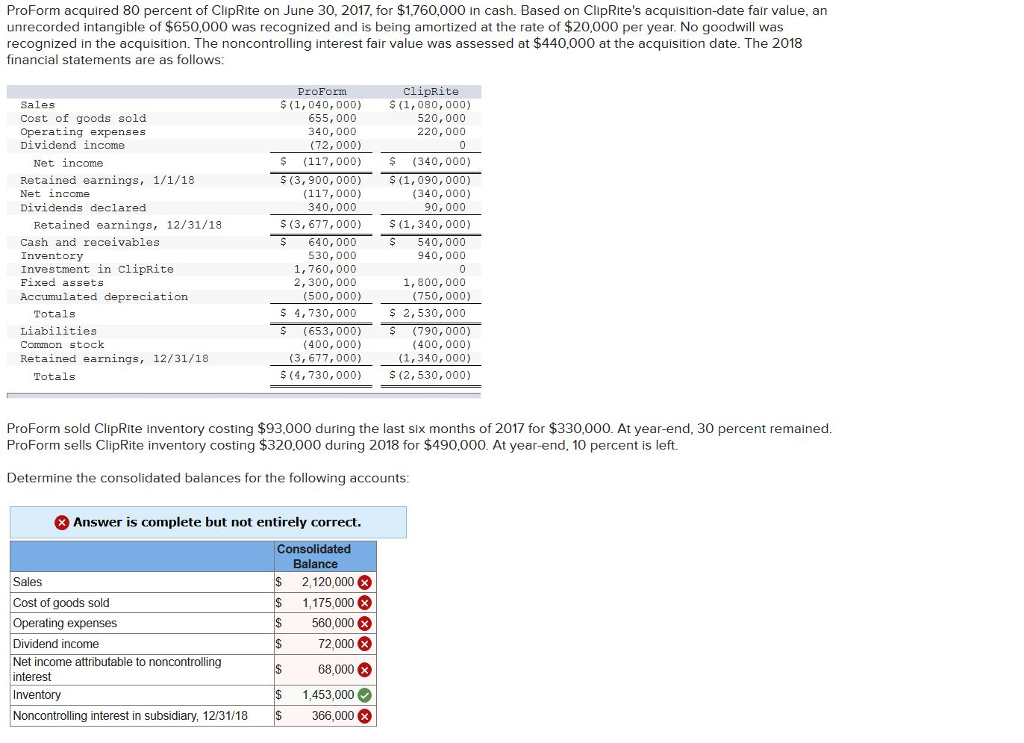

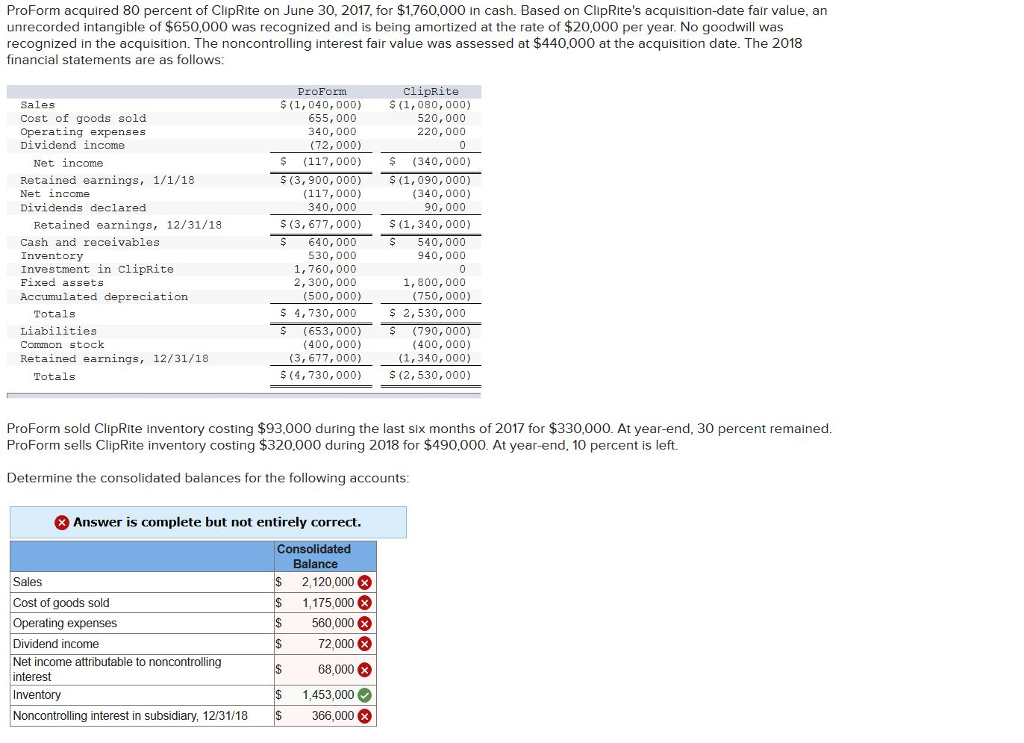

ProForm acquired 80 percent of ClipRite on June 30, 2017, for $1,760,000 in cash. Based on ClipRite's acquisition-date fair value, an unrecorded intangible of $650,000 was recognized and is being amortized at the rate of $20,000 per year. No goodwill was recognized in the acquisition. The noncontrolling interest fair value was assessed at $440,000 at the acquisition date. The 2018 financial statements are as follows: ProForm $ (1,040, 000) ClipRite S (1,080,000) Sales Cost of goods sold Operating expenses Dividend income 655, 000 340,000 (72,000) 520,000 220,000 Net income Retained Net income Dividends declared $ (117,000) (340,000) $ (3,900,000) (1,090,000) (340,000) 90,000 $ (3, 677,000) $(1,340,000) earnings, 1/1/18 (117,000) 340,000 Retained earnings, 12/31/18 Cash and receivable:s Inventory Investment in ClipRite Fixed assets Accumulated depreciation S 540,000 940,000 S 640,000 530,000 1,760,000 2,300, 000 1,800, 000 (750,000) s 2,530,000 $ (653,000) S (790,000) (400,000) (1,340,000) S (2,530,000) $ 4,730,000 Totals Liabilities Common stock Retained earnings, 12/31/18 (400,000) Totals $ (4, 730,000) ProForm sold ClipRite inventory costing $93,000 during the last six months of 2017 for $330,000. At year-end, 30 percent remained. ProForm sells ClipRite inventory costing $320,000 during 2018 for $490,000. At year-end, 10 percent is left. Determine the consolidated balances for the following accounts Answer is complete but not entirely correct Consolidate Balance Sales Cost of goods sold Operating expenses Dividend income Net income attributable to noncontrolling 2,120,000 1,175,000 560,000 72,000 68,000 1,453,000 366,000 Noncontrolling interest in subsidiary, 12/31/18 ProForm acquired 80 percent of ClipRite on June 30, 2017, for $1,760,000 in cash. Based on ClipRite's acquisition-date fair value, an unrecorded intangible of $650,000 was recognized and is being amortized at the rate of $20,000 per year. No goodwill was recognized in the acquisition. The noncontrolling interest fair value was assessed at $440,000 at the acquisition date. The 2018 financial statements are as follows: ProForm $ (1,040, 000) ClipRite S (1,080,000) Sales Cost of goods sold Operating expenses Dividend income 655, 000 340,000 (72,000) 520,000 220,000 Net income Retained Net income Dividends declared $ (117,000) (340,000) $ (3,900,000) (1,090,000) (340,000) 90,000 $ (3, 677,000) $(1,340,000) earnings, 1/1/18 (117,000) 340,000 Retained earnings, 12/31/18 Cash and receivable:s Inventory Investment in ClipRite Fixed assets Accumulated depreciation S 540,000 940,000 S 640,000 530,000 1,760,000 2,300, 000 1,800, 000 (750,000) s 2,530,000 $ (653,000) S (790,000) (400,000) (1,340,000) S (2,530,000) $ 4,730,000 Totals Liabilities Common stock Retained earnings, 12/31/18 (400,000) Totals $ (4, 730,000) ProForm sold ClipRite inventory costing $93,000 during the last six months of 2017 for $330,000. At year-end, 30 percent remained. ProForm sells ClipRite inventory costing $320,000 during 2018 for $490,000. At year-end, 10 percent is left. Determine the consolidated balances for the following accounts Answer is complete but not entirely correct Consolidate Balance Sales Cost of goods sold Operating expenses Dividend income Net income attributable to noncontrolling 2,120,000 1,175,000 560,000 72,000 68,000 1,453,000 366,000 Noncontrolling interest in subsidiary, 12/31/18