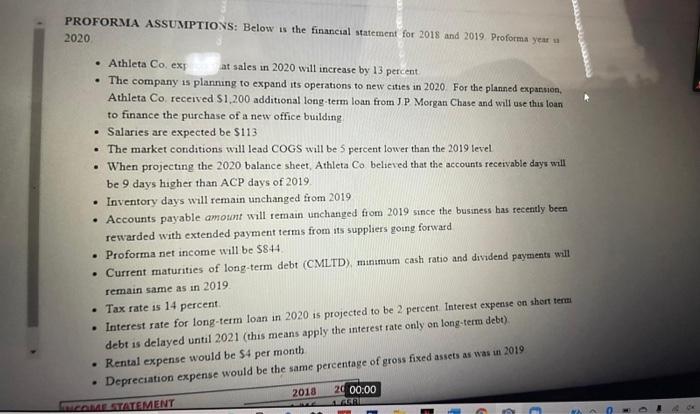

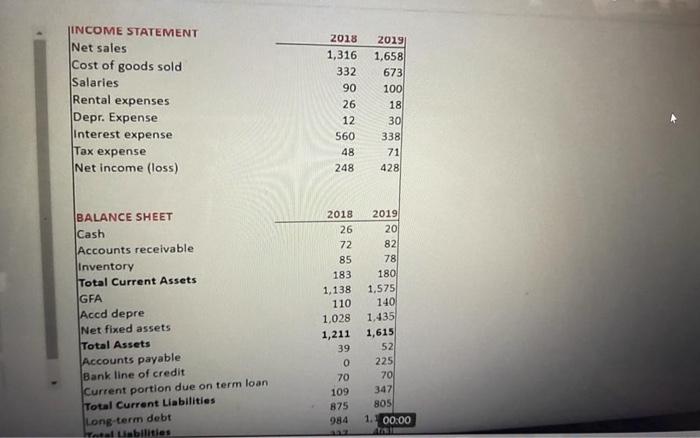

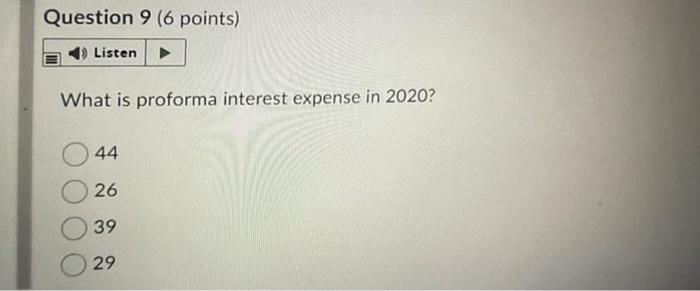

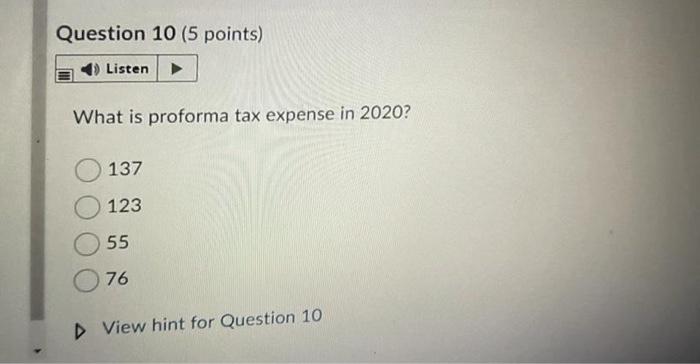

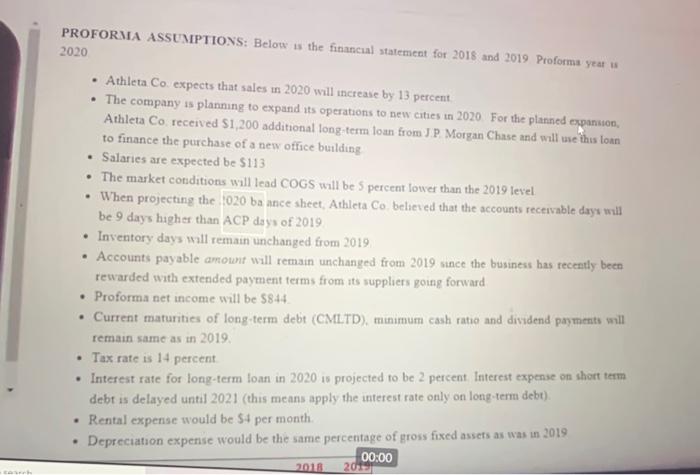

PROFORMA ASSUMPTIONS: Below is the financial statement for 2018 and 2019. Proforma year a 2020 Athleta Co, ex at sales in 2020 will increase by 13 percent The company is planning to expand its operations to new cities in 2020. For the planned expansion Athleta Co received $1,200 additional long term loan from JP Morgan Chase and will use this loan to finance the purchase of a new office building Salaries are expected be $113 The market conditions will lead COGS will be 5 percent lower than the 2019 level When projecting the 2020 balance sheet, Athleta Co believed that the accounts receivable days will be 9 days higher than ACP days of 2019. Inventory days will remain unchanged from 2019 Accounts payable amount will remain unchanged from 2019 since the business has recently been rewarded with extended payment terms from its suppliers going forward Proforma net income will be $844 Current maturities of long-term debt (CMLTD) minimum cash ratio and dividend payments will remain same as in 2019 Tax rate is 14 percent . Interest rate for long-term loan in 2020 is projected to be 2 percent Interest expense on short term debt is delayed until 2021 (this means apply the interest rate only on long-term debt) Rental expense would be $4 per month Depreciation expense would be the same percentage of gross fixed assets as was in 2019 2018 20 00:00 CAMEGTATEMENT INCOME STATEMENT Net sales Cost of goods sold Salaries Rental expenses Depr. Expense Interest expense Tax expense Net Income (loss) 2018 1,316 332 90 26 12 560 48 248 2019 1,658 673 100 18 30 338 71 428 BALANCE SHEET Cash Accounts receivable Inventory Total Current Assets GFA Accd depre Net fixed assets Total Assets Accounts payable Bank line of credit Current portion due on term loan Total Current Liabilities Long-term debt naal abilities 2018 26 72 85 183 1,138 110 1.028 1,211 39 o 70 109 875 984 2019 20 82 78 180 1,575 140 1.435 1,615 52 225 70 347 BOS 1. 00:00 Question 9 (6 points) Listen What is proforma interest expense in 2020? 44 26 39 29 Question 10 (5 points) Listen What is proforma tax expense in 2020? 137 123 55 76 View hint for Question 10 . PROFORMA ASSUMPTIONS: Below is the financial statement for 2018 and 2019 Proforma yra 2020 Athleta.Co. expects that sales in 2020 will increase by 13 percent The company is planning to expand its operations to new cities in 2020 For the planned expansion, Athleta Co received $1,200 additional long term loan from JP Morgan Chase and will me this loan to finance the purchase of a new office building Salaries are expected be $113 The market conditions will lead COGS will be 5 percent lower than the 2019 level When projecting the 1020 ba ance sheet. Athleta Co believed that the accounts receivable days will be 9 days higher than ACP days of 2019 Inventory days will remain unchanged from 2019 Accounts payable amount will remain unchanged from 2019 since the business has recently been rewarded with extended payment terms from its suppliers going forward Proforma net income will be 5844 Current maturities of long-term debt (CMLTD), minimum cash ratio and dividend payments will remain same as in 2019. Tax rate is 14 percent Interest rate for long-term loan in 2020 10 projected to be 2 percent Interest expense on short term debt is delayed until 2021 (this means apply the interest rate only on long-term debt). Rental expense would be 54 per month Depreciation expense would be the same percentage of gross fixed assets as was in 2019 2018 00:00 2019