PROFORMA, WACC, and IRR

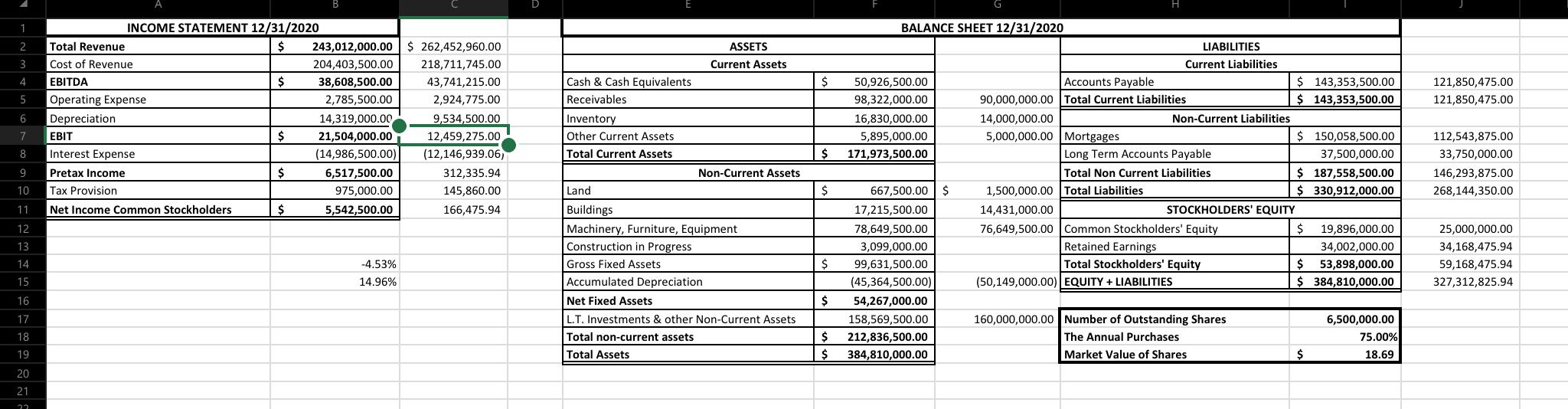

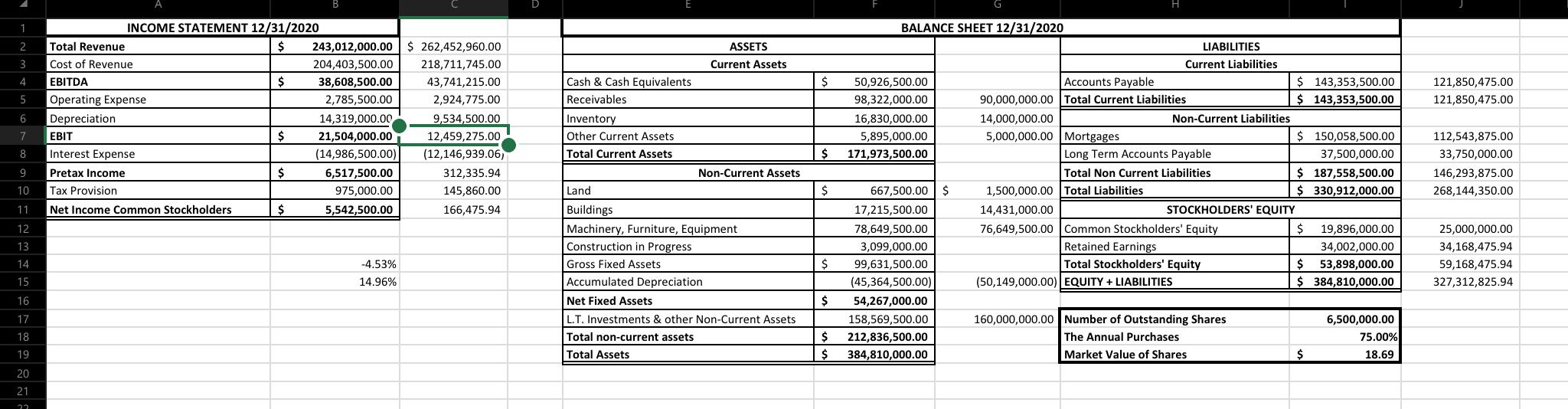

Part I. Help with cash and cash equivalents, and non-current assets section. If something is wrong please correct

Part II. WACC answers are: 1. 9.06%. 2. 10.43%. Is that right?

Part III. Please help.

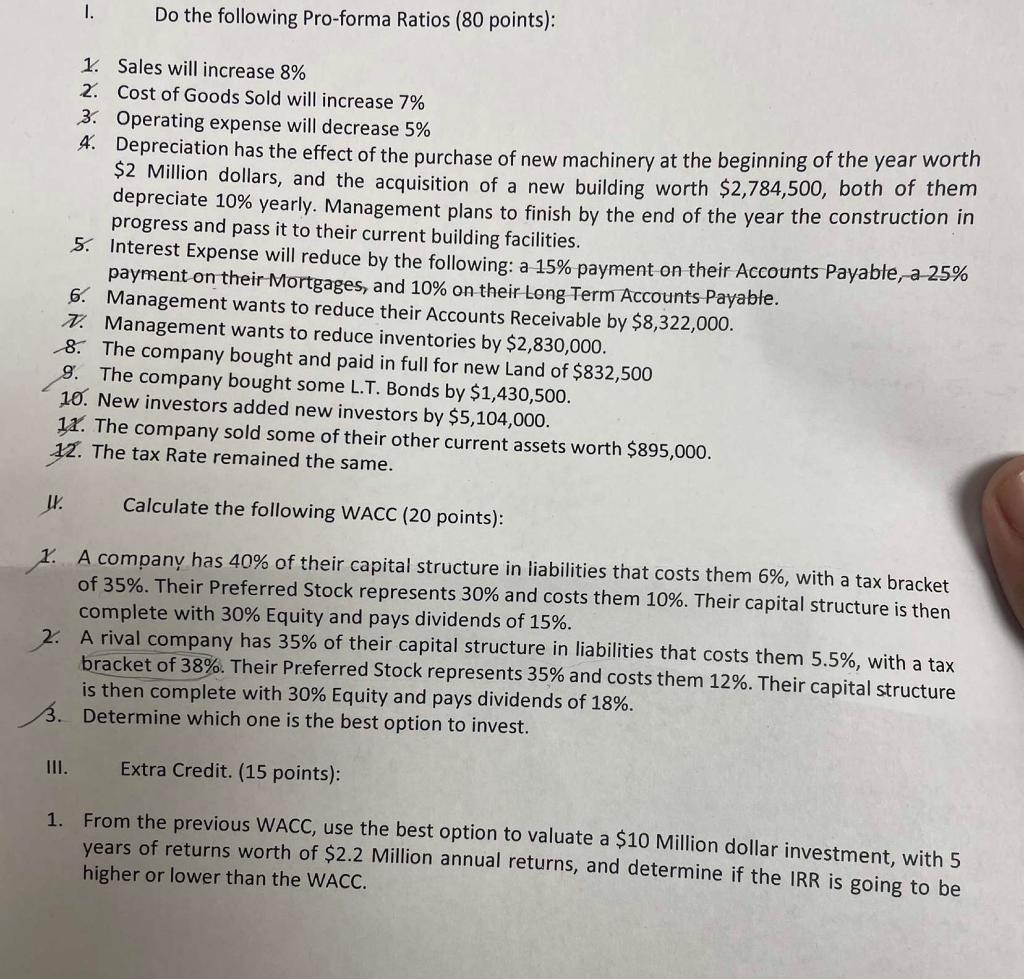

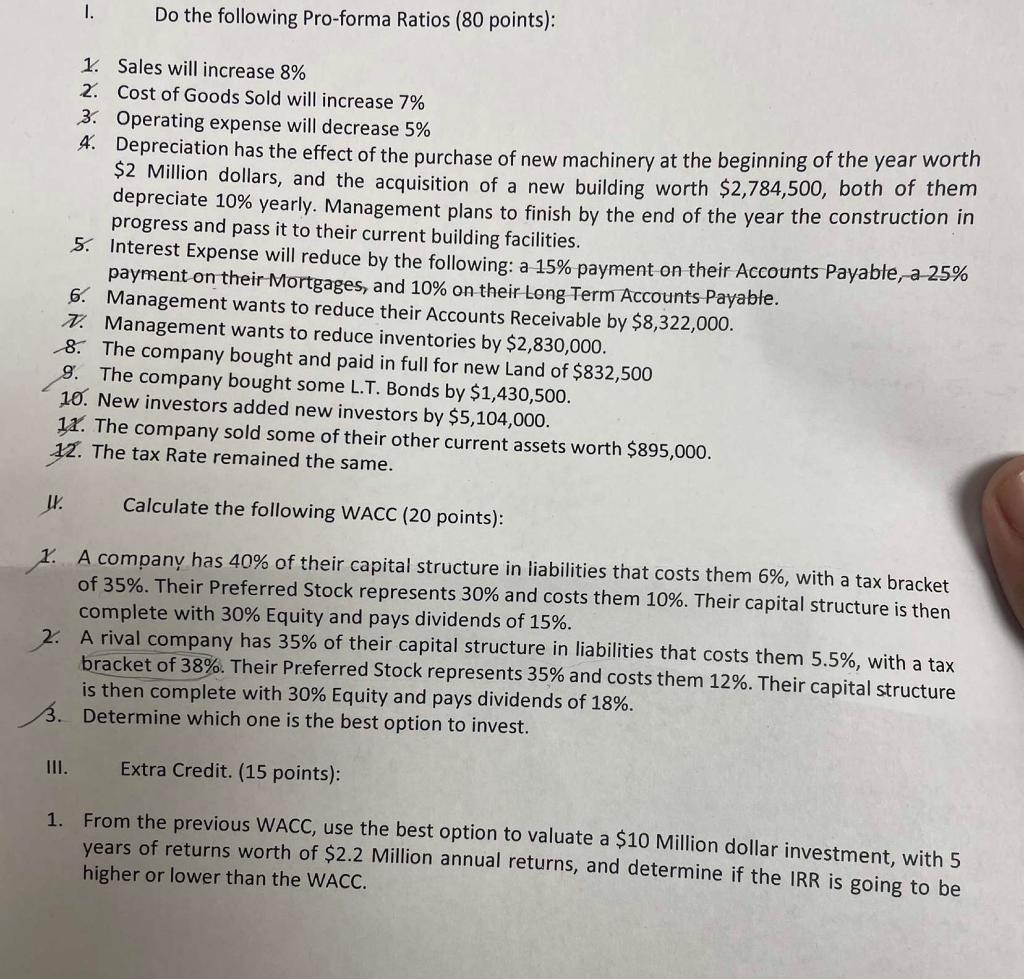

1. Do the following Pro-forma Ratios (80 points): 1. Sales will increase 8% 2. Cost of Goods Sold will increase 7% 3. Operating expense will decrease 5% 4. Depreciation has the effect of the purchase of new machinery at the beginning of the year worth $2 Million dollars, and the acquisition of a new building worth $2,784,500, both of them depreciate 10% yearly. Management plans to finish by the end of the year the construction in progress and pass it to their current building facilities. 5. Interest Expense will reduce by the following: a 15% payment on their Accounts Payable, a 25% payment on their Mortgages, and 10% on their Long Term Accounts Payable. 6. Management wants to reduce their Accounts Receivable by $8,322,000. N. Management wants to reduce inventories by $2,830,000. 8. The company bought and paid in full for new Land of $832,500 9. The company bought some L.T. Bonds by $1,430,500. 10. New investors added new investors by $5,104,000. 12. The company sold some of their other current assets worth $895,000. 12. The tax Rate remained the same. U. Calculate the following WACC (20 points): 1. A company has 40% of their capital structure in liabilities that costs them 6%, with a tax bracket of 35%. Their Preferred Stock represents 30% and costs them 10%. Their capital structure is then complete with 30% Equity and pays dividends of 15%. 2. A rival company has 35% of their capital structure in liabilities that costs them 5.5%, with a tax bracket of 38%. Their Preferred Stock represents 35% and costs them 12%. Their capital structure is then complete with 30% Equity and pays dividends of 18%. 3. Determine which one is the best option to invest. III. Extra Credit. (15 points): 1. From the previous WACC, use the best option to valuate a $10 Million dollar investment, with 5 years of returns worth of $2.2 Million annual returns, and determine if the IRR is going to be higher or lower than the WACC. 1. Do the following Pro-forma Ratios (80 points): 1. Sales will increase 8% 2. Cost of Goods Sold will increase 7% 3. Operating expense will decrease 5% 4. Depreciation has the effect of the purchase of new machinery at the beginning of the year worth $2 Million dollars, and the acquisition of a new building worth $2,784,500, both of them depreciate 10% yearly. Management plans to finish by the end of the year the construction in progress and pass it to their current building facilities. 5. Interest Expense will reduce by the following: a 15% payment on their Accounts Payable, a 25% payment on their Mortgages, and 10% on their Long Term Accounts Payable. 6. Management wants to reduce their Accounts Receivable by $8,322,000. N. Management wants to reduce inventories by $2,830,000. 8. The company bought and paid in full for new Land of $832,500 9. The company bought some L.T. Bonds by $1,430,500. 10. New investors added new investors by $5,104,000. 12. The company sold some of their other current assets worth $895,000. 12. The tax Rate remained the same. U. Calculate the following WACC (20 points): 1. A company has 40% of their capital structure in liabilities that costs them 6%, with a tax bracket of 35%. Their Preferred Stock represents 30% and costs them 10%. Their capital structure is then complete with 30% Equity and pays dividends of 15%. 2. A rival company has 35% of their capital structure in liabilities that costs them 5.5%, with a tax bracket of 38%. Their Preferred Stock represents 35% and costs them 12%. Their capital structure is then complete with 30% Equity and pays dividends of 18%. 3. Determine which one is the best option to invest. III. Extra Credit. (15 points): 1. From the previous WACC, use the best option to valuate a $10 Million dollar investment, with 5 years of returns worth of $2.2 Million annual returns, and determine if the IRR is going to be higher or lower than the WACC