Answered step by step

Verified Expert Solution

Question

1 Approved Answer

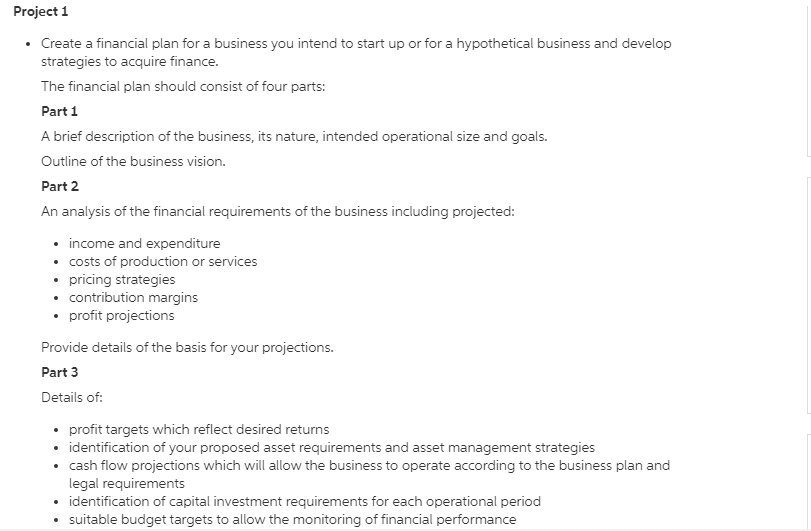

Project 1 Create a financial plan for a business you intend to start up or for a hypothetical business and develop strategies to acquire

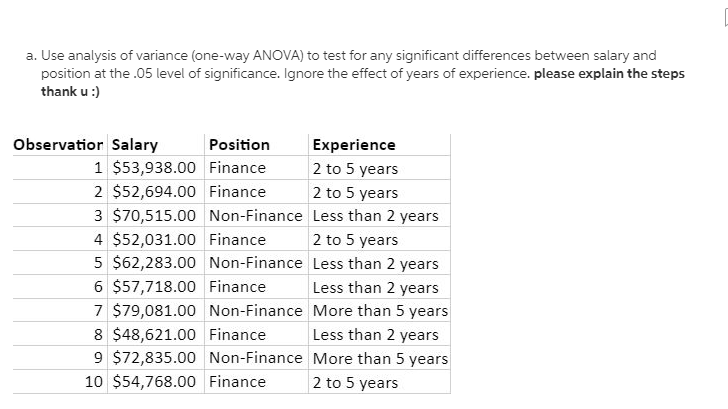

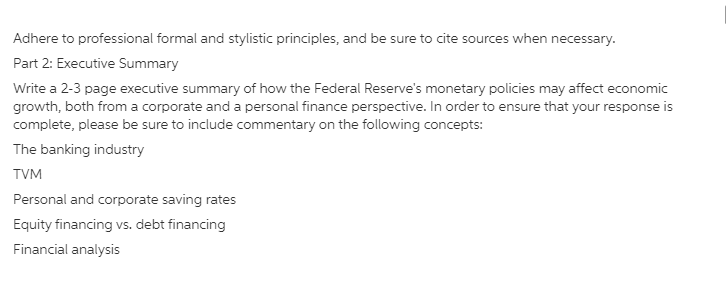

Project 1 Create a financial plan for a business you intend to start up or for a hypothetical business and develop strategies to acquire finance. The financial plan should consist of four parts: Part 1 A brief description of the business, its nature, intended operational size and goals. Outline of the business vision. Part 2 An analysis of the financial requirements of the business including projected: income and expenditure costs of production or services pricing strategies contribution margins profit projections Provide details of the basis for your projections. Part 3 Details of: profit targets which reflect desired returns identification of your proposed asset requirements and asset management strategies cash flow projections which will allow the business to operate according to the business plan and legal requirements identification of capital investment requirements for each operational period suitable budget targets to allow the monitoring of financial performance a. Use analysis of variance (one-way ANOVA) to test for any significant differences between salary and position at the .05 level of significance. Ignore the effect of years of experience. please explain the steps thank u :) Observation Salary Experience Position 1 $53,938.00 Finance 2 to 5 years 2 $52,694.00 Finance 2 to 5 years 3 $70,515.00 Non-Finance Less than 2 years 4 $52,031.00 Finance 2 to 5 years 5 $62,283.00 Non-Finance Less than 2 years 6 $57,718.00 Finance Less than 2 years 7 $79,081.00 Non-Finance More than 5 years 8 $48,621.00 Finance Less than 2 years 9 $72,835.00 Non-Finance More than 5 years 10 $54,768.00 Finance 2 to 5 years Adhere to professional formal and stylistic principles, and be sure to cite sources when necessary. Part 2: Executive Summary Write a 2-3 page executive summary of how the Federal Reserve's monetary policies may affect economic growth, both from a corporate and a personal finance perspective. In order to ensure that your response is complete, please be sure to include commentary on the following concepts: The banking industry TVM Personal and corporate saving rates Equity financing vs. debt financing Financial analysis

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started