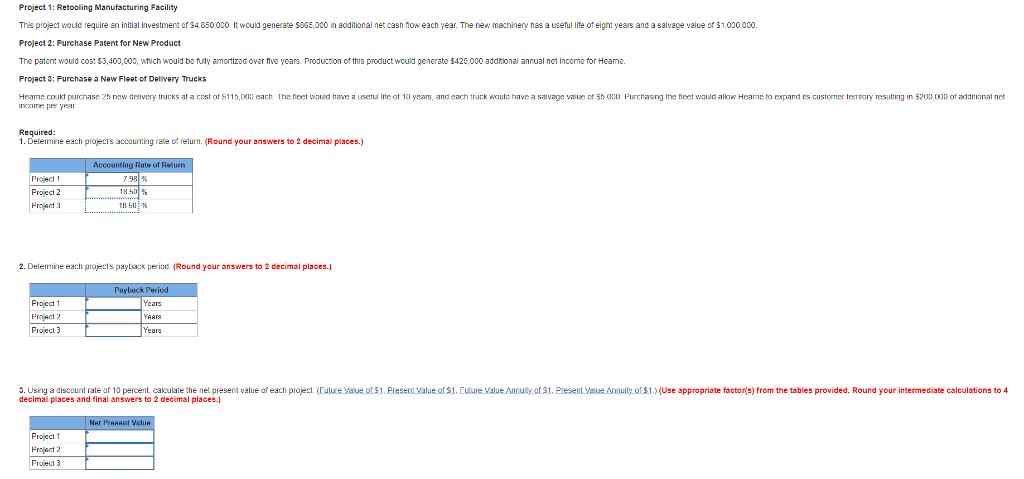

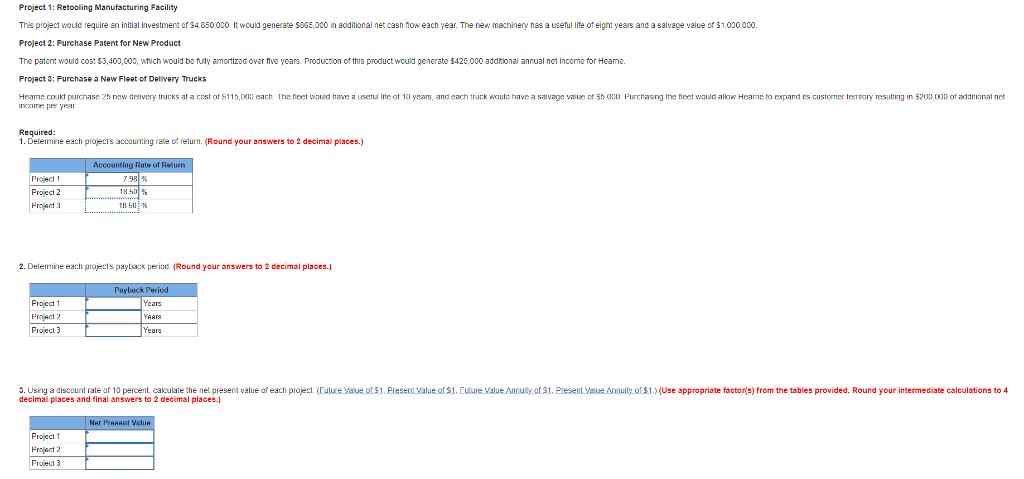

Project 1: Retooling Manufacturing Facility This project would require an initial investment of 4,850000. It would generae $85,000 in additional net cash flow each year. The new machinery has a useful lite of eight years and a salvage value of 1,000000 Project 2: Purchase Patent for New Product The patent would co51 3,400,000, which would ba fuily amortizad over tive vears. Production of this product would generate $425,000 addtional annual net Incoma for Heama. Project 3: Purchase a New Fleet of Delivery Trucks Hear e cold ase 25 new drive trucks at a cost of $115 000 each The net woud have u etul Ite ' 1 ] years, and ea truck would have a salva e value of 5 000 Furchasn the n1 wu ld allow Hearne to ex and rs custo mer ter narv res ting ln $20.) 00Dot addrtKInal net Required: 1. Detemine each project's accouming rate of relurn. (Round your answers to 2 decimal places.) g Rote of Retun Froject Project2 Projact 18.501 % 2. Detemne each projects paytack period (Round your answers to 2 decimal places Peri Project reject 2 Project 3 Years 3. Using a discount rate of 10 percent caculate the net present value of each project. Euture Value ofs1, Present Value of S1, E decimal places and final answers to 2 decimal places. Present Value Annuity of 31.) (Use appropriate factons) from the tables provided. Round your intermediate calculations to 4 Ner Project 1 Projact Project 3 Project 1: Retooling Manufacturing Facility This project would require an initial investment of 4,850000. It would generae $85,000 in additional net cash flow each year. The new machinery has a useful lite of eight years and a salvage value of 1,000000 Project 2: Purchase Patent for New Product The patent would co51 3,400,000, which would ba fuily amortizad over tive vears. Production of this product would generate $425,000 addtional annual net Incoma for Heama. Project 3: Purchase a New Fleet of Delivery Trucks Hear e cold ase 25 new drive trucks at a cost of $115 000 each The net woud have u etul Ite ' 1 ] years, and ea truck would have a salva e value of 5 000 Furchasn the n1 wu ld allow Hearne to ex and rs custo mer ter narv res ting ln $20.) 00Dot addrtKInal net Required: 1. Detemine each project's accouming rate of relurn. (Round your answers to 2 decimal places.) g Rote of Retun Froject Project2 Projact 18.501 % 2. Detemne each projects paytack period (Round your answers to 2 decimal places Peri Project reject 2 Project 3 Years 3. Using a discount rate of 10 percent caculate the net present value of each project. Euture Value ofs1, Present Value of S1, E decimal places and final answers to 2 decimal places. Present Value Annuity of 31.) (Use appropriate factons) from the tables provided. Round your intermediate calculations to 4 Ner Project 1 Projact Project 3