Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Project 1 : urchase Snacky Snacks, Inc. Snacks R' Us, Inc. manufactures and distributes a variety of snack foods. They are considering expanding the business,

Project 1 : urchase Snacky Snacks, Inc.

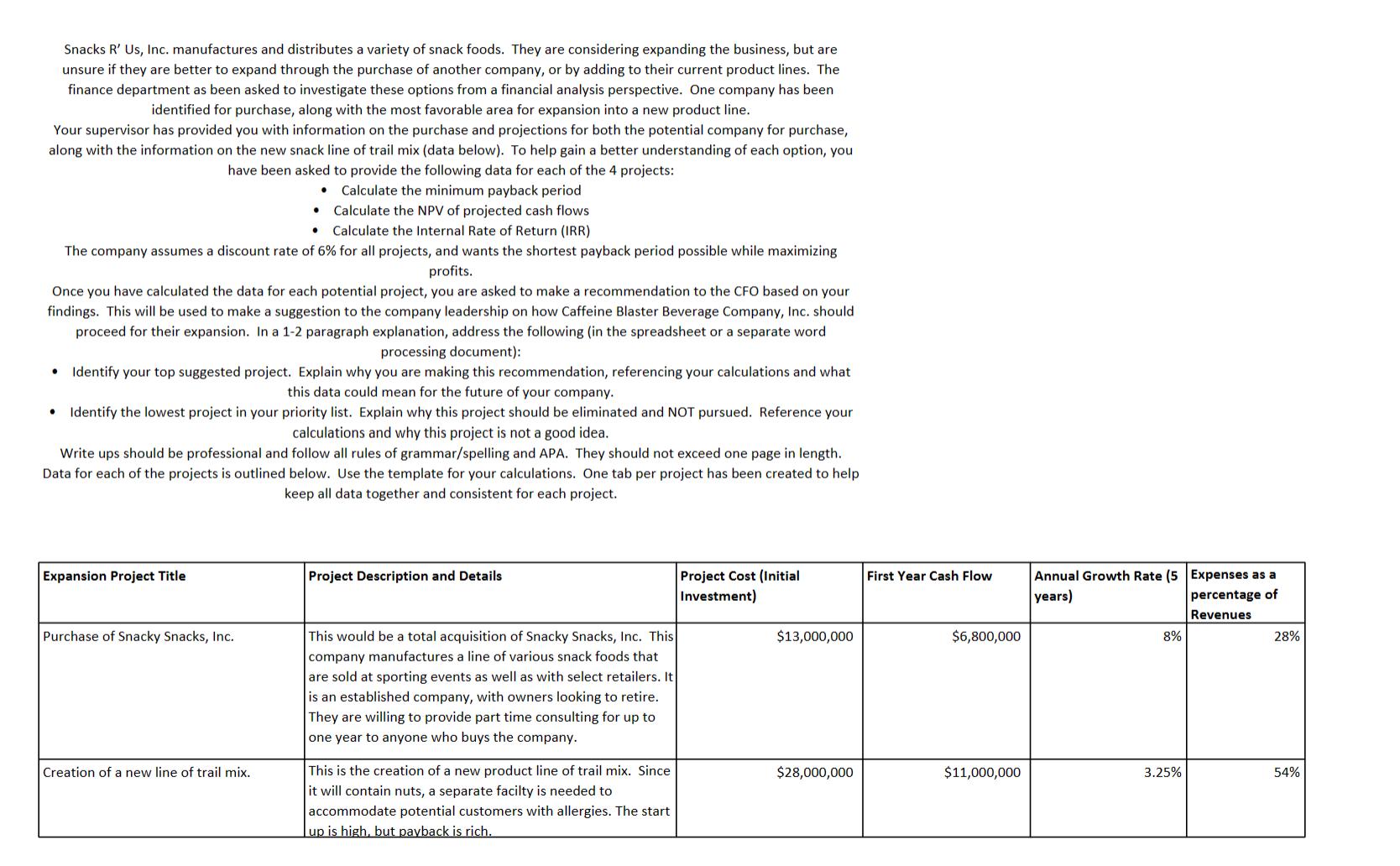

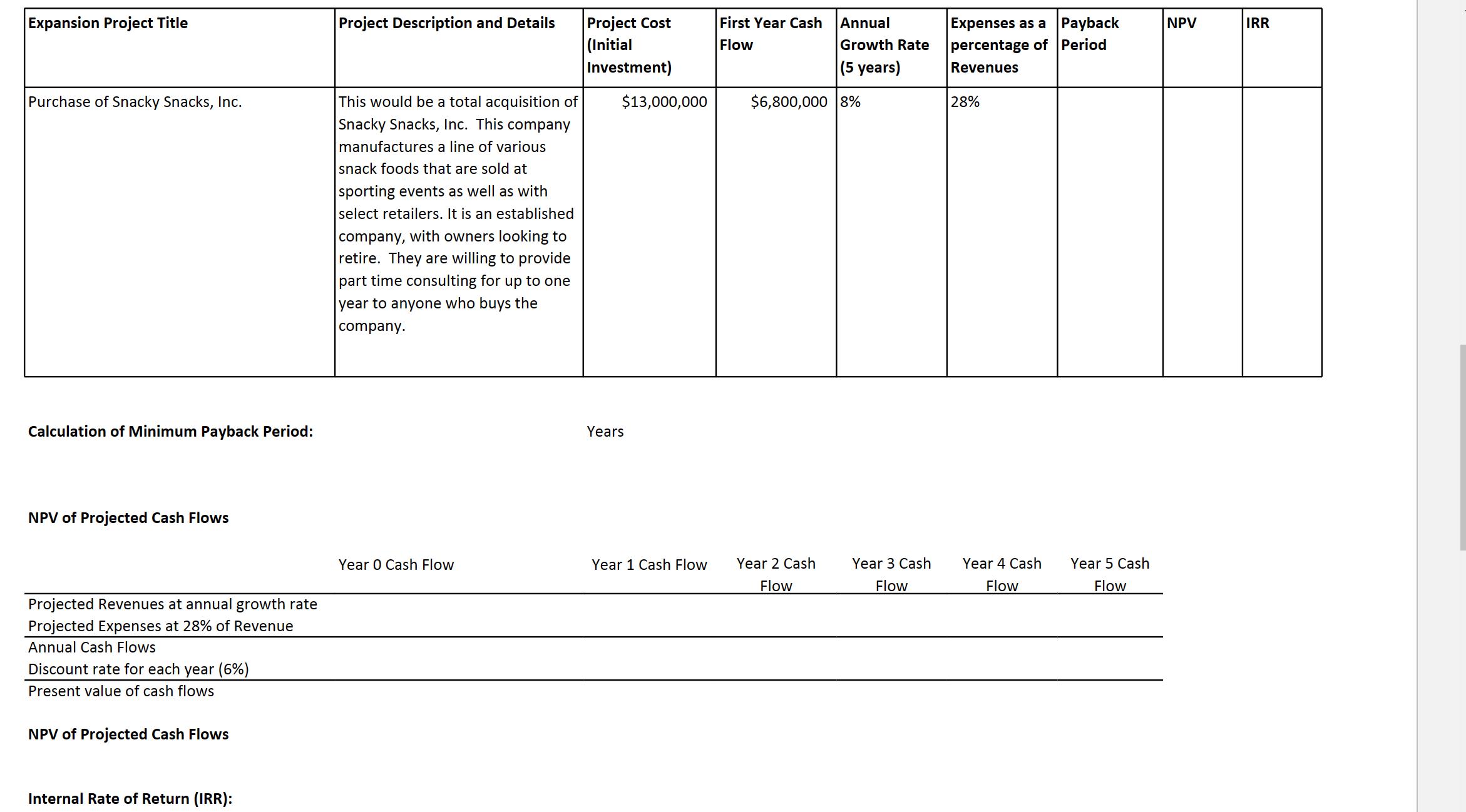

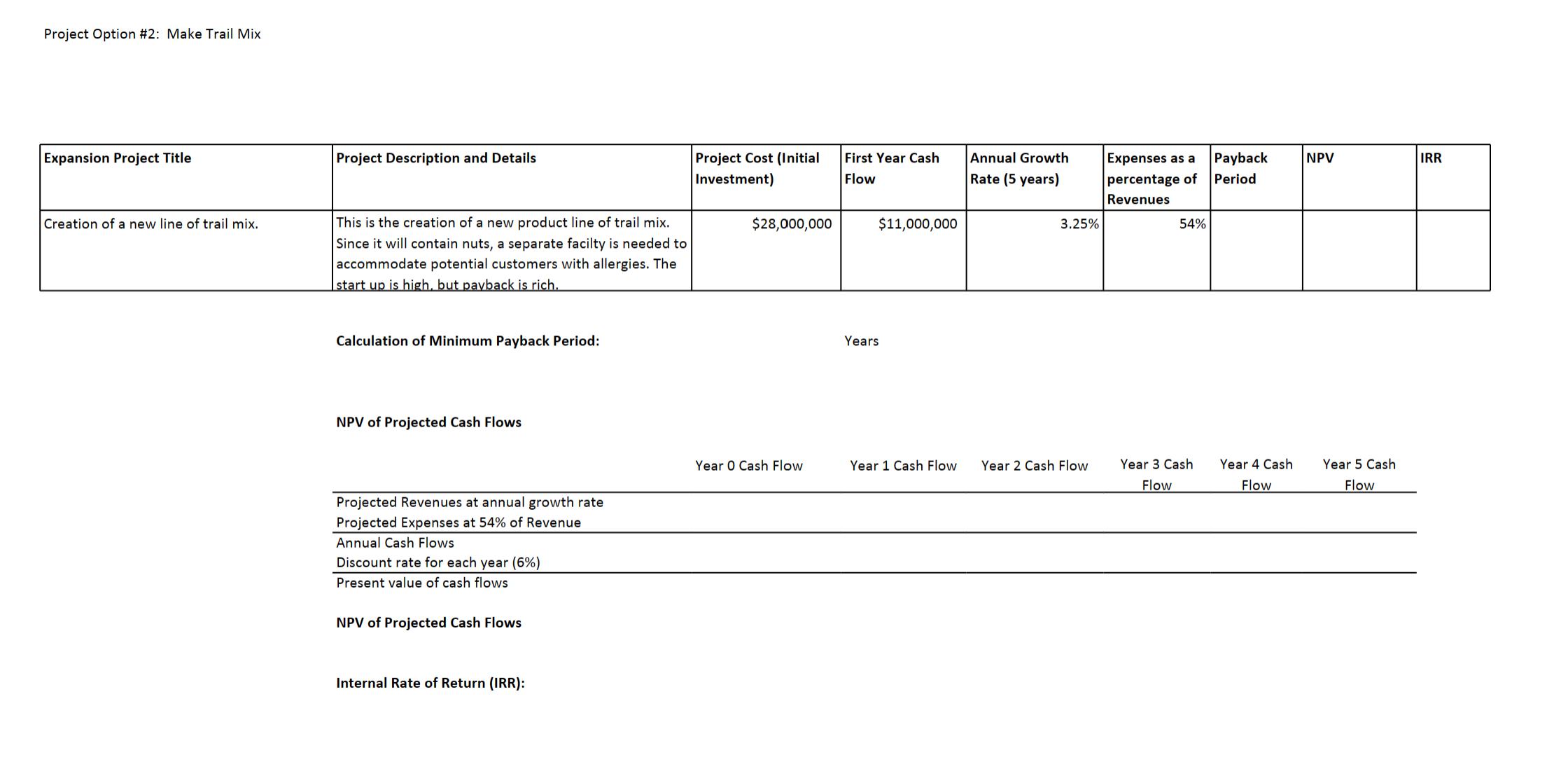

Snacks R' Us, Inc. manufactures and distributes a variety of snack foods. They are considering expanding the business, but are unsure if they are better to expand through the purchase of another company, or by adding to their current product lines. The finance department as been asked to investigate these options from a financial analysis perspective. One company has been identified for purchase, along with the most favorable area for expansion into a new product line. Your supervisor has provided you with information on the purchase and projections for both the potential company for purchase, along with the information on the new snack line of trail mix (data below). To help gain a better understanding of each option, you have been asked to provide the following data for each of the 4 projects: Calculate the minimum payback period Calculate the NPV of projected cash flows Calculate the Internal Rate of Return (IRR) The company assumes a discount rate of 6% for all projects, and wants the shortest payback period possible while maximizing profits. Once you have calculated the data for each potential project, you are asked to make a recommendation to the CFO based on your findings. This will be used to make a suggestion to the company leadership on how Caffeine Blaster Beverage Company, Inc. should proceed for their expansion. In a 1-2 paragraph explanation, address the following (in the spreadsheet or a separate word processing document): Identify your top suggested project. Explain why you are making this recommendation, referencing your calculations and what this data could mean for the future of your company. Identify the lowest project in your priority list. Explain why this project should be eliminated and NOT pursued. Reference your calculations and why this project is not a good idea. Write ups should be professional and follow all rules of grammar/spelling and APA. They should not exceed one page in length. Data for each of the projects is outlined below. Use the template for your calculations. One tab per project has been created to help keep all data together and consistent for each project. Expansion Project Title Purchase of Snacky Snacks, Inc. Creation of a new line of trail mix. Project Description and Details This would be a total acquisition of Snacky Snacks, Inc. This company manufactures a line of various snack foods that are sold at sporting events as well as with select retailers. It is an established company, with owners looking to retire. They are willing to provide part time consulting for up to one year to anyone who buys the company. This is the creation of a new product line of trail mix. Since it will contain nuts, a separate facilty is needed to accommodate potential customers with allergies. The start up is high, but payback is rich. Project Cost (Initial Investment) $13,000,000 $28,000,000 First Year Cash Flow $6,800,000 $11,000,000 Annual Growth Rate (5 Expenses as a years) percentage of Revenues 8% 3.25% 28% 54%

Step by Step Solution

★★★★★

3.44 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started