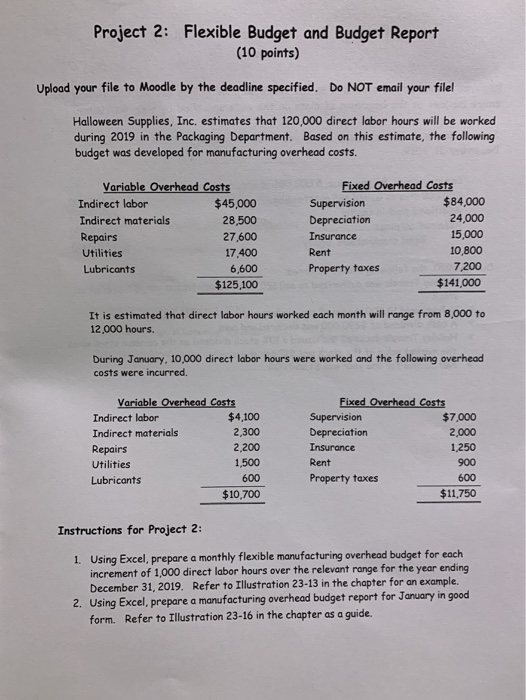

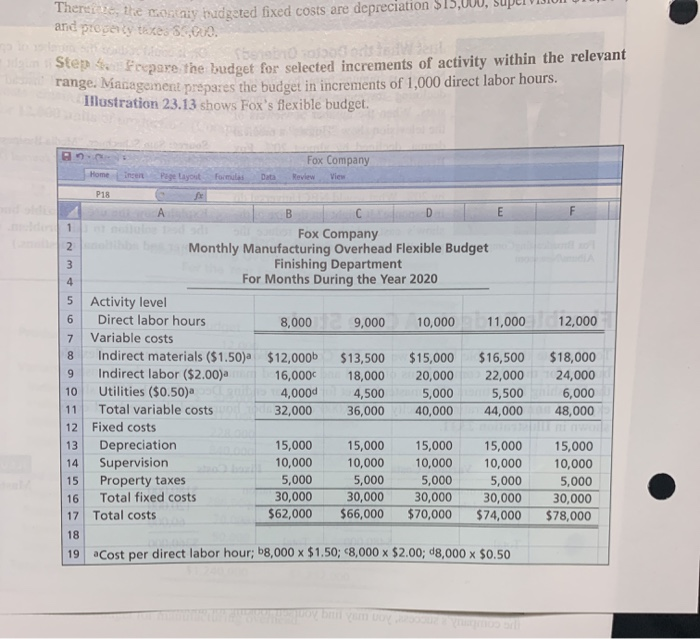

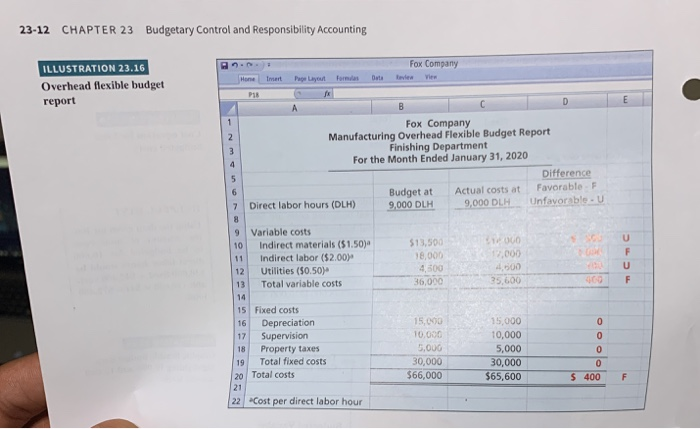

Project 2: Flexible Budget and Budget Report (10 points) Upload your file to Moodle by the deadline specified. Do NOT email your filel Halloween Supplies, Inc. estimates that 120,000 direct labor hours will be worked during 2019 in the Packaging Department. Based on this estimate, the following budget was developed for manufacturing overhead costs. Variable Overhead Costs Indirect labor $45,000 Indirect materials 28,500 Repairs 27,600 Utilities 17.400 Lubricants 6,600 $125,100 Fixed Overhead Costs Supervision $84,000 Depreciation 24,000 Insurance 15,000 Rent 10,800 Property taxes 7,200 $141,000 ida It is estimated that direct labor hours worked each month will range from 8,000 to 12,000 hours. During January, 10,000 direct labor hours were worked and the following overhead costs were incurred. Variable Overhead Costs Indirect labor $4,100 Indirect materials 2,300 Repairs 2,200 Utilities 1,500 Lubricants 600 $10,700 Fixed Overhead Costs Supervision $7,000 Depreciation 2,000 Insurance 1,250 Rent Property taxes 600 $11.750 900 Instructions for Project 2: 1. Using Excel, prepare a monthly flexible manufacturing overhead budget for each increment of 1,000 direct labor hours over the relevant range for the year ending December 31, 2019. Refer to Illustration 23-13 in the chapter for an example. 2. Using Excel, prepare a manufacturing overhead budget report for January in good form. Refer to Illustration 23-16 in the chapter as a guide. Ele contaiy hudgeted fixed costs are depreciation $15,000, supl VIDIO and property taxes S3,000. Step Prepare the budget for select are the budget for selected increments of activity within the relevant Management prepares the budget in increments of 1,000 direct labor hours. Illustration 23.13 shows Fox's flexible budget. Nm 5 12,000 7 8 9 10 Fox Company Home Encert Page Layout Formulas Data Review View P18 uool A B Carlo D E Fox Company Monthly Manufacturing Overhead Flexible Budget Finishing Department For Months During the Year 2020 Activity level Direct labor hours 8,000 9,000 10,000 11,000 Variable costs Indirect materials ($1.50)a $12,000 $13,500 $15,000 $16,500 Indirect labor ($2.00) 16,000 18,000 20,000 22,000 Utilities ($0.50) 4,0000 4,500 5,000 5 ,500 Total variable costs 32,000 36,000 40,000 44,000 Fixed costs Depreciation 15,000 15,000 15,000 15,000 Supervision 10,000 10,000 10,000 10,000 Property taxes 5,000 5,000 5,000 5,000 Total fixed costs 30,000 30,000 30,000 30,000 Total costs $62,000 $66,000 $70,000 $74,000 $18,000 24,000 6,000 48,000 12 14 15,000 10,000 5,000 30,000 $78,000 16 17 19 aCost per direct labor hour; 58,000 x $1.50; 8,000 x $2.00; d8,000 x $0.50 23-12 CHAPTER 23 Budgetary Control and Responsibility Accounting Fox Company vien View Home Imert Page Layout Forms ILLUSTRATION 23.16 Overhead flexible budget report Outi Fox Company Manufacturing Overhead Flexible Budget Report Finishing Department For the Month Ended January 31, 2020 Difference Budget at Actual costs at Favorable F Direct labor hours (DLH) 9,000 DLH 9,000 DLH Unfavorable. U 9 Variable costs Indirect materials ($1.50) Indirect labor ($2.00) Utilities (50.50) Total variable costs $13,500 18,000 4,500 36,000 1000 17.000 4,500 25,600 13 15 16 17 18 19 20 Fixed costs Depreciation Supervision Property taxes Total fixed costs Total costs 15,000 10.000 5,000 30,000 $66,000 15,000 10,000 5,000 30,000 $65,600 S 400 22 Cost per direct labor hour