Answered step by step

Verified Expert Solution

Question

1 Approved Answer

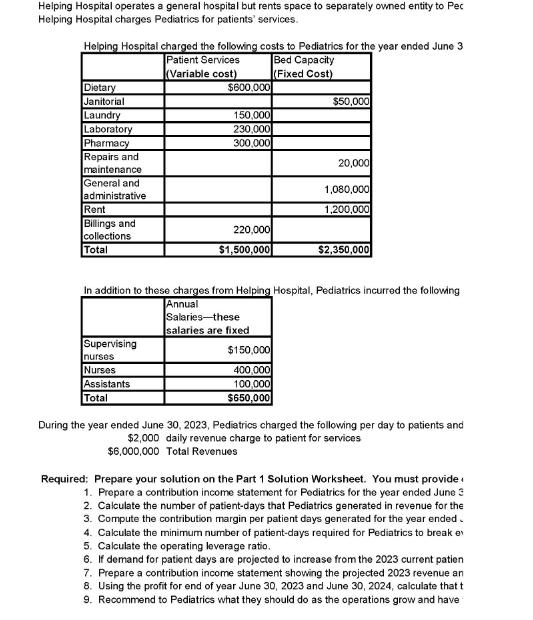

Helping Hospital operates a general hospital but rents space to separately owned entity to Pec Helping Hospital charges Pediatrics for patients' services. Helping Hospital

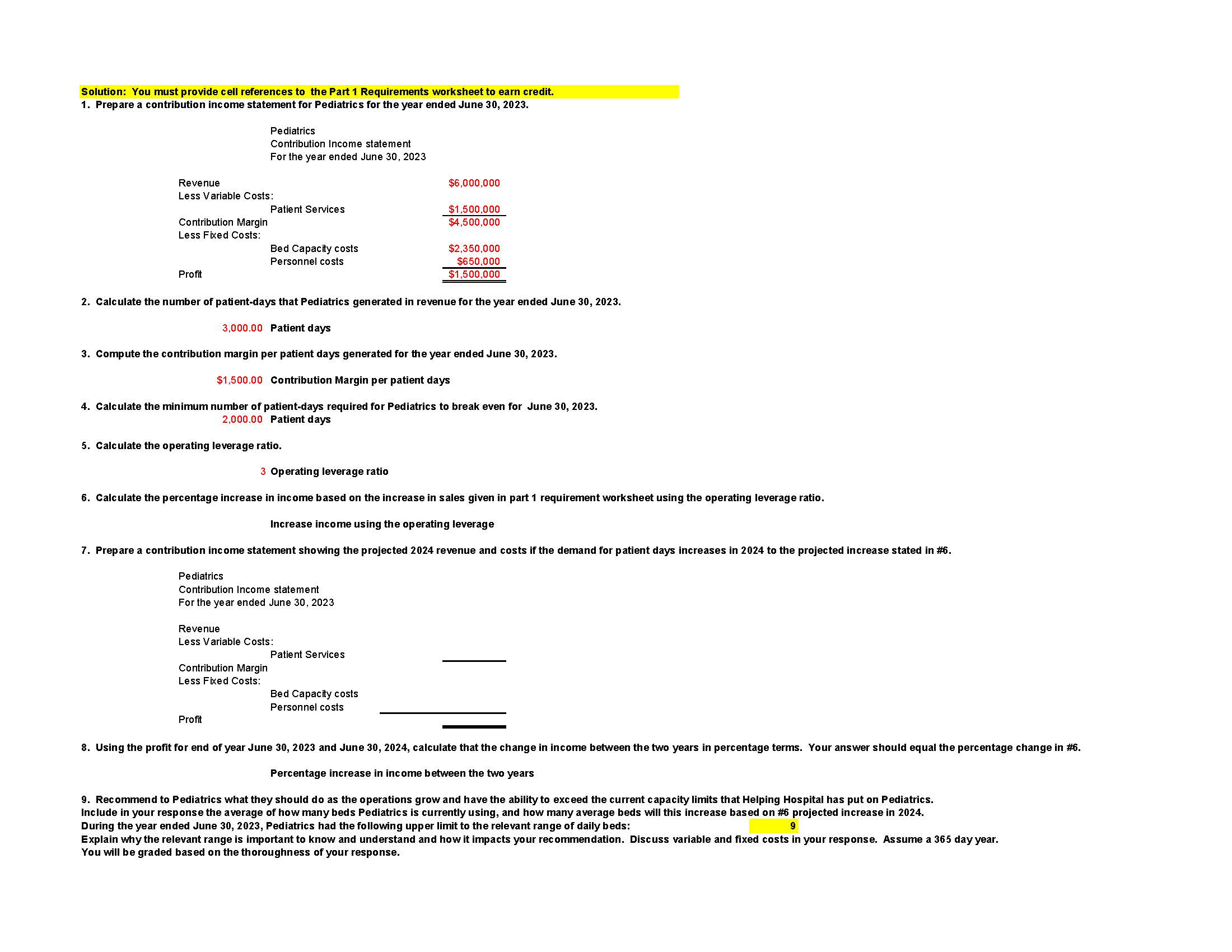

Helping Hospital operates a general hospital but rents space to separately owned entity to Pec Helping Hospital charges Pediatrics for patients' services. Helping Hospital charged the following costs to Pediatrics for the year ended June 3 Dietary Janitorial Laundry Laboratory Pharmacy Repairs and maintenance General and administrative Rent Billings and collections Total Patient Services Bed Capacity (Variable cost) (Fixed Cost) $600,000 $50,000 150,000 230,000 300,000 20,000 1,080,000 1,200,000 220,000 $1,500,000 $2,350,000 In addition to these charges from Helping Hospital, Pediatrics incurred the following Annual Salaries-these salaries are fixed Supervising $150,000 nurses Nurses 400,000 Assistants 100,000 $650,000 Total During the year ended June 30, 2023, Pediatrics charged the following per day to patients and $2,000 daily revenue charge to patient for services $6,000,000 Total Revenues Required: Prepare your solution on the Part 1 Solution Worksheet. You must provide 1. Prepare a contribution income statement for Pediatrics for the year ended June 3 2. Calculate the number of patient-days that Pediatrics generated in revenue for the 3. Compute the contribution margin per patient days generated for the year ended. 4. Calculate the minimum number of patient-days required for Pediatrics to break e 5. Calculate the operating leverage ratio. 6. If demand for patient days are projected to increase from the 2023 current patien 7. Prepare a contribution income statement showing the projected 2023 revenue an 8. Using the profit for end of year June 30, 2023 and June 30, 2024, calculate that t 9. Recommend to Pediatrics what they should do as the operations grow and have Include in your response the average of how many beds Pediatrics is currently using During the year ended June 30, 2023, Pediatrics had the following upper limit to the Explain why the relevant range is important to know and understand and how it impa You will be graded based on the thoroughness of your response. I generated the following annual revenue: cell references to this worksheet to earn credit. year ended June 30, 2023. 10% Calculate the percentage increase in income using the opera id costs if the demand for patient days increases in 2023 to the projected increase stated in #6. the change in income between the two years in percentage terms. Your answer should equal the the ability to exceed the current capacity limits that Helping Hospital has put on Pediatrics. ], and how many average beds will this increase based on #6 projected increase in 2024. 9 acts your recommendation. Discuss variable and fixed costs in your response. Assume a 365 da percentage change in #6. Solution: You must provide cell references to the Part 1 Requirements worksheet to earn credit. 1. Prepare a contribution income statement for Pediatrics for the year ended June 30, 2023. Revenue Less Variable Costs: Contribution Margin Less Fixed Costs: Profit Pediatrics Contribution Income statement For the year ended June 30, 2023 Patient Services Bed Capacity costs Personnel costs 5. Calculate the operating leverage ratio. 2. Calculate the number of patient-days that Pediatrics generated in revenue for the year ended June 30, 2023. 3,000.00 Patient days 3. Compute the contribution margin per patient days generated for the year ended June 30, 2023. $1,500.00 Contribution Margin per patient days Contribution Margin Less Fixed Costs: 4. Calculate the minimum number of patient-days required for Pediatrics to break even for June 30, 2023. 2,000.00 Patient days Pediatrics Contribution Income statement For the year ended June 30, 2023 Profit Revenue Less Variable Costs: 3 Operating leverage ratio 6. Calculate the percentage increase in income based on the increase in sales given in part 1 requirement worksheet using the operating leverage ratio. Increase income using the operating leverage 7. Prepare a contribution income statement showing the projected 2024 revenue and costs if the demand for patient days increases in 2024 to the projected increase stated in #6. $6,000,000 $1,500,000 $4,500,000 Patient Services $2,350,000 $650,000 $1,500,000 Bed Capacity costs Personnel costs 8. Using the profit for end of year June 30, 2023 and June 30, 2024, calculate that the change in income between the two years in percentage terms. Your answer should equal the percentage change in #6. Percentage increase in income between the two years 9. Recommend to Pediatrics what they should do as the operations grow and have the ability to exceed the current capacity limits that Helping Hospital has put on Pediatrics. Include in your response the average of how many beds Pediatrics is currently using, and how many average beds will this increase based on #6 projected increase in 2024. During the year ended June 30, 2023, Pediatrics had the following upper limit to the relevant range of daily beds: 9 Explain why the relevant range is important to know and understand and how it impacts your recommendation. Discuss variable and fixed costs in your response. Assume a 365 day year. You will be graded based on the thoroughness of your response.

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Here is the solution to the problem 1 Prepare a budget for the year ended June 30 2023 Revenue Patie...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started