Answered step by step

Verified Expert Solution

Question

1 Approved Answer

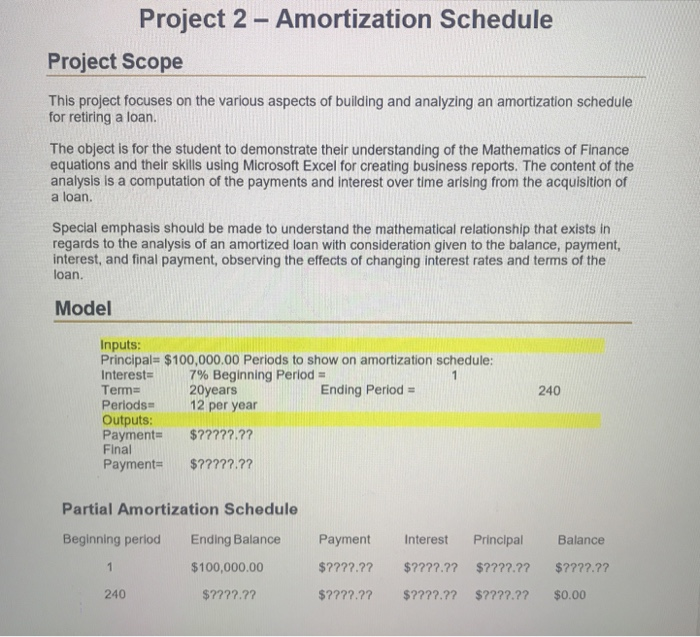

project 2 Project 2 - Amortization Schedule Project Scope This project focuses on the various aspects of building and analyzing an amortization schedule for retiring

project 2

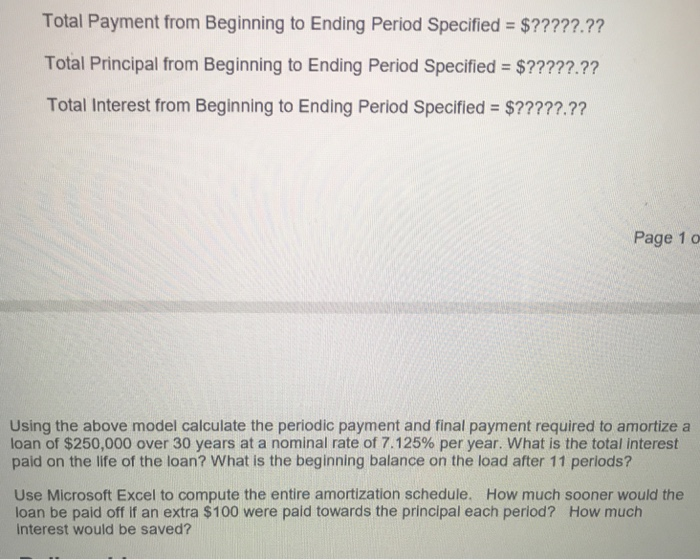

Project 2 - Amortization Schedule Project Scope This project focuses on the various aspects of building and analyzing an amortization schedule for retiring a loan. The object is for the student to demonstrate their understanding of the Mathematics of Finance equations and their skills using Microsoft Excel for creating business reports. The content of the analysis is a computation of the payments and interest over time arising from the acquisition of a loan. Special emphasis should be made to understand the mathematical relationship that exists in regards to the analysis of an amortized loan with consideration given to the balance, payment, interest, and final payment, observing the effects of changing interest rates and terms of the loan. Model Inputs: Principal- $100,000.00 Periods to show on amortization schedule: Interests 7% Beginning Period Term Periods12 per year Outputs: Payment-????7.2? Final Payment- $7777.7 20years Ending Period - 240 Partial Amortization Schedule Beginning period Ending Balance Payment Interest Princlpal Balance $100,000.00 240 $?7?2.?? Total Payment from Beginning to Ending Period Specified $????7.?? Total Principal from Beginning to Ending Period Specified $????2.?7 Total Interest from Beginning to Ending Period Specified $????2.? Page 1 o Using the above model calculate the periodic payment and final payment required to amortize a loan of $250,000 over 30 years at a nominal rate of 7.125% per year, what is the total interest paid on the life of the loan? What is the beginning balance on the load after 11 perlods? Use Microsoft Excel to compute the entire amortization schedule. How much sooner would the loan be pald off if an extra $100 were paid towards the principal each period? How much interest would be saved Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started