Answered step by step

Verified Expert Solution

Question

1 Approved Answer

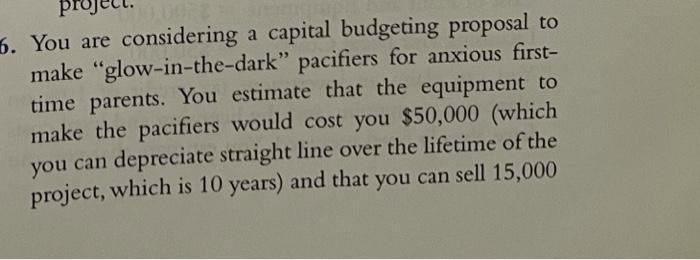

project. 6. You are considering a capital budgeting proposal to make glow-in-the-dark pacifiers for anxious first- time parents. You estimate that the equipment to

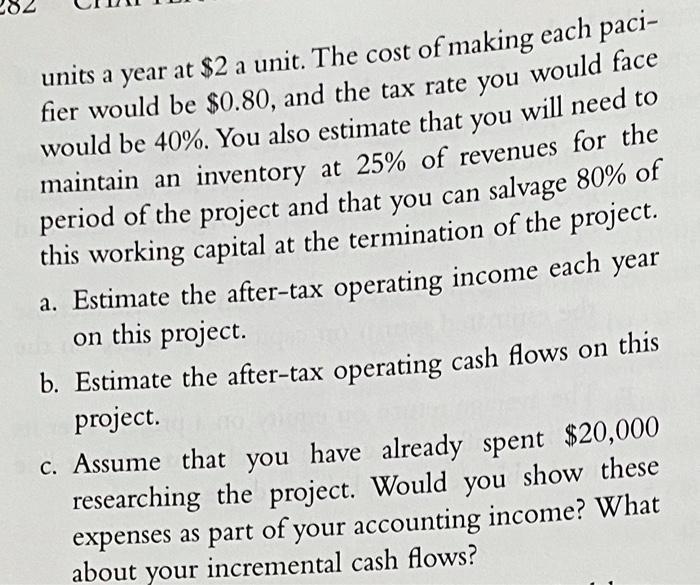

project. 6. You are considering a capital budgeting proposal to make "glow-in-the-dark" pacifiers for anxious first- time parents. You estimate that the equipment to make the pacifiers would cost you $50,000 (which you can depreciate straight line over the lifetime of the project, which is 10 years) and that you can sell 15,000 units a year at $2 a unit. The cost of making each paci- fier would be $0.80, and the tax rate you would face would be 40%. You also estimate that you will need to maintain an inventory at 25% of revenues for the period of the project and that you can salvage 80% of this working capital at the termination of the project. a. Estimate the after-tax operating income each year on this project. b. Estimate the after-tax operating cash flows on this project. c. Assume that you have already spent $20,000 researching the project. Would you show these expenses as part of your accounting income? What about your incremental cash flows?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer a Project cost 50000 Life 10 years Depreciation each year 5000 Units Sold 15000 units 2 p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started