Answered step by step

Verified Expert Solution

Question

1 Approved Answer

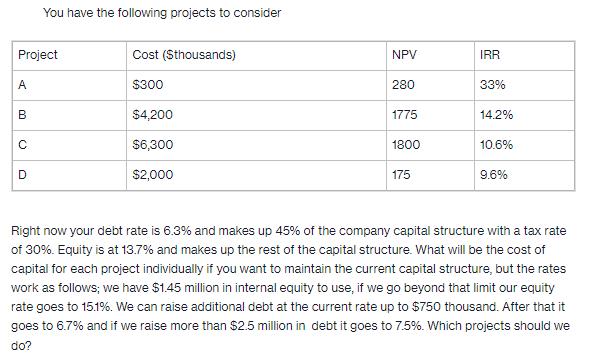

Project A B C You have the following projects to consider D Cost (Sthousands) $300 $4,200 $6,300 $2,000 NPV 280 1775 1800 175 IRR

Project A B C You have the following projects to consider D Cost (Sthousands) $300 $4,200 $6,300 $2,000 NPV 280 1775 1800 175 IRR 33% 14.2% 10.6% 9.6% Right now your debt rate is 6.3% and makes up 45% of the company capital structure with a tax rate of 30%. Equity is at 13.7% and makes up the rest of the capital structure. What will be the cost of capital for each project individually if you want to maintain the current capital structure, but the rates work as follows; we have $1.45 million in internal equity to use, if we go beyond that limit our equity rate goes to 15.1%. We can raise additional debt at the current rate up to $750 thousand. After that it goes to 6.7% and if we raise more than $2.5 million in debt it goes to 7.5%. Which projects should we do?

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Please find the below table for the cost of capital with keeping the same capital structure Limitati...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started