Answered step by step

Verified Expert Solution

Question

1 Approved Answer

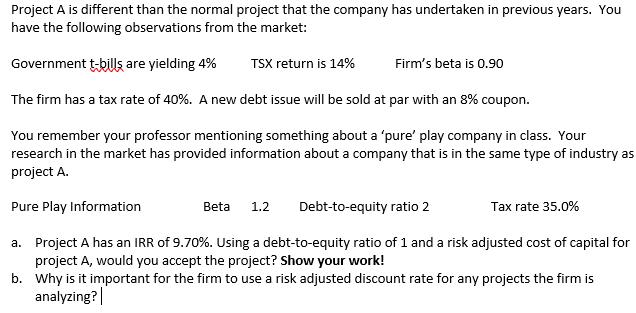

Project A is different than the normal project that the company has undertaken in previous years. You have the following observations from the market:

Project A is different than the normal project that the company has undertaken in previous years. You have the following observations from the market: Government t-bills are yielding 4% TSX return is 14% The firm has a tax rate of 40%. A new debt issue will be sold at par with an 8% coupon. You remember your professor mentioning something about a 'pure' play company in class. Your research in the market has provided information about a company that is in the same type of industry as project A. Pure Play Information Beta 1.2 Debt-to-equity ratio 2 a. Project A has an IRR of 9.70%. Using a debt-to-equity ratio of 1 and a risk adjusted cost of capital for project A, would you accept the project? Show your work! b. Why is it important for the firm to use a risk adjusted discount rate for any projects the firm is analyzing? Firm's beta is 0.90 Tax rate 35.0%

Step by Step Solution

★★★★★

3.38 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

a To determine whether to accept Project A we need to calculate the riskadjusted cost of capital for the project The riskadjusted cost of capital cons...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started