Question

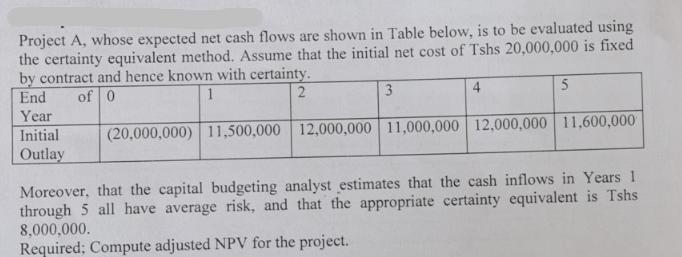

Project A, whose expected net cash flows are shown in Table below, is to be evaluated using the certainty equivalent method. Assume that the

Project A, whose expected net cash flows are shown in Table below, is to be evaluated using the certainty equivalent method. Assume that the initial net cost of Tshs 20,000,000 is fixed by contract and hence known with certainty. End of 0 1 2 Year Initial Outlay 3 4 5 (20,000,000) 11,500,000 12,000,000 11,000,000 12,000,000 11,600,000 Moreover, that the capital budgeting analyst estimates that the cash inflows in Years 1 through 5 all have average risk, and that the appropriate certainty equivalent is Tshs 8,000,000. Required; Compute adjusted NPV for the project.

Step by Step Solution

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

The adjusted NPV can be calculated as follows Year 0 Initial Outlay Tshs 20000000 known with certain...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Financial Management

Authors: Eugene F. Brigham, Joel F. Houston

12th edition

978-0324597714, 324597711, 324597703, 978-8131518571, 8131518574, 978-0324597707

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App