Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PROJECT FINANCE case study Breiterfluss Submerged Toll Tunnel Overview Richmond Bank Infrastructure Project Finance (IPF)has been approached by Bauunternehmen GmbH Bau as the potential lead

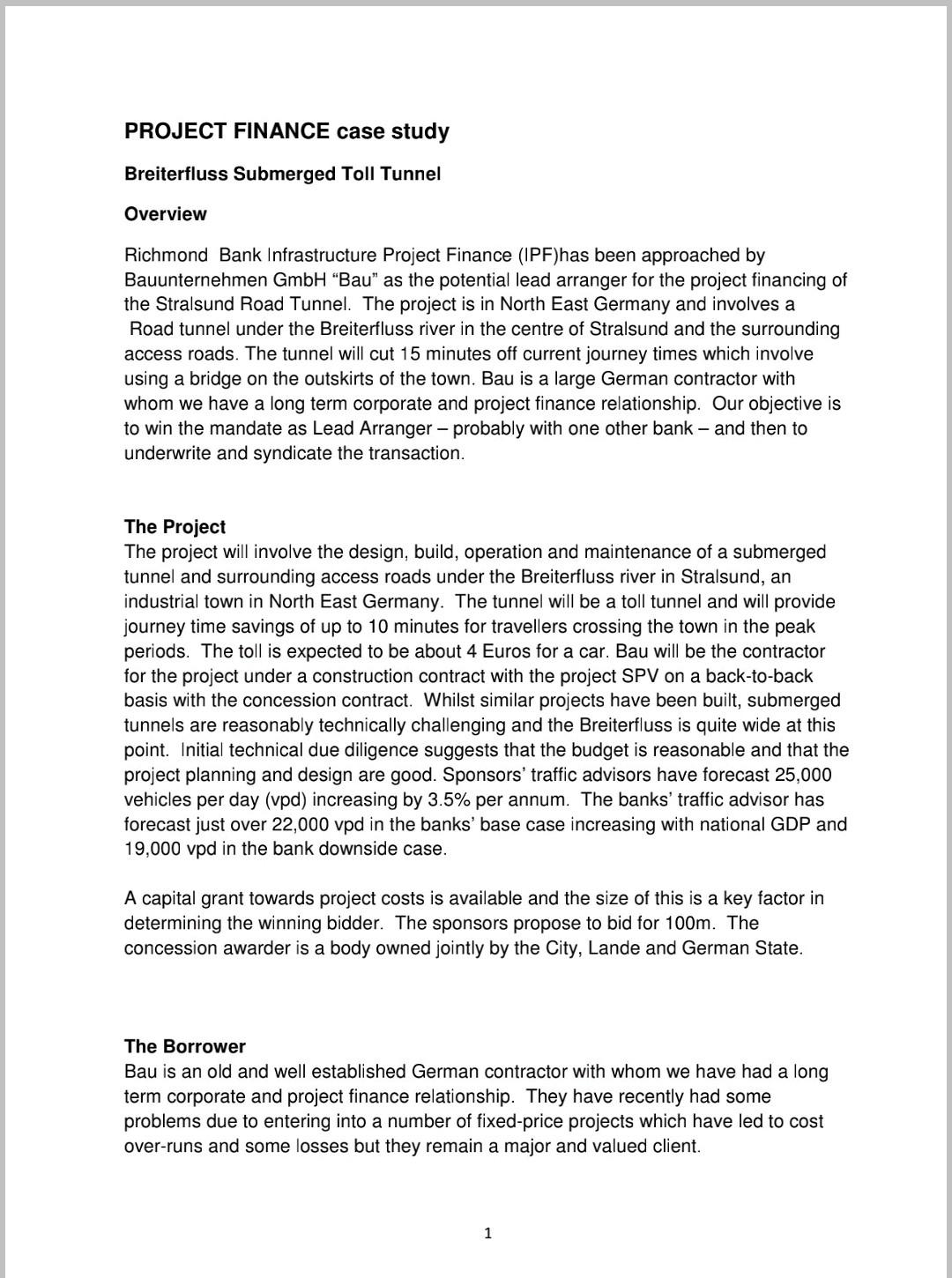

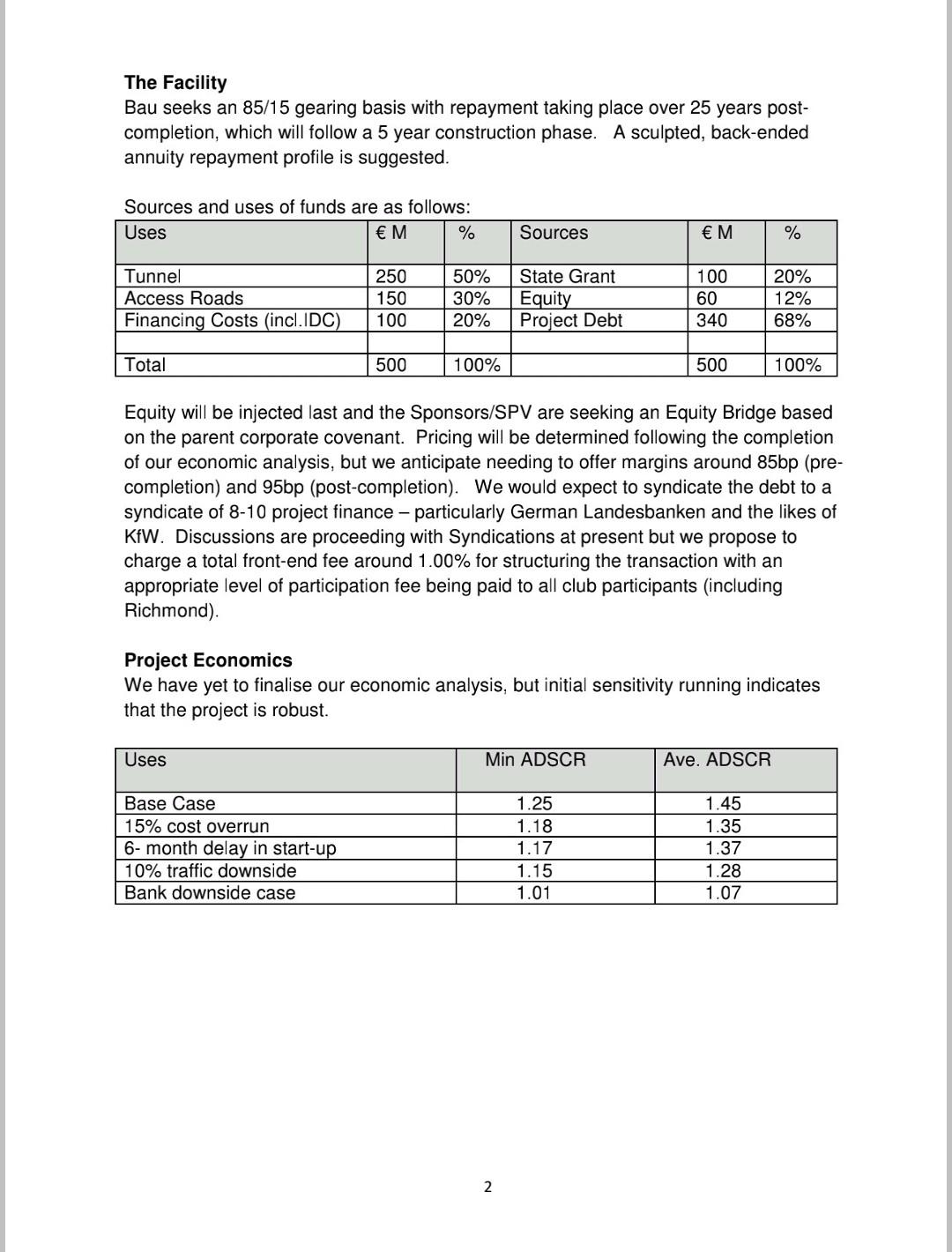

PROJECT FINANCE case study Breiterfluss Submerged Toll Tunnel Overview Richmond Bank Infrastructure Project Finance (IPF)has been approached by Bauunternehmen GmbH "Bau" as the potential lead arranger for the project financing of the Stralsund Road Tunnel. The project is in North East Germany and involves a Road tunnel under the Breiterfluss river in the centre of Stralsund and the surrounding access roads. The tunnel will cut 15 minutes off current journey times which involve using a bridge on the outskirts of the town. Bau is a large German contractor with whom we have a long term corporate and project finance relationship. Our objective is to win the mandate as Lead Arranger - probably with one other bank - and then to underwrite and syndicate the transaction. The Project The project will involve the design, build, operation and maintenance of a submerged tunnel and surrounding access roads under the Breiterfluss river in Stralsund, an industrial town in North East Germany. The tunnel will be a toll tunnel and will provide journey time savings of up to 10 minutes for travellers crossing the town in the peak periods. The toll is expected to be about 4 Euros for a car. Bau will be the contractor for the project under a construction contract with the project SPV on a back-to-back basis with the concession contract. Whilst similar projects have been built, submerged tunnels are reasonably technically challenging and the Breiterfluss is quite wide at this point. Initial technical due diligence suggests that the budget is reasonable and that the project planning and design are good. Sponsors' traffic advisors have forecast 25,000 vehicles per day (vpd) increasing by 3.5% per annum. The banks' traffic advisor has forecast just over 22,000 vpd in the banks' base case increasing with national GDP and 19,000 vpd in the bank downside case. A capital grant towards project costs is available and the size of this is a key factor in determining the winning bidder. The sponsors propose to bid for 100m. The concession awarder is a body owned jointly by the City, Lande and German State. The Borrower Bau is an old and well established German contractor with whom we have had a long term corporate and project finance relationship. They have recently had some problems due to entering into a number of fixed-price projects which have led to cost over-runs and some losses but they remain a major and valued client. 1 The Facility Bau seeks an 85/15 gearing basis with repayment taking place over 25 years post- completion, which will follow a 5 year construction phase. A sculpted, back-ended annuity repayment profile is suggested. Sources and uses of funds are as follows: Uses M % Sources M % Tunnel Access Roads Financing Costs (incl.IDC) 250 150 100 50% 30% 20% State Grant Equity Project Debt 100 60 340 20% 12% 68% Total 500 100% 500 100% Equity will be injected last and the Sponsors/SPV are seeking an Equity Bridge based on the parent corporate covenant. Pricing will be determined following the completion of our economic analysis, but we anticipate needing to offer margins around 85bp (pre- completion) and 95bp (post-completion). We would expect to syndicate the debt to a syndicate of 8-10 project finance - particularly German Landesbanken and the likes of KfW. Discussions are proceeding with Syndications at present but we propose to charge a total front-end fee around 1.00% for structuring the transaction with an appropriate level of participation fee being paid to all club participants (including Richmond). Project Economics We have yet to finalise our economic analysis, but initial sensitivity running indicates that the project is robust. Uses Min ADSCR Ave. ADSCR Base Case 15% cost overrun 6-month delay in start-up 10% traffic downside Bank downside case 1.25 1.18 1.17 1.15 1.01 1.45 1.35 1.37 1.28 1.07 2 Request We ask for comments and approval for IPF to move forward with a full credit submission, based on Richmond Bank underwriting 50% of the debt package. Prior to proceeding to full Credit Committee we shall be required to sign a an (uncommitted) letter of interest confirming our willingness to support Bau's bid for concession. While uncommitted, and expressed to be subject to Credit Committee approval, documentation and satisfactory due diligence, there would be a reputational risk for us in our relations with Bau and in our German marketing if we did not proceed with the financing for the bid. The project appears to us however to be sufficiently strong for this not to be a major concern. Task You are a member of Richmond Bank's "Peer Review" Committee, which meets weekly to review loan opportunities before they proceed to formal Credit Committee submission. You will be expected to: . . Give a view on the attractiveness of this project. State whether the project may be allowed to proceed to full approval Provide guidance to the contract team on the key areas they should give particular attention. . 3 PROJECT FINANCE case study Breiterfluss Submerged Toll Tunnel Overview Richmond Bank Infrastructure Project Finance (IPF)has been approached by Bauunternehmen GmbH "Bau" as the potential lead arranger for the project financing of the Stralsund Road Tunnel. The project is in North East Germany and involves a Road tunnel under the Breiterfluss river in the centre of Stralsund and the surrounding access roads. The tunnel will cut 15 minutes off current journey times which involve using a bridge on the outskirts of the town. Bau is a large German contractor with whom we have a long term corporate and project finance relationship. Our objective is to win the mandate as Lead Arranger - probably with one other bank - and then to underwrite and syndicate the transaction. The Project The project will involve the design, build, operation and maintenance of a submerged tunnel and surrounding access roads under the Breiterfluss river in Stralsund, an industrial town in North East Germany. The tunnel will be a toll tunnel and will provide journey time savings of up to 10 minutes for travellers crossing the town in the peak periods. The toll is expected to be about 4 Euros for a car. Bau will be the contractor for the project under a construction contract with the project SPV on a back-to-back basis with the concession contract. Whilst similar projects have been built, submerged tunnels are reasonably technically challenging and the Breiterfluss is quite wide at this point. Initial technical due diligence suggests that the budget is reasonable and that the project planning and design are good. Sponsors' traffic advisors have forecast 25,000 vehicles per day (vpd) increasing by 3.5% per annum. The banks' traffic advisor has forecast just over 22,000 vpd in the banks' base case increasing with national GDP and 19,000 vpd in the bank downside case. A capital grant towards project costs is available and the size of this is a key factor in determining the winning bidder. The sponsors propose to bid for 100m. The concession awarder is a body owned jointly by the City, Lande and German State. The Borrower Bau is an old and well established German contractor with whom we have had a long term corporate and project finance relationship. They have recently had some problems due to entering into a number of fixed-price projects which have led to cost over-runs and some losses but they remain a major and valued client. 1 The Facility Bau seeks an 85/15 gearing basis with repayment taking place over 25 years post- completion, which will follow a 5 year construction phase. A sculpted, back-ended annuity repayment profile is suggested. Sources and uses of funds are as follows: Uses M % Sources M % Tunnel Access Roads Financing Costs (incl.IDC) 250 150 100 50% 30% 20% State Grant Equity Project Debt 100 60 340 20% 12% 68% Total 500 100% 500 100% Equity will be injected last and the Sponsors/SPV are seeking an Equity Bridge based on the parent corporate covenant. Pricing will be determined following the completion of our economic analysis, but we anticipate needing to offer margins around 85bp (pre- completion) and 95bp (post-completion). We would expect to syndicate the debt to a syndicate of 8-10 project finance - particularly German Landesbanken and the likes of KfW. Discussions are proceeding with Syndications at present but we propose to charge a total front-end fee around 1.00% for structuring the transaction with an appropriate level of participation fee being paid to all club participants (including Richmond). Project Economics We have yet to finalise our economic analysis, but initial sensitivity running indicates that the project is robust. Uses Min ADSCR Ave. ADSCR Base Case 15% cost overrun 6-month delay in start-up 10% traffic downside Bank downside case 1.25 1.18 1.17 1.15 1.01 1.45 1.35 1.37 1.28 1.07 2 Request We ask for comments and approval for IPF to move forward with a full credit submission, based on Richmond Bank underwriting 50% of the debt package. Prior to proceeding to full Credit Committee we shall be required to sign a an (uncommitted) letter of interest confirming our willingness to support Bau's bid for concession. While uncommitted, and expressed to be subject to Credit Committee approval, documentation and satisfactory due diligence, there would be a reputational risk for us in our relations with Bau and in our German marketing if we did not proceed with the financing for the bid. The project appears to us however to be sufficiently strong for this not to be a major concern. Task You are a member of Richmond Bank's "Peer Review" Committee, which meets weekly to review loan opportunities before they proceed to formal Credit Committee submission. You will be expected to: . . Give a view on the attractiveness of this project. State whether the project may be allowed to proceed to full approval Provide guidance to the contract team on the key areas they should give particular attention. . 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started